Oracle (ORCL)

-

Medpace

I did mention it here and an email will go out, probably next week

-

Oracle Q4 2025 Earnings Summary and FY26 Outlook. Beat & Raise

Strong Year-End Finish and Upgraded Outlook

Oracle ended fiscal 2025 with a strong fourth quarter. CEO Safra Catz reported that both revenue and earnings per share (EPS) exceeded previous guidance. For FY26, Oracle now expects revenue to surpass $67 billion, reflecting 16% year-over-year growth in constant currency.Cloud Momentum and AI Focus

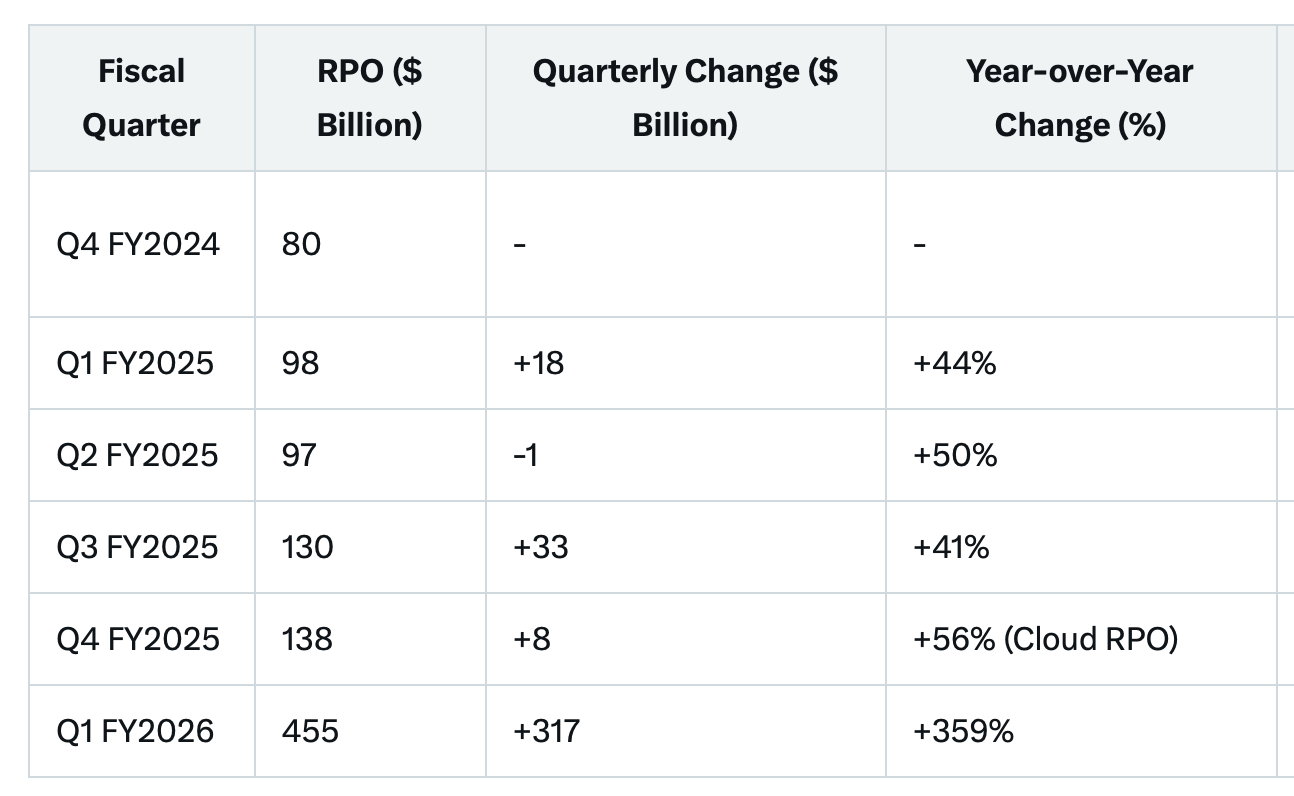

Catz described the company reaching a pivotal stage in its transition to the cloud, with broad-based double-digit growth. She projected accelerated growth in cloud applications revenue, driven by the launch of over 100 AI agents and high renewal rates for key SaaS offerings.The cloud infrastructure business (OCI) is poised for exceptional expansion, with Oracle forecasting over 70% growth in OCI revenue this year—up from 51% in FY25—supported by long-term, non-cancellable contracts within its $138 billion backlog of remaining performance obligations (RPO).

