Should PHT be worried?

-

Hegseth saying that a Chinese invasion of Taiwan 'could be imminent'.

https://www.bbc.co.uk/news/articles/c071xm4x7g7o

I'd have thought that such a thing would be a disaster for the likes of NVIDIA and SMCI, given that they do a lot of manufacturing there.

What would happen to values of these (and others) should Beijing invade?

-

Morning,

We've been over this before. It's completely over blown. They'd shoot themselves in the foot given their own reliance on the country, destroy their own economy and this would prob lead to massive civil unrest(in China). They want growth and stability over ego. If anyone is really worried they should consider Gold(physical) and build a bunker.But you raise a good point that perhaps this will be the next message that will be pushed in an attempt to keep tech down. Every day the supply chain diversifies away from Taiwan.

It's obvious to anyone who reads that companies like Nvidia will be much much bigger than they are today.

-

Hi O,

What I focus on is the near term positives. I certainly don't ignore any potential risks but they are weighed accordingly. All I'll say on China is that everything that is going on today, trade, restrictions, minerals etc is to be taken as a collective negotiating tactic by the US administration. Nvidia and others are caught in the cross fire 'today' and everything is on the table. I would summarise by saying it's at peak tension. Something will give but in the mean time we carry on with our investment plan. Investing in the best companies, with the best prospects, having weighed the risks.

I'll give you some current thoughts on SMCI.

Dell is often in the news-Dell is very vocal and it's not an exaggeration to say 'Dell' likes to over play its hand with marketing spin and puffery. They are not even in the same league technologically and their AI business is weak. They are product takers. They do not design or manufacture any of their AI racks. This in not my opinion. It is a fact.

They just guided F2026 AI revenue of $15 billion. That is 260k GPUs between Feb and Jan 2026. Now think about what they have said previously. That they are working on Colossus-2. Just one project of several. They said they won a $5B project for Colossus(2). Yet C2 is a $40B project and covers min 800k GPU to be installed between now and jan/feb 2026.

The market and its experts have failed to note that Colossus-1 was Hopper and half was air cooled racks, half was DLC. Dell and SMCI shared this project 50/50 AND it just so happened that 50% was air cooled and 50% DLC. Dell have not delivered any DLC. SMCI delivered it all. Colossus-2 is almost certainly 100% DLC as it is all Blackwell.

If Dell are guiding 260k GPU shipments total give or take and just one project is 800k GPU, who is supplying all these chips/racks? It is not Dell.

Dells margins on AI racks are almost zero and overall their trailing net margin is 4%. 50% behind SMCI(which is at a historic low and can only go up).

And full circle. Dells margins are so low because they don't manufacture anything.

Over the next 12 months I fully expect SMCI to dominate the ODM AI server space-they already supply more than twice the number of racks that Dell does and this gap is only going to widen to 3X pretty soon.

There is a flurry of road shows and conferences throughout Europe over the next 3 weeks-watch this space for several Sovereign AI/Token Factory/AI Factory deals being announced.

-

The previously posted tables containing predicted min Blackwell (packaged) chips has proven very accurate in fact we also said TSMC would likely find additional capacity(and apparently they have). And from that we forecast the revenue growth, knowing what they sell these chips for. The start of Blackwell was clunky due to the transition from Hopper because Hopper was packaged on the 'S' line and Blackwell on the 'L' line and there were some heating issues which is no surprise because it was all very new. We predicted about $10 billion Q o Q growth vs $4-5B during Hoppers reign. We are now at this point today.

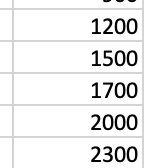

Blackwell is bug free and at ramping as fast as CoWoS will allow. This is the old schedule by quarter in 000's:

. TSMC have indicated circa 500k chips per month and growing from June. They are all sold(5-10X).

. TSMC have indicated circa 500k chips per month and growing from June. They are all sold(5-10X).Losing China completely, and it wont be but let's just ignore it all together. All that has happened is we take the hit and next quarter they achieve $47B and the next $57, $67, $77 and so on. The only caveat is that when Rubin arrives at year end, Dec/Jan they will add further revenue to each quarter simply due to the ASP of Rubin being higher-so id expect $12-$13B q o q increases.

Next year automotive will be meaningful as all car makers equip their cars with ADAS and robotics/omniverse will start adding revenues-the q o q rhythm will grow again. But this is exactly how I see their revenue grow over time. A very long time and yes I expect 100B+ per quarter some time at the end of next year or Q1 the following.And to anyone who thinks they will have transition issues again, well, Rubin and Rubin Ultra are all packaged on the same line so the transition will be seamless . It is not until 2027 that packaging will move to a new process called Sow-X which is when the real party starts. We are looking at racks 40X more powerful than today's. Racks containing 500 chips and consuming 1 megawatt each and could cost $20M or more. This is the roadmap from 2027 to 29.

The experts have been predicting a plateau in revenue for over a year now-remember Cathy Wood and the 'Dean of Valuation'. They were all wrong and continue to be so. Cisco-look at Cisco. A very scientific analogy.

Exciting times ahead imo.