Busy couple of weeks on results front

-

If you recall, we mentioned Nuclear power in the data centre quite some time ago. More recently it's become a discussion point. Over the past few months we have been looking at it as an investment option. We have decided to pass. Why?

Utility companies are very heavy capital consumers. The best investments allow for expanding sales capacity with a relative high margin and relative low capital deployment . Like software or take Apple, a premium brand which attracts super high margin. Power generation is the opposite. Sure, we knew that several stocks would likely move higher but is it FOMO or something sustainable?

Monetising nuclear power for the data centre will take years. The market is reacting early and with irrational optimism in our opinion. And we feel when the reality of years long wait for earnings to materialise, the debt and the drag that will have on earnings, becomes reality the gains will start to unwind. Choosing a winner is also fraught with uncertainty.

Our thematic approach to investing and portfolio building allows us to look at the segment(AI) for complimentary businesses. A supply chain of critical businesses, without which accelerated computing wouldn't exist. However power is a commodity whereas other components are very complex, difficult to product, have high margins and a select few control the supply. This is where we want to be invested.

We will be adding a new name very shortly (2-3 weeks) and an announcement will be made closer to the time.

-

Thanks Adam. This has the fingerprints of a 'buy-and-hold' strategy all over it, which I like. Short term-ism on businesses with less strong fundamentals is referred to by our old friend Terry Smith as 'Greater Fool Theory', and I approve more of the former.

-

Breaking News-Trump revokes Biden's AI Chip Difussion policy. It's now a case of watch this space to see what they come up with. It's definitely a positive

-

It didn't 'react' when the Stargate project was announced, nor when they imposed the chip policy so i don't expect much now. Investors are waiting for earnings/guidance and whilst other tech reporting next week or so will be a catalyst I doubt much will happen until they announce their quarterly figures and provide some commentary on the rest of the year-after all it is floating around its all time high. And it is the world most valuable company

-

Thanks Adam, makes sense, easy to forget they stock split @ 1200 not too long ago !!

Any thoughts on SMCI ? I know earnings are due soon, in the light of no more bad news, I'm hoping for something positive !@exIM said in Busy couple of weeks on results front:

Thanks Adam, makes sense, easy to forget they stock split @ 1200 not too long ago !!

Any thoughts on SMCI ? I know earnings are due soon, in the light of no more bad news, I'm hoping for something positive !I'm hoping SMCI will drop swiftly so I can buy some more.

-

Hi,

Re SMCI, it appears as though they did nothing wrong. Earnings won't be officially released until they file the 10-k, the dead line is 25 Feb. They can comment on an earnings guide but it's just that. All 10-Q(quarterly) will remain outstanding until they file the 10-k (Annual Report).All I'll say is the mess they found themselves in would not have happened if the senior management had tighter control over everything. They made bad decisions in certain communications with investors and 'the street' and I hope they have learned from it!

Stargate and all future DC build out needs DLC. SMCI just don't supply DLC, theirs is no doubt, the best. There is only so much capacity, globally and they control maybe 40% of it. So imo either way they are going to get a lot of business. But as you have seen, great product, lousy management, so the point is, they need to make certain corrections in many areas. We decided to retain a holding because of two reasons, we booked a very high realised gain and the product is too good to ignore.

The company will have to raise more capital to meet the continued increase in server prices and demand-this isn't anything new, so i expect a combination of equity(dilution) and debt.

Things for them should get back on track after March, provided they file on time-i believe they will.

-

Meta, not to be outdone by OpenAi just announced its 4 Million Sq ft, Louisiana Data Centre. Power consumption will be 2GW and all renewable. The project will be finished by year end and consume 1.3 million GPU at a capital cost of circa $65B. To put that into perspective, there are 500 data centres in the UK consuming 6.9GW. It's enormous. Meta is at an all time high of $650. We purchased the stock initially on 3 May 2024 for $450

