Busy couple of weeks on results front

-

Problem is thou …..none of her potential replacements seem to have a grasp on basic economics

-

I think the issues are-and im staying apolitical

Trust gap: The rhetorical wriggling reinforces the idea Labour says one thing, does another. I recall the first budget was a big shock, given the promises made not to and then another promise 'not to ever repeat it'. And it would seem the chancellor is leaking her ideas to see the reaction in advance. A novel way of formulating policy.

Economic credibility vs political honesty: Reeves is trying to be “fiscally serious” for the markets, while telling the public it won’t hurt them. The problem is, ordinary voters feel the hurt in their rent, bills, and taxes—so the words ring hollow. And I suspect there might be a shortage of broad shoulders after November.

Long tail risk: If the perception hardens that Labour is “mealy-mouthed,” it can lose the moral high ground it’s been trading on since Johnson/Truss era Tory chaos. Anyone recall the recent 'tweet' about lowering bus fares for families, when in fact the fare went up.

I think it's fair to say, the public is tired of hearing the government pat themselves on the back when it is clear the economy is faltering -inflation is sticky, growth evades us and interest rates are high. I'm surprised the BOE lowered rates (political?)

It is one thing to raise capital for investment. It's another to raise income to spend it on 'stuff' and it would appear this government has no intention of reigning in spending of any kind.

And then you have the Minister for Housing, who has gone on record before, calling out legal avoidance and how wrong it is, only to do the exact same thing. Regardless of your political colours this is poor. I'm sure she did something previously to mitigate GCT on her cheap council flat-the flat she bought under a scheme she then withdrew. Or is it tax everyone with money just as long as it's not me.

The issue with the UK is low productivity, particularly in the public sector

The bottom line is, higher costs are exactly the same as taxes so high inflation, higher interest rates, higher business costs, landlords, property, you name it are ALL taxes on working people.

That's my brief take-all while staying agnostic of course

-

I'm sick of labour blaming the conservatives for everything (they've been in power over a year now!). I also haven't had a pay rise since very early last year, the reason, minimum wage going up (so lower paid colleagues have, narrowing the pay gap) and national insurance rises, amongst other increasing costs, and thus the company can't afford to pay us more - yet they can still afford very expensive holidays! Labour has literally taken money out of my pocket, and they said they wouldn't hit the working man.

They need to get a grip on why things cost so much, the Faroe islands built a tunnel system with an undersea roundabout with three tunnels coming off it, total cost circa £500m. We on the other hand haven't even put a spade in the ground yet the lower Thames crossing has so far cost circa £1 billion.

Its only going to get worse.

-

The tories are just as bad

Miss appropriation of funds for ppe

Eat out to help out

Covid furlough bollocks

Boris

Unable to follow their own laws during covid

J rees mogg

Chancellors dodging taxNot to forget Liz Truss and Kwazi Kwarteng

The whole lot are a shitshow

Best keep politics for another place

-

Ron and anyone else-you are free to discuss politics if you wish. After all, it has an outsized impact on your investments. Some warranted and perhaps even more that is not and why we have a non UK tilt for the present period and have done for some time.

-

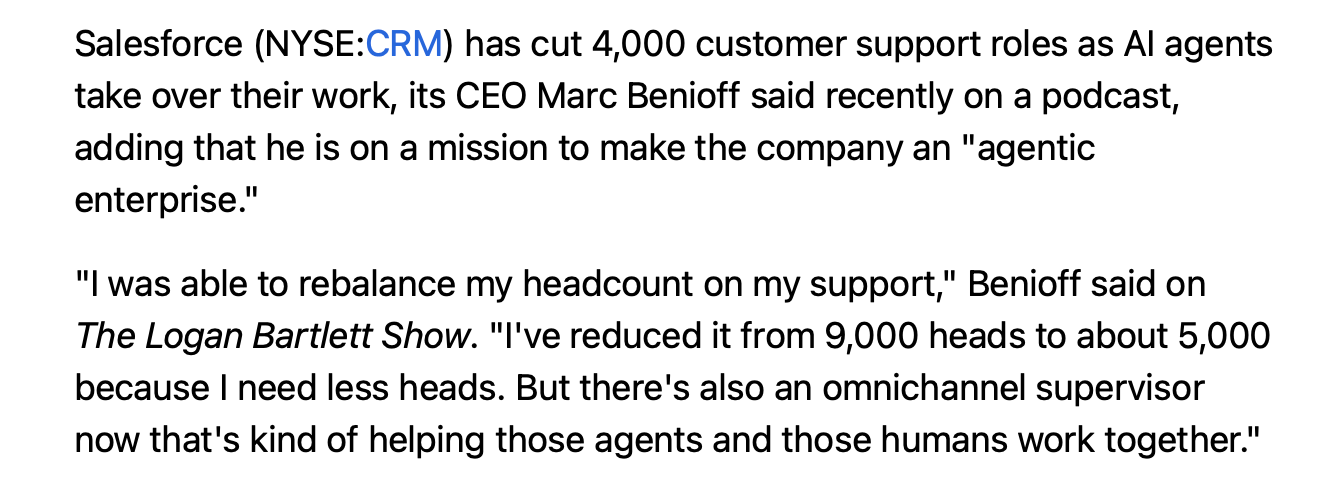

Interesting to see AI agents gaining traction, and why not. It's obvious we are on the cusp of a pervasive AI based customer support roll out. Calling a bank, utility or telco fills most customers with dread. I can see interactions in the near future being via an App and verbal, not necessarily initiated by a phone call.

