Busy couple of weeks on results front

-

Amazon has launched its first 27 Project Kuiper satellites, a major milestone in its $10 billion venture to provide high-speed broadband internet from space, competing with SpaceX’s Starlink. Deployed using a United Launch Alliance Atlas V rocket from Florida, these satellites aim to connect underserved and remote areas globally. The project plans to deploy 3,236 satellites, utilising Amazon’s cloud computing expertise to challenge Starlink’s dominance.

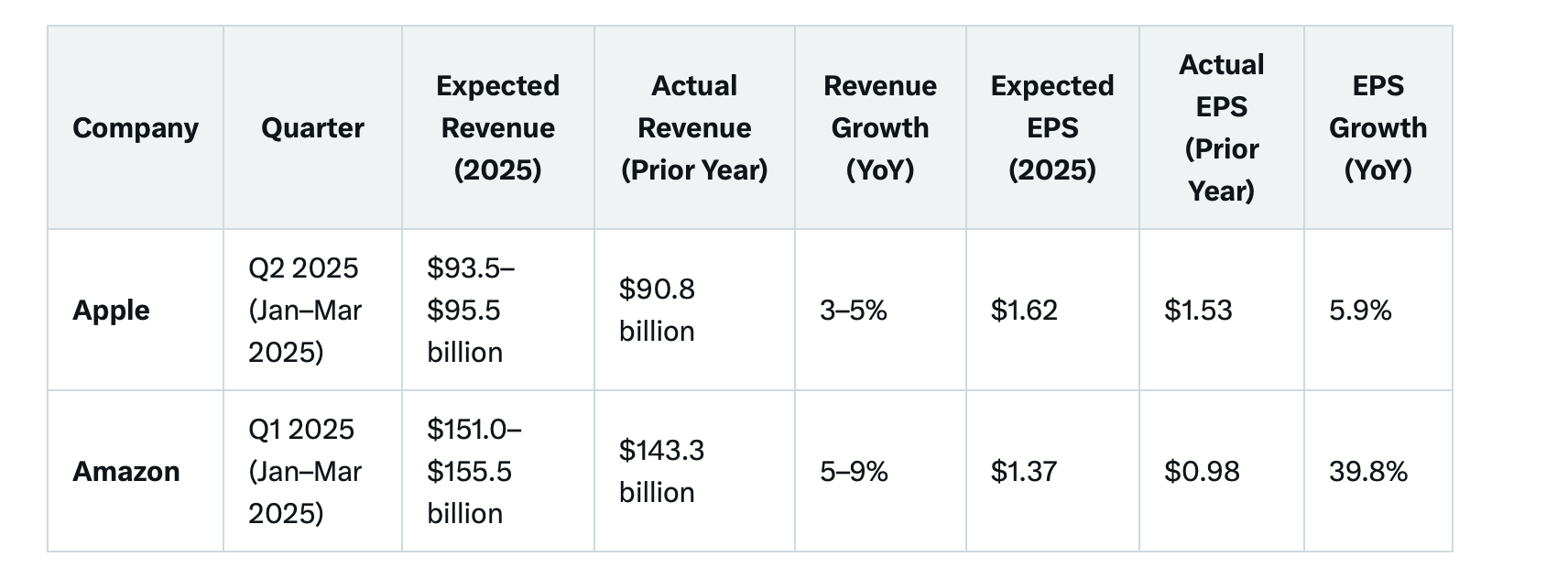

The company will report earnings after the market close on 1 May (Thursday). Expectations are for Revenue of $155.1B and EPS $1.36

-

Earnings on deck tonight:

