General News

-

What a turn around that was. With metals and the Fed choice causing havoc over the weekend I was bemused, which is a good way to describe the nonsense. Checking in at 0630 seeing a sea of red a lot of head scratching ensued. Steadily back it came. But strong green(everywhere). Very nice to see.

-

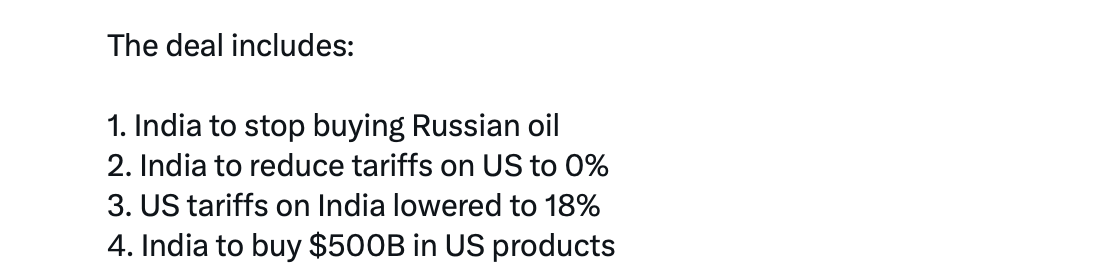

India's deal with the US

-

AppLovin’s(APP) recent collapse is a textbook example of how fast sentiment can turn when a high-multiple story meets credible disruption risk. Just weeks ago, the stock was riding high near $745, priced for near-flawless execution and continued dominance of the mobile ad stack. Today, it’s below $400 — a brutal near-50% drawdown in a matter of weeks. That’s not noise. That’s repricing.

The catalyst wasn’t a blow-up in earnings, but something the market arguably fears more: structural risk. The emergence of CloudX — a new, well-funded startup founded by veterans who helped build parts of the modern mobile ad stack — has raised uncomfortable questions about AppLovin’s moat. CloudX is explicitly targeting mediation, optimisation, and workflow automation using AI agents, which strikes at the heart of AppLovin’s value proposition to publishers.

That matters because AppLovin is no longer diversified. After divesting its gaming business, it’s essentially a single-bet ad-tech company wrapped in an AI narrative. When that narrative is challenged, the valuation doesn’t gently compress — it snaps.

The speed and magnitude of the sell-off suggest many investors were crowded into the trade, extrapolating recent success too far. In that context, taking profits near the highs looks less like good luck and more like discipline.

-

Posted because it pretty much spot on. From 'an analyst' said

The Market's AI Freakout Creates A Massive Mispricing

Technology is the worst-performing S&P 500 sector YTD, down nearly 6%, while energy leads with a 17% gain amid a growth-to-value rotation. BUT

Despite the tech selloff, AI-related CapEx is surging toward $650 billion in 2026, fueling opportunities across the entire AI infrastructure value chain.

Earnings growth remains robust, with S&P 500 Q4 2025 estimates at 12% and tech companies delivering nearly 30% growth, supporting the sector's long-term leadership.

Tech valuations have reset to multi-year lows, presenting a compelling entry point for fundamentally strong software and AI beneficiaries as pessimism peaks.

NB: Our tech is not -ve. It's up 4.35% YTD.

What's the take away. I'll say it again, irrational behaviour. Tech delivered the outsized earnings growth but fear drove many to do foolish things...sell the very thing delivering. The headline Amazon miss by 1 penny-they didn't. They settled some massive law suits and restructured parts of their business and took a one time 2.4B charge. They smashed it operationally.

The very reason so much extra Capex is being invested in rack scale AI factories is because the Mag 7 CEOs know something you don't-we are on the cusp of a step change in AI ability. They know it and it's very exciting. Not only that, every GPU they have is sold out. I expect some very big software companies to be in big trouble in the next year or so as AI agents structurally unpick their business model, big retail will be turned on its head, customer service will encounter a revolution, recommender systems(search) will be transformed.

Jensen Huang has been teasing the media with sound bites for the past 2 weeks. Significant acceleration in growth. Visits to Taiwan, clearly asking TSM to turn up the dial.

