Busy couple of weeks on results front

-

I didn't deal with the Tariff/Trump comments. Firstly, has he said that 'I will raise tariffs on AI chips from Korea' or is it the media speculating, again.

Tariffs are put in place to protect local industry. For the US, I can imagine, cars, heavy industry, food. Reading Trumps pre election pledge '60 to 100% on ALL Chinese goods and 10-20% on every other product from all other trading partners.' Does that worry me? No.

The US does not currently manufacture these chips. They will within 3-4 years via TSM Texas fab. The tariff, if any will only be passed on to customers. The main users of the technology are US based interests. It makes no sense to hurt your own economy and hurt his very good friend Elon Musk, a big buyer of said chips.

-

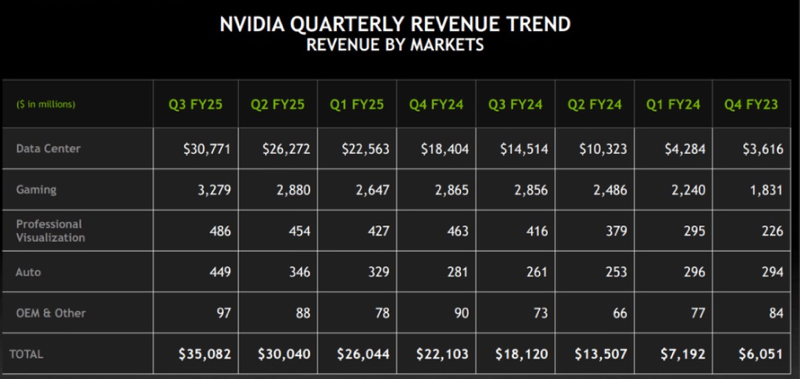

A useful summary if the past 2 years

-

Thanks Adam. All good and sensible stuff. Keep it coming!

Comments about detractors are interesting, and probably spot on the money. I happened to buy $5k's worth of NVDA shares about 30 months ago (directly, via Charles Schwab), not really knowing what I was doing. Someone at the time commented that they had sold all of theirs and I almost had cold feet about it on the basis of the comment. In retrospect I am very glad that I didn't!

Keep 'em coming. (Helpful comments and profits alike!) Thanks again.

-

It's nice to see some admit their folly.

Druckenmiller, who admitted that he didn’t know how to spell Nvidia, bought shares in fourth-quarter 2022 at the urging of his partner.

He had picked up the stock just one month before OpenAI unleashed the AI chatbot ChatGPT on the world. He said, “Even an old guy like me could figure out what that meant, so I increased the position substantially.” Druckenmiller is something a legend in investment circles.

He managed money for the investor and philanthropist George Soros from 1988 to 2000 as the lead portfolio manager for Quantum Fund.

Their most celebrated play was a bet against the British pound in 1992. Commentators said they “broke the Bank of England," reportedly hauling in $1 billion in the process. "I like putting all my eggs in one basket and then watching the basket very carefully," Druckenmiller once said.

He said he cut Duquesne Family Office’s position in Nvidia in late March, saying he needed a break.

"I’ve made so many mistakes in my investment career," he told Bloomberg last month. "One of them was I sold all my Nvidia (shares). ... I own none. ... It was a big mistake in terms of AI."

What does that have to do with the price of eggs?

Well, Nvidia, which reported earnings after the market closed on Nov. 20, recently overtook Apple AAPL to become the world's most valuable company. And Nvidia's stock has climbed nearly 193% from a year ago."I think Nvidia is a wonderful company and were the price to come down we would get involved again, but right now I'm licking my wounds from a bad sale there," Druckenmiller said.

-

The sale he mentions, netting a gain of over $1B I might add. When news broke of the sale it actually moved the stock down 10%, such is the impact of big named investor/traders. He sold at $93. You will read 'news' every day, mostly designed to influence your investment decisions. Most investors come from a position of fear, fear of losing money, so it doesn't take much to sway you. And in my experience the biggest hurdle to overcome for an individual is to deal with or filter out the noise. What is more fact than fiction.

People buy and sell the same stock every day and for completely different reasons. Did Stanley above sell because he thought it fully valued. Unlikely. He sold because he was up $1 Billion and in his own words 'he needed a break'.

-

Netflix has broken through $900. An all time high. I will post an update tomorrow outlining the companies competitive advantage. The stock has performed exceptionally well and it has been watched very closed and actively managed to capitalise on the growth.

Regards

Adam

-

Morning,

A few returns to Nov mend.

PHE +18.96%-since our changes to the model weights, the portfolio has performed very well. Now materially exceeding Fundsmith which has achieved 10.76%.

PHT +44.17%. Materially exceeding its benchmark by well over 50% and I often look at Nest Sharia as a comparison which has achieved +26.38%. Compare this to Fidelity Global tech which has only achieved +18.9%, quite poor given the benchmark performance of close to 30%.

Index 100 at 19.88% having also performed very well. No doubt do to its US biasIMOP Income+13.07% and Global growth +16.05%

Lifestyle Growth, our flagship is +33.09% continues to excel

Some great numbers as we look to close out the year

-

HI O,

The figures are YTD (11 months), after fees and IMOP is Optimum

Regards

Adam

-

Great work and much appreciated here.

-

The Bells of Santa are chiming. Buoyed by the resignation of the Intel CEO and a flurry from Tesla, the Nasdaq and SP500 hit all time highs. It's the biggest day we have seen from Tech and Lifestyle for a while with gains so far > 280bps on tech and close to 200 on Lifestyle, thanks in part to SuperMicro which is +33% today. Meta and KLAC also posted outsized gains today and apple also hit an ATH

Regards

Adam

-

This day in 2023......Bank of America called the SP500 2024 y/end target at 5,000.

KEY POINTS

CNBC's Jim Cramer reacted to Bank of America's bullish prediction for 2024, saying that for the most part, he's similarly optimistic.

Chief strategist Savita Subramanian wrote on Tuesday that the S&P could reach 5,000 by the end of next year, which would be an all-time high for the index.The prediction was made when the index was 4,540, i.e a 10% rise in 2024. An increase of 460 points. Today the index is 6,071, an increase so far of 1,531. He was only 232% wrong.

The takeaway is, no one can predict where an index is going over 12 months. The same 'expert' was favouring 'long value stocks, and short growth stocks'. We don't make predictions but focussing on the micro level(company), the details, gives one the greatest prospect of success.

-

Yesterday Alphabet (GOOG) rose almost $10 on the back of news it had unveiled a new Quantum Computing chip, named Willow. The company said it sees the chip as an important step in their journey to build a useful quantum computer with practical applications for drug discovery and fusion energy. Where computational speed is key, Willow can perform calculations in '5 minutes' that would take the worlds fastest super computers today, 10 Trillion Trillion Trillion years. Quite fast it would seem

This sort of discovery is precisely why we hold GOOG. The company employs the brightest minds and invests for decades in moon-shot ideas. It's interesting that Nvidia are working with Google on this project. It could well be the next big thing (beyond 2035).

Classical computers use bits, which can be a 0 or a 1 which are either 'on' or 'off (0 or 1).

Quantum computers use qubits and due to the properties of quantum mechanics called superposition, a qubit can be in multiple states at the same time. This is how it achieves what Google describes as 'mind boggling' speed.A good analogy is a coin. In two dimensions it can be heads or tails but a spinning coin in the quantum realm can be anywhere in between.

There are other aspects such as entanglement which allows distinct qubits to work together leading to enormous computing power. It's a very complex field suffice to say it's an exciting break through and something to watch

️

️