-

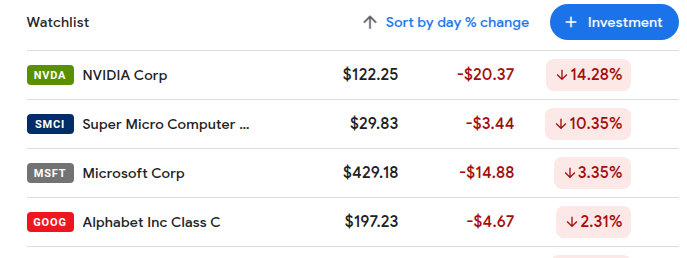

Over the weekend, a little know Chinese start up published results of it's latest LLM-DEEPSEEK which were very impressive, sending the US tech sector into a wobble. They claim to have achieved these results with a handful of chips and a laptop. Not quite but $5M. The truth looks like they have 50,000 H100 Nvidia chips-and obviously they can't say that. My take is, are we to believe an unknown has done what Altman, Deepmind, Musk and Zuckerburg could not. In our opinion all that has changed today is the market wants to sell stock and even if there is some truth behind the claims it doesn't change a thing.

LLM's like chatgpt are not the end game, in the scheme of things they are very early and basic building blocks. Stargate and Meta's $65B data centre announced Friday are AGI-goal machines.

To think across the Mag 7, they all got outdone by a handful of guys in a back room with a laptop is, shall we say 'unlikely'.

-

If anything, it may show that China are not as far behind as many think-the LLM is apparently very good but the suggestion it was trained on a handful of H800 chips is not plausible. If anything it will drive even more US investment.

-

It's a completely irrational view. Even if true and it's looking like it's completely false. Sam Altman says Deepseek has copied OpenAi 'technology' and that what they have done is 'easy' when you don't have to innovate and create new things.

Second if there is this new breakthrough(cheap) then it's good news because it means we will reach AGI even faster and all that compute can be used for inference rather than long periods of time and money in training.

On the basis the drop is unwarranted, yes it is an opportunity for those that like the space and see a long term future in it.

-

I would also say; there is no coincidence that Trump comes out promoting America first in the AI arms race and China just happens to rain on his parade. Secondly we know OpenAi has much more advanced models.

Third, what may happen is the next generation of chips will only be made in the US and never leave. TSMC will start production in their Arizona Fab this year. The Blackwell Ultra will be produced in this facility. It's also interesting when looking at DLC server racks. The big foreign player is Foxconn-they will produce these in Mexico but SMCI is the only American made supplier. Could they see favour with the 'buy american' policy. and what if tariffs are applied to Mexico goods? This could play out very nicely for American companies.

I envisage a scenario under Trump, that any friendly/partner country (west and some European), Australia etc wanting the next generation of chip, they can have it provided they set up shop in the US. When you think about the administrations policy, it would make a lot of sense to require all this business being State Side. Investment, jobs, security, tech advantage, all in America. The next season of Yellowstone might see the cattle moved on and a 10GW data centre in its place

-

Lots of Big Tech earnings this week. I am sure we will get plenty of CEO comments on this very topic.

Msft CEo Nadella commented 'Jevons Paradox' strikes against. Basically he is happy AI might become more efficient because it will simply lead to more consumption..'we just can't get enough of it' he said.

-

If anything, it may show that China are not as far behind as many think-the LLM is apparently very good but the suggestion it was trained on a handful of H800 chips is not plausible. If anything it will drive even more US investment.

-

Hi O,

Large daily moves are all part of the investment journey-no stock is immune. Some are warranted and permanent, others are not, being caused by a combination of sitting at peaks(the case) and a rumour or misinformation (the case). Even if this claim is true, would it change the built out. No it would not. As we have discussed numerous times, AI is little to do with LLM chatbots which are just stepping stones to reach AGI. That is the goal and the West will invest trillions to achieve it. Whether they succeed is up for debate. For now we get some clever productivity tools. One day we might get the theory for everything and a cure for all diseases.

China may or may not succeed but one thing is certain. Western allies will not be buying their discoveries any time soon, hence why the Mag 7 are building it. Meta's new Louisianna DC is already stood up, you can google photos. They aren't walking away because some Chinese startup made a clever chatbot. The only risk with Nvidia is whether a better accelerator comes to market (more efficient). It doesn't exist so we are happy investing in 'Team Green'

To reiterate, those that think the world is done buying GPUs simply don’t understand the purpose. It’s not to generate cat video’s. It’s to solve what is impossible today, tomorrow.

-

Adam, thanks. All understood, and I'm very happy to upvote your post (along with Dangermouse).

Holding one's nerve when faced with an interesting news day is all part of the fun of it I guess. And as Terry Smith said, "If you don't like what the screens are telling you then turn the screens off".