Busy couple of weeks on results front

-

Thanks again Adam….

-

KLA has consistently proven everyone wrong. In any event the US(China) controls have been in play for 2 years now. In fact Nvidia has only just started selling their nerfed Hopper chip, the H20 in the last 2 quarters. The West's demand is much more than the ability to supply and that won't change for 'years'. China is a non issue. They are years behind and will always be so, which is a good thing. Huawei chips are dinosaurs compared to their US alternatives and the media are misinformed as to their(Huawei) ability. Their chips are double masked which means 2X processed which means they give very poor yields, cost a fortune to produce and are in very small supply. We have also discussed what a fast chip even means. Nothing without the ability to network 1000's of them together or have the software to run them. It's dog whistle self adulation from China, 'look we can produce a 5nm chip'. Good luck with your 'one' chip.

Circling back to KLA. They do have significant China revenue at the sub 15 nm node but nothing material at the sub 7nm node. The US isn't interested in restricting the sub 15nm node. This is the sort of tech you find in cars and washing machines. Yet again, the market is mis informed. We will hear from KLA management very soon-they are always very conservative and transparent. If the past decade is anything to go by, the company will navigate any issues with great skill and competency. A great business with the best years ahead of them.

Regards

Adam

-

Taiwan Semi reported their quarterly results, handily beating expectations and raising guidance significantly above consensus expectations. Driven by Sub 7nm nodes, particularly 3nm which is the architecture used by Blackwell and H200. Fascinating to see the market react to this 'news' which was pretty much known for some time. TSM always low ball their numbers, such is their conservatism. The sector gets thumped on Monday due to a related by tenuous link (ASML), Nvidia drops 5% to 130 and is back to 140 in pre market today.

-

Great info again ….

Will we see KLA get a boost from this news thou -

Hi Ducati,

KLA is up $17 in pre market.

Here is what the CEO said in July whilst delivering their quarterly earnings.

-

We are encouraged by the continuing signs of a strengthening market environment at the leading edge and are increasingly confident in our plan for steady improvement throughout the remainder of this calendar year and into 2025.

-

AI continues to be a growth driver. We see higher wafer volume (check) and more complex designs (check) and growing in advanced packaging (check!-this is exactly where the very high growth is today)

The things to note. KLA does sell a lot of equipment and services into China. However the US restrictions are not new. KLA took the hit last year(on China) and are now back in growth mode so it appears the market is dwelling over issues which are in the rear view mirror. Most of Chinas semi conductor industry is focussed on DRAM/NAND and this is not really an area of concern to the US.

KLA had a long history of excellence and we will hear from management on the 30th.

Regards

Adam

-

-

Is Tesla part of any Portfolio

-

Hi Ducati. No, Tesla is not held.

The valuation is predicated on Self Drive/Robo Taxi. The chances of seeing this before 2030 are slim. Solar and energy storage divisions make losses. Robots may pay off in years however there are many other companies competing in the sector. All the while one is paying an extreme valuation for a company that derives modest earnings from selling cars. Less money than BMW, which has a valuation 6% OF Tesla.When all is said and done. If PHT had purchased the stock at inception we would be down 40%. Everyone may be wrong about Tesla . That is irrelevant to us because, as said, its valuation is based on faith(fact) and in this business, at least the way we run our business, we do not take huge leaps of faith-the numbers must stack up. That takes nothing away from Mr Musk, who is an exceptional engineer and even better at marketing his brand.

Regards

Adam

Regards

Adam

-

Adam….as always appreciate the reply and info

-

Thanks Adam

Musk is certainly a character, but I bet some of his shenanigans (odd behaviours, potential bribery of US electors to name a couple of recent ones) actively put people off Tesla

I count myself amongst them, tbh - maybe cutting my nose off to spite my face, but sometimes you've gotta do you

️

️eta: by why oh why has TSLA just popped 20%

-

The week is not quite finished but what a week so far! The markets rejoiced at returning DT to the White House coupled with a further rate cut by the Federal Reserve. Corporate earnings remain resilient. An accumulation of positive factors driving equity indexes to new highs, as did other risk assets including bitcoin. The Dow made it's biggest advance since April 2020!

Many holdings reached new highs also; Netflix, UNH, Nvidia, Meta, Vertex. Others turned positive overall-Twilio, Paypal. Every single PHT holding is 'in profit'.

Nvidia has taken the honour of the worlds most valuable company ($3.65T), eclipsing Apples all time high valuation of $3.49T.

-

Thanks again for the update Adam…..

Let’s hope Nvidia keep the ball up when the earnings come out on the 20th -

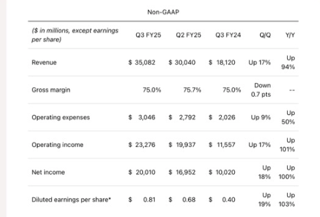

The guide for Q3 was $32.5B. They have been consistently surpassing their outlook by $2B so we should see, circa $35B and net income of $20B or 80c/share (Non GAAP). The market will expect the Q4 outlook to be Q3(actual) +$2B. I think it will be a lot more than this. Perhaps +$8B ($45B?). It's a big number but the evidence puts it in-scope. We are at the point now where their actual earnings will start exceeding that of Msft and Apple.

