Oracle (ORCL)

-

Following on from the above it has been confirmed that OpenAi Stargate is the Oracle customer-they have signed a deal for 4.6GW of compute. An enormous amount and the biggest ever contract for data centre HPC. Oracle-cloud revenue today is running at around $11B/annum and this will add $30B starting in 2028. As part of the deal oracle will invest $40 billion of its own money and the rest likely from other Stargate partners.

As per Jensen 1GW = $40B revenue to Nvidia and as we can see this is 4.6GW and equates to at least 30,000 racks.

My take on this- it confirms the narrative that Nvidia are just getting started. Secondly, first move to Oracle/Openai. What will MSFT/AWS/GOOG/Meta/XAI do to defend their position? Answer-very likely accelerate and expand their plans materially. They have to. Winners will certainly be:

MU

NVDA

SMCI

AVGO

ORCL -

Oracle report earnings, missing by 1 penny. The stock instantly fell 4%. But

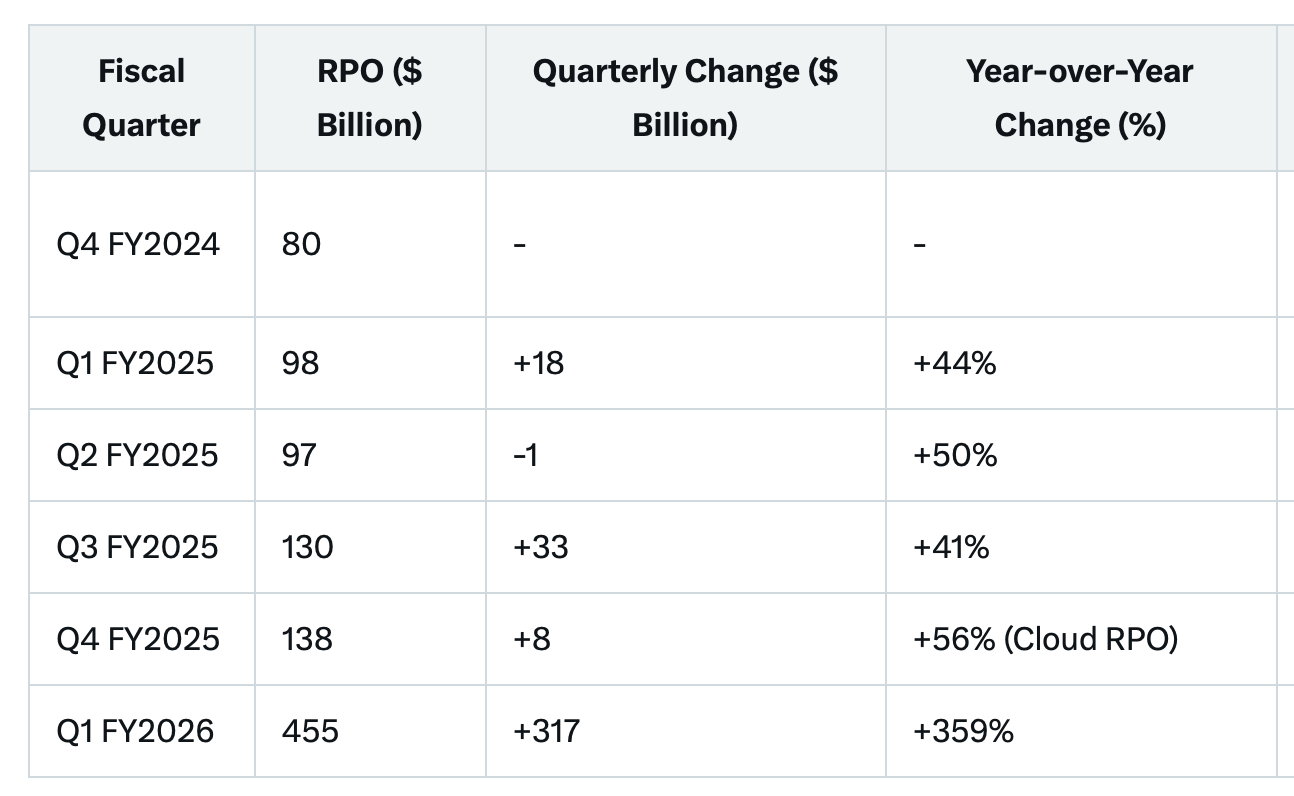

We signed four multi-billion-dollar contracts with three different customers in Q1,” said Oracle CEO, Safra Catz. “This resulted in RPO contract backlog increasing 359% to $455 billion. It was an astonishing quarter—and demand for Oracle Cloud Infrastructure continues to build.

The stock is now up 20%+ after hours, marching towards 300. We acquired the stock in February for circa 150.

-

Numbers so big, they defy logic. We said 3 years ago that this space would experience a decades low super-bull run. Right here is hard evidence of that.

The surge in RPO (Remaining Performance Obligations) to $455 billion, a 359% YoY increase, is largely attributed to the signing of large-scale cloud contracts, particularly for AI workloads. Cloud RPO alone grew nearly 500% YoY in Q1 FY2026, indicating a shift toward long-term, high-value commitments.