KLA

META

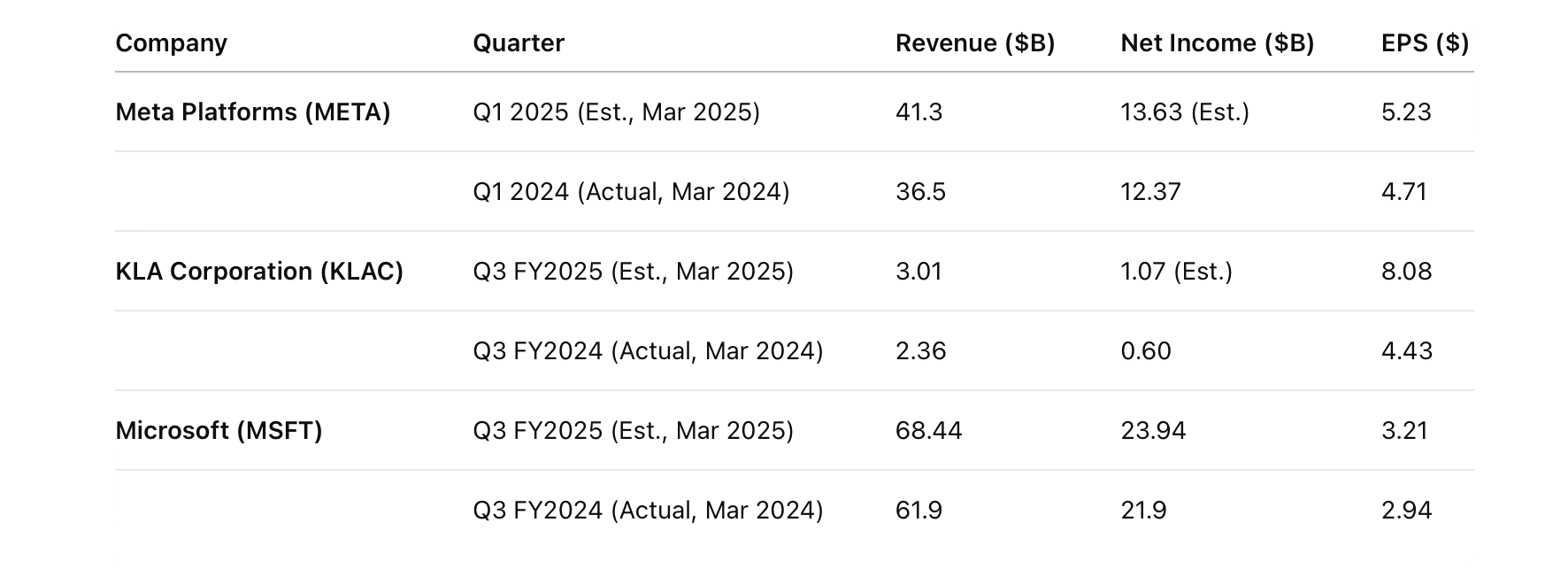

MSFThere are the estimates with comparative prior periods

I would expect beats, particularly for Meta. Their business is really firing. Look for comments on their chatgpt competitor.

KLA will be heavily involved in the COWOS ecosystem and we know demand and capacity expansion is very strong. Further, the cycle for smart devices has improved which should also bode well. I expect KLA to reaffirm their 2025 guides+. This is one company where we are investing in management just as much as the 'product'-they are at the top of their game.

MSFT-I expect Azure to continue to grow and for management to reaffirm their Capex ($80B) and at the same time say they have a lot more demand than their ability to supply re AI infrastructure

-

The latest slew of earnings reports confirm a common thread. Earnings are very strong(records) with the main driver being monetisation of AI driven technology which runs contrary to some suggesting the industry has yet to monetise this new productivity tool. Case in point, Meta says AI has driven a 30% increase in Reels ad spend.

The other consistent comment from CEO's is they can't get enough and they are committed to adding more capacity. Again this shuts the door on the rhetoric of bubbles and demand peaks.

There will always be choppy production and build outs-MSFT noted their data centre re-organisation, which the media took to be cancellations was in actual fact, due to some regions (they are global) running out of available power and the physical building out being slower than their needs. This is to be expected with anything new. And what we need to remember is you can't just click your fingers and have a multi billion dollar 'building' just appear. In saying that they are standing these structures up at a staggering pace.

The future for Big-Tech looks very positive. Inflation in the US, as reported yesterday is still falling, there appears to be more calm re the Trump taxation plans and we may even see some progress in the Russia/Ukraine situation.

-

Amazon and Apple earnings are on deck (after close tonight)

I don't expect any surprises with Apple. If anything they probably did a bit better than expected as consumers pulled forward purchases due to tariff concerns. Of greater interest will be their App Store growth which is a real cash cow. Also, we will be wanting to hear what they have in play re AI initiatives given the Apple Intelligence project, which didn't really get off the ground. Apple needs to up their investment in AI significantly and I think that is what they will discuss.

Amazon, I expect will have a great quarter with a solid beat. As you can see the EPS growth expectation is significant. This is due to the massive warehousing and logistics expansion.