Nvidia are still in 'surprise' mode as opposed to potential chance of disappoint. Still constrained and most likely will be for 'years'. We will find out Nov 20th!

-

Earnings will be announced tomorrow, Nov 20 at around 9.20pm UK time and a conference call will follow, starting at 10pm, which we will be watching live.

Wallstreet expectations, which is an average across a dozen or so analysts projections are:

Non GAAP 75c

GAAP 70c

Revenue $33.12B

The company guide was $32.5B.We expect a beat on the top and bottom lines, closer to $35B and 81c.

The Q4 guide is all important. Will they guide Q3 actual +$2B or will they guide $40B+The market cares but I don't think it matters much whether they guide 38 to 42. With Blackwell sold out for F2025 it's largely academic. The company should deliver well over $200B in revenues next year and tax paid profits of at least $120B. Well ahead of any company in history.

The interesting parts of the conference call will be the take up of Nvidia Enterprise, NIMS, progress with Spectrum X/Ethernet, Omniverse and their collaboration with Google on Quantum computer simulation.

Only one more sleep!

Regards

Adam

-

Nvidia Non-GAAP EPS of $0.81 beats by $0.06, revenue of $35.08B beats by $1.95B

Outlook

NVIDIA’s outlook for the fourth quarter of fiscal 2025 is as follows:Revenue is expected to be $37.5 billion, plus or minus 2%.

GAAP and non-GAAP gross margins are expected to be 73.0% and 73.5%, respectively, plus or minus 50 basis points.The revenue and earnings figures were spot on with the company choosing to guide consistently with their historical cadence of ‘Reported Q + $2B’. I was looking forward to seeing $4X on the guide but it takes little away from how well management are executing. There is no chink in the armour. Guided margin to 73.5% from 75%. Completely expected. As any new architecture (Blackwell) is introduced, yields from wafers is lower and over time it improves. This is simply down to ‘yield learning’. The CFO stated that they expect margins to revert to 75% by mid next year.

The company stated that they shipped 13,000 Blackwell samples to their customers in Q3 including one full DGX system to OpenAi. ‘Today Blackwell is in the hands of all our major partners’- Super Micro even received a shout out from Jensen Huang (important partner) so relations seem intact.

Huang stated ‘Blackwell Demand is staggering and we are racing to scale supply to meet this incredible demand. Customers are gearing up to deploy Blackwell at scale.’

This is key, just 64 Blackwell GPUs are required to run the GPT-3 benchmark compared to 256 H100s (Hopper) which translates to 4X reduction in cost. Often misunderstood , chips and systems are getting cheaper due to throughput. The actual system is obviously more expensive however, in this case, Blackwell is 30X faster which drives down(cost) operations per watt. Geographically, data centre sales to China grew but are well down when compared to pre export control periods. This is a positive and reinforces the option, Nvidia don’t need China to grow. And grow they did. Their annualised run rate is now 87%, lower than their prior Q run rates of 101%. The company generated $35B and reported a net profit of over $20B, which works out at a conversion rates of 57c for every dollar of income. I’m not aware of any other business managing these sorts of returns.I’ll add more as the days goes on

-

Ha - I was just looking at the figures when you posted.

Your expectation of $.81/share on $35bn was spot on. Bravo. All nicely above NVDA's own forecast and also above Wall Street expectations.

And yet the shares dropped more than a percentage point on the news. I guess you'll be telling us (again) that markets are irrational!

I notice that The Orange One has been making noises about wanting chips to be made in the US and clobbering imports from Taiwan (i.e TSMC NVDA chips) with tariffs. Something to be worried about?

-

Hi O,

The stock market will always react to a short lived event. Our job is to identify opportunities backed up by credible quantitative research and continue to test this thesis against actual company performance. Occasionally you have to give the company the benefit of the doubt. Not with Nvidia.

You would be hard pressed to find a credible argument against them. There are plenty of opinions but they are mostly what I would call 'throw away'. Competition is coming, margins won't be maintained, AI is hype, no monetisation. The one thing these all have in common is they are all untrue.

The facts are they dominate the industry, in fact it's almost a monopoly but more importantly, they create new markets, new opportunities.

You will find the vast majority of detractors are simply envious, that they missed out, were wrong (Cathy Wood), never held the stock or sold a long time ago. They are still spouting the same opinions as facts but don't forget, they've been at it since $35/share. And at the same time we were just lucky?

The facts are, the biggest companies in the world have decided they will invest trillions in the pursuit of AGI. Masa Son, CEO of Softbank, who is considered transformative figure in the tech industry and if anyone is qualified to form an opinion, he is, considers that we need $10T in spending to reach AGI over the next 8 years. I don't need to agree with him or work out where the money is coming from. All I need to know is that the end goal is bold, it is huge and it will continue for the next several years. And when i look at the companies performance today, the numbers stack up re their valuation. This coupled wit their growth rate and known roadmap also tells me that there is a lot of growth to come.

Regards

Adam