Think about a machine that will know a lot more about your use case and the services offered-far more than any human can.

-

Bit of a leap in the old Retirement funds this morning!

-

I was waiting in anticipation for this morning….very happy !!!!

As the guys have said …Top job from the team -

Very happy with how my tech fund is going, onwards and upwards hopefully.

-

Hi Jason,

A few others have also done well. Added what is a good return YTD should take into account the general back drop of the wider market(s). There is still a lot of red out there this year. Lifestyle is about +12%. Yes Tech is doing very well. I don't focus on outperforming other tech portfolios but it has. And whilst past performance is no indication of future returns.....ARK Innovation is the only product that has done better this year. And ARK has lost 80% of its value in some years. Nothing in the UK/Europe that I can see has achieved better returns over time so we are very pleased by that stat.

-

Thanks Adam, I also have funds in Global growth, how is that comparing to Lifestyle and is it worth switching. What are your thoughts. Thanks Jason.

-

Hi,

Opt GG has achieved 8.1% YTDLifestyle 1 yr 11.7%

Opt GG 1 y 12.38%Opt GG 3 yr 35.62%

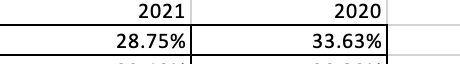

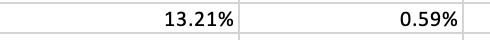

Lifestyle 3 yr 79.8%And in 20/21 Lifestyle returned this:

GG

So looking at a small snap shot is only part of the picture. -

Thanks Adam

-

Hi A,

You're very welcome

-

In an announcement timed with Donald Trump's state visit, leading American tech giants have pledged over $40 billion in investments to bolster the UK's artificial intelligence ecosystem.

Microsoft spearheads the commitment with $30 billion investment from 2025 to 2028, including $15 billion for capital expenditures on AI infrastructure. This will fund the construction of Britain's largest supercomputer, powered Nvidia GPUs in partnership with Nscale, alongside expansions in cloud computing and data centres. Google follows with $6.5 billion, featuring a new Hertfordshire data centre and support for its DeepMind AI research unit in London.

OpenAI, Nvidia, and cloud provider CoreWeave add billions more for data centres and renewable-energy-powered facilities in Scotland and the North East. Salesforce ups its stake to $6 billion while Blackstone eyes $12.8 billion (£10 billion) for an AI Growth Zone in Blyth, promising 5,000 jobs.

Prime Minister Keir Starmer hailed the deals as a "vote of confidence" in Britain's tech prowess, coinciding with a new US-UK "Technology Prosperity Deal" on AI, quantum computing, and nuclear energy (it's not really, it's about being close to your customers and a need for power capacity). Starmer is also quoted as saying 'Labour is securing high paying jobs and putting more money in peoples pockets'.

-

I watched the round of speeches during the State Banquet. The cameras spending a disproportionate amount of time on this attendee

He certainly gets around :). Jensen commented today on the frustrations with China and US relations. He said and quote "I'm disappointed with what I see, but they have larger agendas to work out between China and the United States, and I'm patient about it."

Wise words. The company is thriving in a difficult geopolitical environment as a back drop to fierce competition. I would think he has one of the toughest jobs bar none, and still they excel. Their valuation by any measure is unstretched given their growth and future market opportunities.

-

Expectations are high for a 2 PM UK time call between Donald Trump and Xi Jinping, with hopes of easing US-China tensions.

If all goes well, Trump might visit China soon, the first US president to do so since 2017.

Top of the list: a possible TikTok deal. The app, owned by ByteDance, has dodged bans despite years of claims it’s a security risk due to surveillance or propaganda. Watch for whether it’ll be sold to all-American investors or keep some Chinese ties.

Both sides also agreed to extend their trade truce by 90 days in August after a tariff spat. Issues like fentanyl chemicals, China’s Russia ties, and US farm exports remain on the table. Trump’s optimistic, saying a deal’s close, likely on current terms.

Nvidia’s antitrust probe in China and its chip sales, plus Boeing aircraft orders, are also up for grabs.

My call would be pretty soon the on-again, off-again chip sales and playing nice will be back on-again, at least until it's not-again.