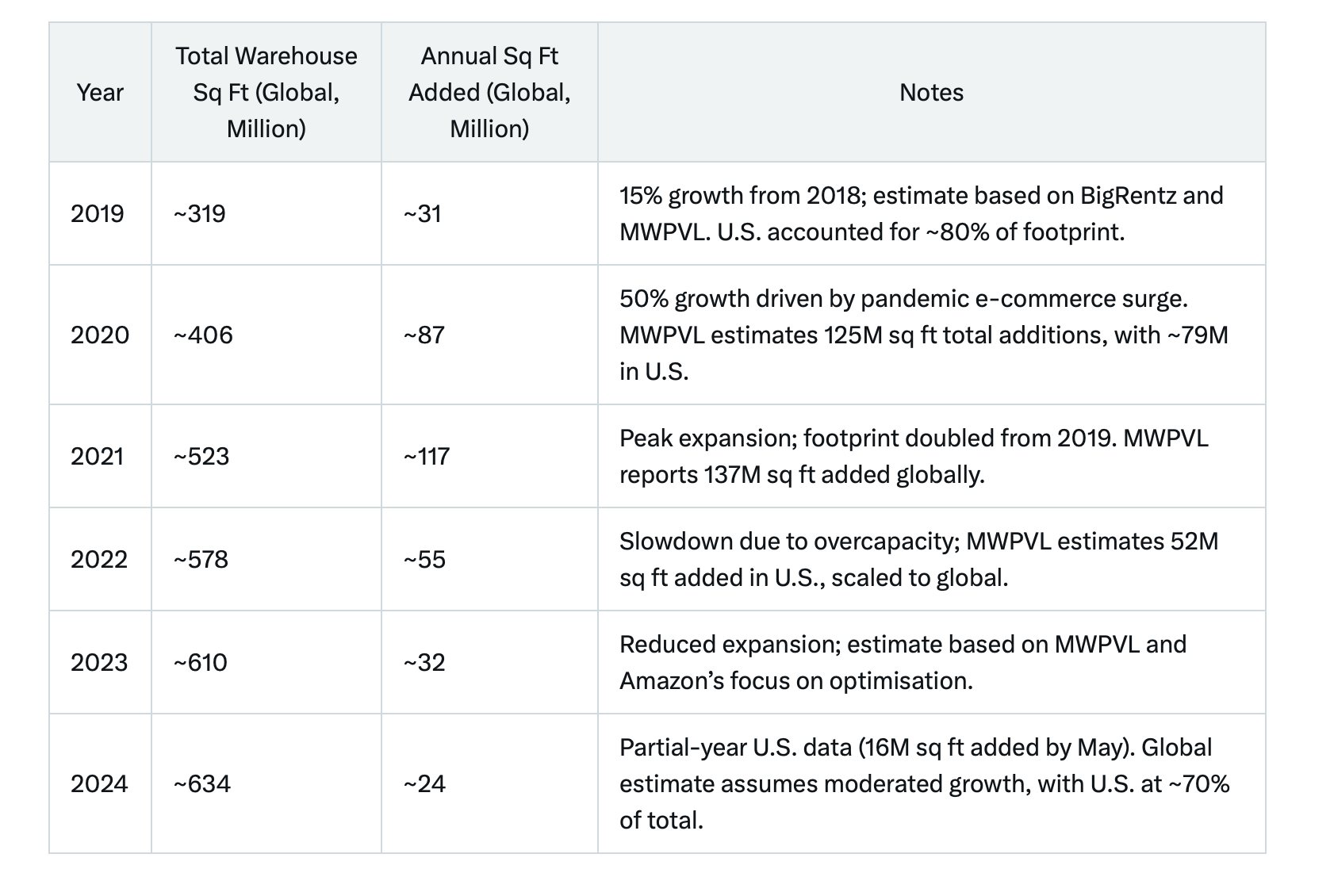

From the table below. 2021 saw 117 million sq feet added to their distribution hubs. Get your heads around that Nr. But the point being, this expansion was a big over supply at the time and it dragged on earnings whilst the company grew into its capacity. Billions every month in rent and opX incurred whilst these facilities were under utilised. But now they are much leaner.

This coupled with cutting edge automation/robotics. Amazon is now a super efficient enterprise. And with its crown jewel AWS, is firing on all cylinders.

-

@exIM The one constant/vindication is 'follow the evidence'. It's only sensible to weigh the rumours but in my mind, driving a stock down 20% on nothing but speculation is idiotic. I accept that certain industries are more exposed to direct taxation and trade policy but the last few weeks has been a case of throwing the baby out with the bath water. Meta was a case in point. It's now +20% since April 21 and for good reason, they excelled and guided higher again. It did allow us to take some opportunistic decisions re weightings.

From what we saw in the past 24 hours-some facts, direct from the CEOs.

- AI is making a lot of money

- Demand is well ahead of supply

- Further AI investment will continue unabated

and some direct quoted from the calls last night:

CEO Satya Nadella emphasised the growing importance of AI across industries. He noted that every customer he speaks with is eager to understand not just how, but how quickly they can apply next-generation AI to address their biggest opportunities and challenges, and to do so safely and responsibly.

Zuckerburg: AI will become ubiquitous in business. Zuckerberg stated, "I think, in the future, every business is going to have an AI," likening it to the essential nature of having an email address or website today

-

"Despite the clear momentum behind AI adoption, a familiar chorus of skeptics remains—many with little exposure and even less conviction. Their posture, unchanged since early 2024, seems less rooted in caution than in envy of those who moved early and decisively. Having missed the inflection point, they now critique from the sidelines, absent both risk and skin in the game."

