-

KLA Q3 EPS of $8.41 beats by $0.33, revenue of $3.06B beats by $50M

-

Management Perspective

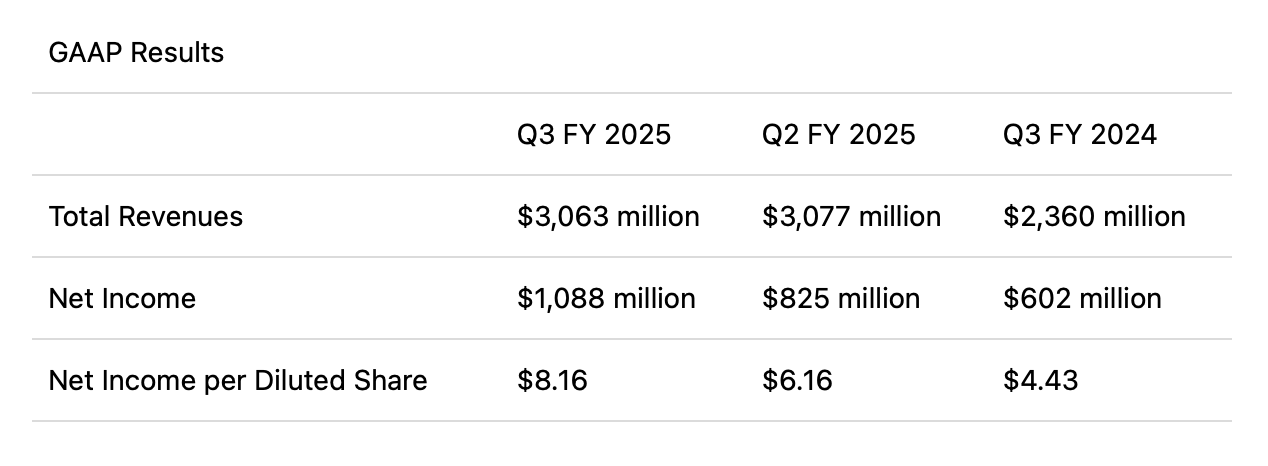

Chief Executive Rick Wallace announced that Q3 2025 revenue reached $3.06 billion, exceeding the forecast midpoint. He highlighted strong demand for cutting-edge logic and high-bandwidth memory (HBM), with growing contributions from advanced packaging, fuelled by AI infrastructure investments. Wallace noted that KLA’s advanced packaging revenue rose to over $500 million in 2024 and is projected to surpass $850 million in 2025, supported by market diversification and product innovation. He emphasised KLA’s continued leadership in global market share for wafer fabrication equipment (WFE) and process control in 2024, with its process control share increasing by approximately 250 basis points over five years.Finance Director Bren Higgins reported a non-GAAP earnings per share (EPS) of $8.41, at the upper end of guidance, with a gross margin of 63%. Operating costs totalled $575 million, below the expected midpoint due to lower expenditure on prototype materials. Free cash flow for the quarter was $990 million, with total capital returns amounting to $733 million. Higgins announced a 12% dividend increase to $1.90 per share quarterly and a new $5 billion share buyback programme, expressing confidence in KLA’s growth trajectory.

Outlook

KLA provided Q2 2025 revenue guidance of $3.075 billion, with non-GAAP EPS expected at $8.53, plus or minus $0.78. The gross margin is forecast to remain at 63%, despite a 100 basis point headwind from global tariffs. The company reaffirmed its WFE growth outlook for 2025, projecting mid-single-digit growth, with KLA aiming to outperform the market through increased process control intensity and market share gains. Leadership anticipates continued growth in advanced packaging revenue, driven by broader AI-led semiconductor advancements, with potential increases in process control intensity in DRAM and logic segments.Financial Performance

For Q3 2025, KLA recorded revenue of $3.06 billion and non-GAAP diluted EPS of $8.41. The gross margin of 63% benefited from a favourable product mix. Advanced packaging played a significant role, with revenue projected to grow from $500 million in 2024 to over $850 million in 2025. Service revenue reached $669 million in the quarter, marking the 52nd consecutive quarter of year-on-year growth, despite challenges from U.S. export controls. Free cash flow over the trailing twelve months was $3.5 billion, with a 30% free cash flow margin, placing KLA among the top 10% of S&P 500 companies.Q&A Session

Harlan Sur, JPMorgan: Raised concerns about tariff impacts and the postponement of Investor Day. Finance Director Higgins explained the delay was due to global trade uncertainties and outlined strategies to mitigate tariff-related cost pressures.

Atif Malik, Citi: Enquired about service growth and advanced packaging positioning. Higgins projected approximately 10% service growth for 2025 and underscored KLA’s strong position in logic and HBM for advanced packaging.