Oracle’s strategic focus on AI infrastructure and its ability to provide cost-effective, high-performance cloud solutions **have positioned it as a preferred provider for AI-driven workloads, as noted by CEO Safra Catz: “**Oracle has become the preferred destination for AI workloads.”

-

When we decided to buy Oracle we took the view that their expertise in database management would cement them in the AI ecosystem-we were right!

Leadership in Database Management: Oracle’s unparalleled expertise in database management, particularly for big data, remains a cornerstone of its success. CEO Safra Catz and CTO Larry Ellison emphasised the company’s vectorised database capabilities, which are critical for AI workloads and handling large, sensitive datasets. Cloud database services generated $2.8 billion in annualised revenue, up 32% year-over-year, underscoring Oracle’s dominance in this space.

Security and Data Sovereignty: Large corporate customers prioritise security and control over their critical data, opting not to migrate to competing clouds like AWS, Azure, or GCP due to privacy and compliance concerns. Ellison highlighted Oracle’s ability to provide secure, private AI solutions, ensuring data remains within customer-controlled environments. This is a key differentiator, as Oracle’s cloud infrastructure (OCI) is designed to support secure, enterprise-grade data management.

Multi-Cloud Strategy: Oracle’s integration of OCI regions within competing clouds (AWS, Azure, GCP) saw multi-cloud database revenue soar by 1,529% in Q1. This allows customers to leverage Oracle’s superior database technology without moving sensitive data, reinforcing trust and driving adoption.AI Workload Advantage: Oracle’s database leadership is pivotal for AI training and inferencing, where secure, high-performance data handling is essential. Partnerships with AI leaders like OpenAI, xAI, Meta, NVIDIA, and AMD reflect Oracle’s role as the “go-to place for AI workloads,” with remaining performance obligations (RPO) hitting $455 billion, up 359% year-over-year.

-

worth a watch-Ellison explaining the F1 AI race. And you have to hand it to him-still working all hours and driven at 81 years young coupled with being the wealthiest man on the planet

-

yes it is. Having signed +300B ish new contracts. And the CFO said:

we expect Oracle Cloud Infrastructure revenue to grow 77% to $18 billion this fiscal year—and then increase to $32 billion, $73 billion, $114 billion, and $144 billion over the subsequent four years."

-

further comments...Oracle $ORCL CEO Safra Catz: "Over the next few months, we expect to sign-up several additional multi-billion-dollar customers and RPO is likely to exceed half-a-trillion dollars."

If this was the Daily Mail it would also say 'Catz made $108,282,333 in total compensation last year.

-all Oracle numbers are big!

-all Oracle numbers are big! -

Oracle is on the move again(up) based on rumours it will run the US operations of Tik-Tok. According to DT (Trump) 'a deal has been done'. The parties to said deal have yet to comment.

-

Oracle is raising $50B for data centre expansion, but not only for OpenAI.

"Oracle said we should expect that this money will go toward data centres for TikTok, AMD, Elon Musk's xAI and Nvidia..."

Recent comments from Jensen Haung about limiting its investment in OpenAI. This isn't a slow down. Rather, recalling the prior $100B announcement I recall Altman announced a deal with AMD(within days) which was clearly a slap in the face and dirty trick imo. My take away from the latest pushback is Jensens way of flexing their dominant position (we have all the money and the chips so play nice). From the Wanderers 'don't X with the

WongsHuangs'It would appear Nvidia is cosying up to XAi

-

What a great film …..

-

I expect Jensen to come out swinging during their next earnings call, scheduled for Web Feb 25 (3 weeks tomorrow). He is very conscious of the stock price action or inaction and I'm confident he will address that with openness, honesty and integrity. I expect some very big numbers and his comments will focus on what they are seeing (insatiable demand) plus China is a new addition.

The market is very fickle but very quick to change sentiment and what you have seen is a flat line range bound scenario where money gets moved into other plays, always chasing that quick buck. When Nvidia moves it does so very quickly and this quarter+guide is the perfect time imo. Blackwell is mature, Hopper is still in demand and Rubin (Vera Rubin) is in full production(scaling).

Four months ago Jensen said they had $500B in orders 'for the next 18 months'. He's talking about data centre not the entire business. I wouldn't be surprised if he raises this number as my numbers suggest closer to 700B total over the next 18 months.

This reported Q(Q4), I think they'll earn very close to $40B net. I can't see why they won't add in some China H200(Q1 guide), how much is unknown. They have orders for 10-12B min but will they ship it all in Q1. They have the stock. No one knows. They have plenty of time (Feb-April). Conservatively I think they will manage the usual +$10B expansion QoQ and +$XB from china, i.e Actual Q4+$10+X. And then guide back $5B. **I think the guide will be somewhere in the range $75B+ range leaving scope to beat this materially (80s). I'd be surprised if they left China out because they aren't reporting for another 3 weeks.

We have to bear in mind they are very conservative and don't ever want to bank on something and end up missing. I believe they could generate $80+B next Q but you won't ever see a guide that high-too risky. I also think they will earn close to $45B next quarter.

Whilst China demand is massive, initial orders will trickle in 2-3B Q1 and scale from there.