-

I believe we have name for such people ….but I’m too polite to write it in here

-

Nasdaq futures surged 3.5% today, driven by optimism from the Geneva talks between US officials, including Treasury Secretary Scott Bessent and Trade Representative Jamieson Greer, and Chinese Vice Premier He Lifeng.

The establishment of a consultation mechanism fuelled hopes of easing tensions. Tech firms in particular being reliant on Chinese markets, will lead the surge. Details remain pending a Monday briefing. As always, the markets will remain highly sensitive to same.

-

Breaking:

In a landmark move, the United States and China have agreed to drastically reduce tariffs, signalling a potential thaw in their long-standing trade war.

According to recent discussions, the U.S. will slash tariffs on Chinese goods from 145% to 30%, whilst China will lower tariffs on American products from 125% to 10%. This 90-day agreement, effective immediately, aims to ease economic tensions and foster renewed trade cooperation.

The decision follows months of negotiations, with both nations recognising the mutual benefits of de-escalation.The U.S. has also committed to capping certain tariffs at 10%, a gesture mirrored by China’s willingness to open its markets further.

Futures are +800 and the USD strengthened by 80bps.

-

Fingers crossed

we see some stability return

we see some stability return -

I think the worse is over but things will remain choppy until we see some definitive policy in the US and some reciprocity from their trading partners.

Earnings have been largely good with specific tech centric strength which bodes well. So what we have is solid fundamentals which now look far less likely to be impeded by tariff/trade concerns. It's what we want. It's a case of, business is doing just fine, let's not derail with geopolitical game playing.

It's what we thought would happen (common sense) so just pleased we now see some light!

-

Consumer CPI came in at +0.2% bringing the YoY inflation rate to 2.4% with no indication of any tariff impact. Future are up/stable and Trump is meeting in Saudi with a slew of US CEOs including Huang and Musk. I'm guessing some big investment announcements will drop in the next 48 hours.

-

In the news:US and Saudi sign multiple mega deals cover various investments. Included is $80B in data centres using NVDA technology. I'm not going to say much more-no surprises. They cant supply the demand anyway but it reaffirms the fact that Nvidia is the greatest beneficiary of tech and will be for a very long time. And of course with then, so will MU, AVGO, KLAC and SMCI directly and indirectly GOOG/MSFT/AWS/ORCL

-

Certainly been a nicer experience looking at the dashboard over these last couple of days...

-

Agreed Steve, the headless chicken action is not pleasant for anyone.

-

Colossus-2 (Xai):

Colossus 2, targets 1 million NVIDIA GPUs ( Blackwell B200/B300) by December 2025, with potential expansion to 2 million by December 2026. Requiring 1,641 MW for 1 million GPUs and 3,281 MW for 2 million, it will use SMCI’s liquid-cooled servers and NVIDIA’s high-performance networking. Located in Memphis, it leverages TVA’s 1.2 GW power commitment and Tesla MegaPacks. This cluster is xAI’s primary vehicle for massive GPU scale-out, designed to train advanced AI models.Demand aint slowing down! Min this is another $50 billion

This is approx 15,625 racks if 64 config and 13,888 if 72.

Mega packs onsite- $150 Million in batteries.

Why batteries are used.

Power Smoothing: Batteries, often part of an Uninterruptible Power Supply (UPS) system, help stabilise power delivery. Data centres, especially those running AI workloads, have massive and fluctuating power demands due to high-performance computing (e.g., GPUs for AI training). Batteries smooth out spikes and dips in power draw, ensuring consistent voltage and preventing damage to sensitive equipment. -

TSMC Chairman C.C. Wei statements at annual shareholder meeting Tuesday 3 June, via media reports.

“Overall AI demand is still very strong”, TSMC still cannot meet chip demand, and related business opportunities continues to increase.

All AI orders are with TSMC, including Nvidia and ASICs.

Humanoid robot-related chips are already making a significant contribution to TSMC’s revenue

TSMC has no plans to build chip fabs in the Middle East

It takes time to build a chip cluster (chip manufacturing location complete with supply chain), and currently such clusters only exist in the US, Taiwan, Japan, Europe and China.

TSMC’s business remains robust and we continue to expand to meet customer demand.

TSMC still sees revenue and earnings reaching new record highs this year despite tariffs, currency volatility.

TSMC technology “cannot be stolen” due to robust safeguards and the complexity of its capabilities.

It is the result of 10,000 R&D engineers and thousands more production engineers who optimise and refine the chip production technology.

“If our technology could be stolen that easily, TSMC wouldn’t be where it is today,” he said, adding “it’s beyond the capacity of an individual, 10 people, or even a hundred, to steal.

Tariffs won’t affect TSMC because importers usually bear the cost, not exporters like TSMC.

But if tariffs can lead to higher prices, or could cause global economic growth to slow, which could affect TSMC

TSMC has talked with the US about the impact of tariffs on importing chip-making equipment to TSMC Arizona, and there appears to be some flexibility.