Vivek Arya, Bank of America Securities: Asked about 2026 WFE prospects. CEO Wallace expressed optimism about sustained AI-driven investments and demand for leading-edge technology, anticipating steady growth through 2030.Sentiment Analysis

Analysts expressed concerns over global trade uncertainties and tariff impacts, adopting a slightly cautious tone. Management remained confident, citing robust demand in AI, advanced packaging, and market share gains. In prepared remarks, leadership highlighted “strong opportunities” and “consistent performance” but adopted a more measured tone when addressing tariff pressures during the Q&A. Compared to the previous quarter, management’s tone remained steady, while analysts focused more on macroeconomic uncertainties and competitive dynamics.Quarter-on-Quarter Comparison

Advanced packaging revenue guidance showed significant growth, rising from $750 million projected in Q2 to over $850 million in Q3 for 2025. Continued emphasis on AI infrastructure as a key driver of leading-edge investments, consistent with prior quarter commentary. Gross margin guidance for 2025 edged up slightly despite new tariff-related challenges, reflecting confidence in product mix improvements and operational efficiency. Analysts maintained their focus on tariff impacts and China-related risks, echoing concerns from the previous quarter.Final Takeaway

KLA Corporation delivered robust Q3 2025 results, driven by strong demand in cutting-edge logic, HBM, and advanced packaging, fuelled by AI infrastructure investments. The company raised its advanced packaging revenue target to over $850 million for 2025 and announced a substantial share buyback programme and dividend increase. Despite challenges from global trade uncertainties and tariff impacts, KLA remains optimistic about its leadership in process control and growth prospects, underpinned by its diversified portfolio and market share gains. -

KLA Corporation (KLAC) Bank of America Global Technology Conference (Transcript) notes.

The take away is the company is doing very well and is outperforming its sector. management are very optimistic despite 'china' and tariffs. KLA has delivered a spectacular recover-there is clearly plenty more growth in the tank.

Strong Growth at the Leading Edge: KLA reported robust growth in demand for leading-edge technologies, particularly at the 2-nanometre node. The company is well-positioned, with a higher market share at this node compared to the 3-nanometre node, driven by increased investment in advanced semiconductor technologies.

Advanced Packaging Revenue Surge(CoWoS-L KLA anticipates significant growth in its advanced packaging segment, projecting USD 850 million in revenue for 2025, up from USD 500 million in 2024. This growth is fuelled by a 70% contribution from process control in advanced packaging, a market expected to grow faster than the core wafer fab equipment (WFE) market, valued at USD 9–10 billion.

Robust Service Business Growth: The service business is expected to achieve low double-digit growth, supported by a 75% contract revenue stream and the extended lifespan of KLA’s tools. This resilience persists despite challenges from restrictions in China, ensuring steady revenue growth. What you could call 'money for old rope'

Financial Performance and Margins: KLA targets a gross margin of 63% in 2026, with a mid-60s target for 2025. The company maintains a 65% incremental gross margin on revenue growth, reflecting sustainable profitability even amidst tariff challenges. The company seeks margin and won't enter low margin segments.

Market Position and Growth Outlook: KLA expects WFE growth to slightly outpace semiconductor revenue growth (projected at 7–8%), with logic foundry WFE and process control growing faster than core WFE. This positions KLA to potentially grow faster than the market, supported by its strong portfolio and unique product capabilities.

Investment in Future Technologies: KLA plans to invest in the next node by 2026, aligning with customer needs for advanced technologies, particularly in AI, high-performance computing, and high-bandwidth memory (HBM). This forward-looking strategy supports long-term growth.

These highlights reflect KLA’s optimistic outlook, underpinned by strategic focus on high-growth areas like advanced packaging and leading-edge technologies.

-

Today's KLA weakness. After hitting an all time high it dropped 5% after hours due to 'sector sympathy'. Applied Materials which is in the same sector although completely different business issued a soft outlook (China). It is completely illogical but this is what happens when trading is algho based. Same sector = sell.

AMAT’s weaker outlook is mostly a China mature-node + export licence story. KLA is riding a completely different wave – process control intensity for AI and packaging nodes – and that’s why they’ve guided higher despite seeing the same macro headlines.

To be ignored Amat issued weak guidance (a contraction). two weeks ago KLA issued record guidance-go figure.

-

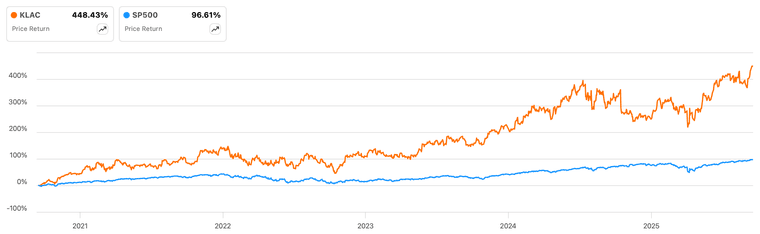

KLAC is +$50 in pre market today-an all time high, after trying to hold the high yesterday, enter the sellers but today it's having another run.

A fabulous business, run by world class executives. Congratulations all shareholders.

-

New All Time High for KLA Corporation today

Having bought in originally at $330 in April 2022 +388% or annualised return +49%. Just spectacular.

We will be pulling some weight out of KLAC next week. It's had quite the run

-

KLA delivered above expectations

The result overall was solid, fundamentally — AI‑driven semiconductor tool demand continues. Analysts have been positive and even raising targets.

KLA’s share price dropped (~7–8% in extended trading) despite that beat/inline result.The stock had already run so far, so fast, that nothing they reported was going to be good enough.

This echoes a classic “sell the news” dynamic:

The stock was frothy heading into earnings — up big recently (nearly +40% in the last month alone and 130% 1 yr!

That run priced in very high expectations for the print. Net it only moved the price down to what it was on Monday!