-

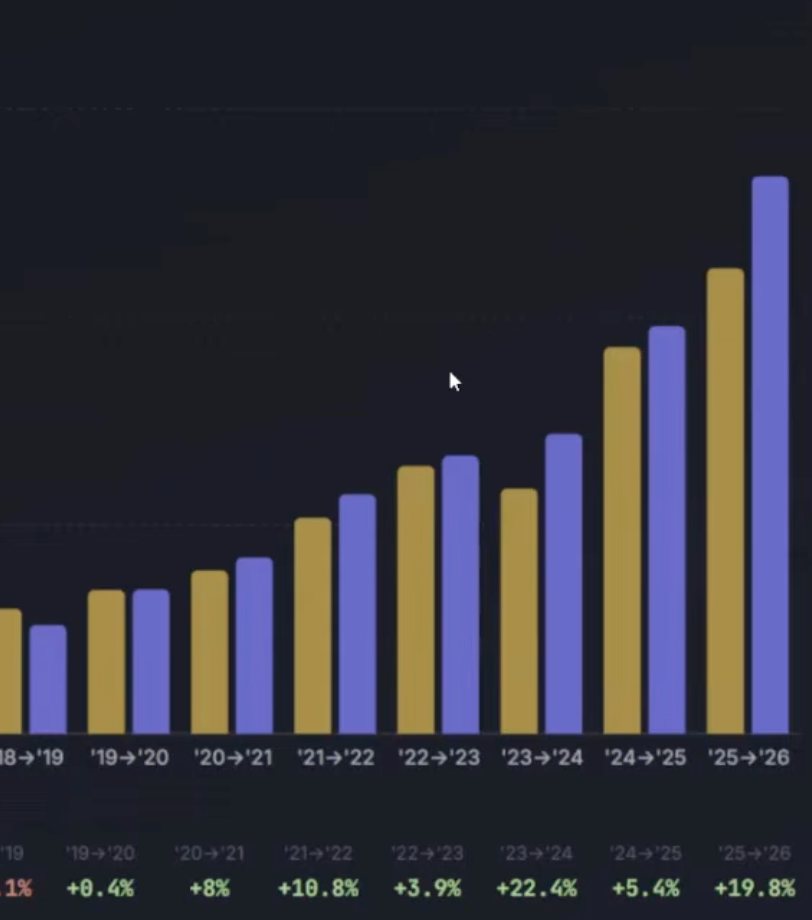

We all like a graph. This is TSM's Jan-Feb delta in revenue over the recent years. Look at 2026. For a giant, it just generated +19% QoQ. That is very impressive. A lot of accelerators being shipped

-

Someone should show that to Andrew Bailey, he's been predicting a 'market correction' for a while now.

AI Overview

Bank of England Governor Andrew Bailey has raised concerns about a potential Artificial Intelligence (AI) bubble multiple times between late 2025 and early 2026, warning that "materially stretched" valuations could lead to a sharp correction if productivity gains fail to materialize.

Based on recent reports, Bailey has warned of an AI-related market crash or bubble at least three to four times in official speeches and publications:

November 6, 2025: Bailey warned of an AI-induced bubble, noting that while AI could drive productivity, markets might be overpricing the future stream of returns.

December 2, 2025: In the Bank of England’s Financial Stability Report, Bailey highlighted that AI valuations were "particularly stretched," drawing comparisons to the dotcom bubble and warning that a sell-off could threaten financial stability.

December 18/19, 2025: Speaking to the BBC, he stated that while AI might transform the world, the frenzy for shares could be overdone, urging that policymakers "have to watch the valuation question".

February 8, 2026: Bailey again warned of "complacency" in financial markets, stating that "expectations of AI-driven productivity gains could be disappointed," which could cause a bubble to burst. -

Given his track record I won't be taking any lessons from AB. He has concerns? I have concerns about his performance and that of the government-and last time I looked the UK isn't really participating. Another missed opportunity.

If you read what he says, 'AI might transform the world' but there's a frenzy-really. 25X PE a frenzy. And he might have to implement policy to deal with it. Like what, Andrew? In summary he says it might be transformative, it might not. Very useful.

It's as useful as 'The Dean of valuation' expertise in saying Nvidia was worth $23/share

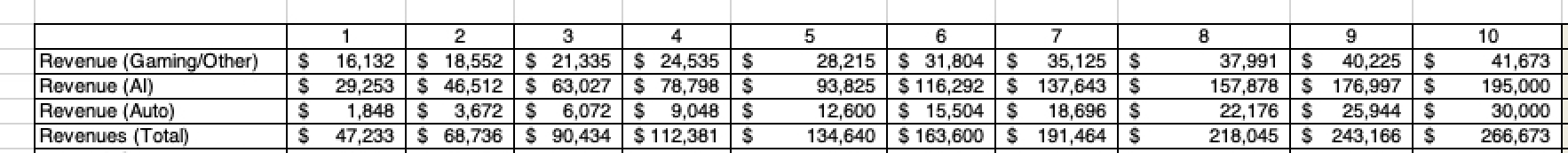

. 2024 to 2033 projected revenues. Only problem being his 2033 revenue will be exceeded in 2026 and he used an operating margin of 40% when it's actually 65%. You too can spend 100k a year to send your kids to his University and listen to the learned professor. I saved his research papers in 2023 as I had a hunch it wouldnt age well. He has continued to double down even to this day calling Nvidia 'priced at insanity'. What many dont know is he owned the stock and sold it in 2023. He's like so many others (Cathie Wood) who sold out and now spend their time throwing shade on the company, making themselves look stupid. Wood has destroyed more capital than any other asset manager in recent history by taking reckless moon-shots that pay off for 5 minutes then get obliterated.

. 2024 to 2033 projected revenues. Only problem being his 2033 revenue will be exceeded in 2026 and he used an operating margin of 40% when it's actually 65%. You too can spend 100k a year to send your kids to his University and listen to the learned professor. I saved his research papers in 2023 as I had a hunch it wouldnt age well. He has continued to double down even to this day calling Nvidia 'priced at insanity'. What many dont know is he owned the stock and sold it in 2023. He's like so many others (Cathie Wood) who sold out and now spend their time throwing shade on the company, making themselves look stupid. Wood has destroyed more capital than any other asset manager in recent history by taking reckless moon-shots that pay off for 5 minutes then get obliterated.The takeaway being, everyone has an opinion but don't listen to anyone with an axe to grind or is holding themselves out to be an expert when the reality is they have no experience whatsoever. What expertise gives the BOE governor or a finance lecturer the authority to speak on any business.

-

Taking in others opinions can be a positive but first you need to assess whether that opinion is based on any actual knowledge/expertise and whether they are biased. Take Semi Analysis. They favour Taiwan over US companies and imo actively engage with miscreants, writing negative spin to earn revenues. If you didn't know that you could be swayed. And then you have posters on forums like PH, 1% actual knowledge and 99% made up nonsense(attention seeking). Fake Gurus with forums can pull in a few easily lead.“Hello, McFly! Anybody home?” – Biff Tannen. Remember Biff, he reinvented himself as a Fund manager using his almanac

-

US nonfarm payrolls rose by 130K in January, comfortably beating the +70K consensus and well up from December’s +48K, which was revised slightly down from the initial +50K estimate, according to figures out Wednesday from the Bureau of Labour Statistics.

Futures up