General News

-

Yep….not too bad thou..expected around 2/3% drop

-

All that matters is the big names will be reporting next week-I'm expecting record earnings all round. The tech portfolio is still the best performer in town. Past performance is no indication of future returns.

-

Or a U turn.

-

From a MS report today

-

Quick update. Both meta and msft beat nicely. Meta is plus 8% and msft is down 4%. Futures plus 250. Both results as posted earlier(solid beats). Happy with the results and regardless, the net portfolio impact is positive.

-

What a turn around that was. With metals and the Fed choice causing havoc over the weekend I was bemused, which is a good way to describe the nonsense. Checking in at 0630 seeing a sea of red a lot of head scratching ensued. Steadily back it came. But strong green(everywhere). Very nice to see.

-

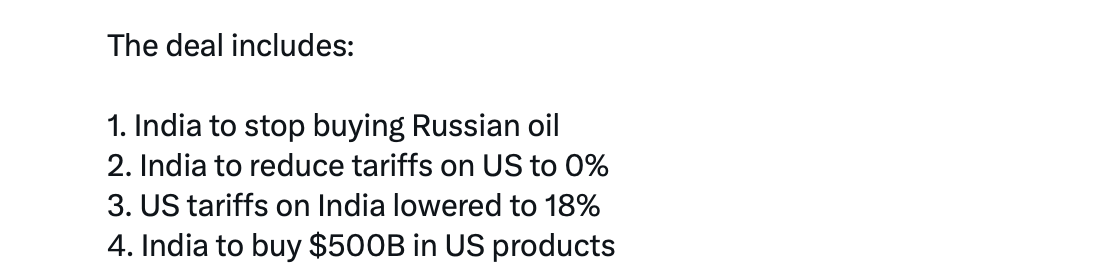

India's deal with the US

-

AppLovin’s(APP) recent collapse is a textbook example of how fast sentiment can turn when a high-multiple story meets credible disruption risk. Just weeks ago, the stock was riding high near $745, priced for near-flawless execution and continued dominance of the mobile ad stack. Today, it’s below $400 — a brutal near-50% drawdown in a matter of weeks. That’s not noise. That’s repricing.

The catalyst wasn’t a blow-up in earnings, but something the market arguably fears more: structural risk. The emergence of CloudX — a new, well-funded startup founded by veterans who helped build parts of the modern mobile ad stack — has raised uncomfortable questions about AppLovin’s moat. CloudX is explicitly targeting mediation, optimisation, and workflow automation using AI agents, which strikes at the heart of AppLovin’s value proposition to publishers.

That matters because AppLovin is no longer diversified. After divesting its gaming business, it’s essentially a single-bet ad-tech company wrapped in an AI narrative. When that narrative is challenged, the valuation doesn’t gently compress — it snaps.

The speed and magnitude of the sell-off suggest many investors were crowded into the trade, extrapolating recent success too far. In that context, taking profits near the highs looks less like good luck and more like discipline.

-

Posted because it pretty much spot on. From 'an analyst' said

The Market's AI Freakout Creates A Massive Mispricing

Technology is the worst-performing S&P 500 sector YTD, down nearly 6%, while energy leads with a 17% gain amid a growth-to-value rotation. BUT

Despite the tech selloff, AI-related CapEx is surging toward $650 billion in 2026, fueling opportunities across the entire AI infrastructure value chain.

Earnings growth remains robust, with S&P 500 Q4 2025 estimates at 12% and tech companies delivering nearly 30% growth, supporting the sector's long-term leadership.

Tech valuations have reset to multi-year lows, presenting a compelling entry point for fundamentally strong software and AI beneficiaries as pessimism peaks.

NB: Our tech is not -ve. It's up 4.35% YTD.

What's the take away. I'll say it again, irrational behaviour. Tech delivered the outsized earnings growth but fear drove many to do foolish things...sell the very thing delivering. The headline Amazon miss by 1 penny-they didn't. They settled some massive law suits and restructured parts of their business and took a one time 2.4B charge. They smashed it operationally.

The very reason so much extra Capex is being invested in rack scale AI factories is because the Mag 7 CEOs know something you don't-we are on the cusp of a step change in AI ability. They know it and it's very exciting. Not only that, every GPU they have is sold out. I expect some very big software companies to be in big trouble in the next year or so as AI agents structurally unpick their business model, big retail will be turned on it's head, customer service will encounter a revolution, recommender systems(search) will be transformed.

Jensen Huang has been teasing the media with sound bites for the past 2 weeks. Significant acceleration in growth. Visits to Taiwan, clearly asking TSM to turn up the dial.