Capital Spending to Support Demand

To address record demand, Oracle plans to increase capital expenditure (CapEx) to over $25 billion in FY26, up from $21.2 billion in FY25. Catz said this increase is critical as “supply is not meeting demand,” indicating continued pressure on data centre capacity and equipment deployment.Technology Leadership and AI Integration

CTO Larry Ellison doubled down on Oracle’s ambitions to lead in cloud infrastructure, applications, and databases. He introduced Oracle 23 AI, a new vector-based AI database that allows enterprises to integrate their private data with popular large language models, all while maintaining strict data privacy.Q4 FY25 Financial Highlights

Total revenue: $15.9 billion (up 11%)

Non-GAAP EPS: $1.70

GAAP EPS: $1.19

Cloud revenue (SaaS + IaaS): $6.7 billion (up 27%)

IaaS revenue: $3 billion (up 52%)

OCI consumption revenue: up 62%

Autonomous Database revenue: up 47%

Operating income: up 7%

Operating cash flow: $6.2 billion

CapEx (Q4): $9.1 billion

Remaining Performance Obligations: $138 billion (up 41%)

FY26 GuidanceTotal revenue: ≥ $67 billion

Cloud revenue growth: > 40%

Cloud infrastructure revenue growth: > 70%

Q1 revenue growth: 11%–13%

Q1 cloud revenue growth: 26%–30%

Q1 non-GAAP EPS: $1.44–$1.48

RPO expected to grow more than 100%

Long-term confidence reiterated for FY27 and FY29 targetsOracle delivered a record-setting FY25 and enters FY26 with momentum. Its assertive guidance, growing AI portfolio, and $138 billion backlog underline strong confidence in its strategic direction. Significant investment in infrastructure and AI capabilities is key to meeting rising global demand and positioning Oracle as a leader in enterprise cloud and artificial intelligence.

Stocks is up materially AH

-

Even if you don't care about ORCL, tech or AI, do yourself a favour and listen to Larry Ellison, who's run ORCL since the 1970's.

A few choice quotes:

"We actually currently are still waving off customers ... This is a situation that we have not seen in our history and the numbers themselves are so enormous."

"We recently got an order that said we'll take all the capacity you have wherever it is. This could be in Europe, it could be in Asia, we'll just take everything ... The demand is astronomical."

"I mean, I don't know how to describe it. I've never seen anything remotely like this."

Clearly @OpenAI is a part of this. And Stargate will be a part going forward. But that demand is also broad.

- Let me add one little thing. If Stargate turns out to be everything is advertised, then we've understated our RPO growth.

-

The PHT movement today(last nights prices incl FX) was not what I would expect. It was reported as ever so slightly positive when it should have been > 100bps. I have pin pointed that the Oracle price was not updated which is rare-we take the price(valuation)from the custodian who in turn source it from Winterflood. The material ORCL price change yesterday highlighted the issue

Today ORCL is up again. I hope this gets resolved today. It should add approx 100bps to the technology carrying value. Real time the portfolio is flat so when the correction is made you will see +1%(100bps). I will update when this takes place.

Update-we may get a manual price override but either way it will be permanently fixed on Monday.

-

I did wonder why it hadn’t ticked up …

-

Morning All,

the price has been corrected and the valuations look correct. Yesterday was approx (35 bps), we expected +105bps from the correction and I can see +78bps.

Have a good weekend

-

From an 8-k sec filing today

Item 7.01 Regulation FD Disclosure.

Safra Catz, Chief Executive Officer of Oracle Corporation (“Oracle”) plans to meet with other Oracle colleagues later today. She will say, “Oracle is off to a strong start in FY26. Our MultiCloud database revenue continues to grow at over 100%, and we signed multiple large cloud services agreements including one that is expected to contribute more than $30 billion in annual revenue starting in FY28.”Oracles annual revenue today is $57B-so they've signed several large cloud deals and one is worth $30B per year. Hard to get ones head around that but the stock is going north. New ALT today, touching $228 at one point.

-

Following on from the above it has been confirmed that OpenAi Stargate is the Oracle customer-they have signed a deal for 4.6GW of compute. An enormous amount and the biggest ever contract for data centre HPC. Oracle-cloud revenue today is running at around $11B/annum and this will add $30B starting in 2028. As part of the deal oracle will invest $40 billion of its own money and the rest likely from other Stargate partners.

As per Jensen 1GW = $40B revenue to Nvidia and as we can see this is 4.6GW and equates to at least 30,000 racks.

My take on this- it confirms the narrative that Nvidia are just getting started. Secondly, first move to Oracle/Openai. What will MSFT/AWS/GOOG/Meta/XAI do to defend their position? Answer-very likely accelerate and expand their plans materially. They have to. Winners will certainly be:

MU

NVDA

SMCI

AVGO

ORCL -

Oracle report earnings, missing by 1 penny. The stock instantly fell 4%. But

We signed four multi-billion-dollar contracts with three different customers in Q1,” said Oracle CEO, Safra Catz. “This resulted in RPO contract backlog increasing 359% to $455 billion. It was an astonishing quarter—and demand for Oracle Cloud Infrastructure continues to build.

The stock is now up 20%+ after hours, marching towards 300. We acquired the stock in February for circa 150.

-

Numbers so big, they defy logic. We said 3 years ago that this space would experience a decades low super-bull run. Right here is hard evidence of that.

The surge in RPO (Remaining Performance Obligations) to $455 billion, a 359% YoY increase, is largely attributed to the signing of large-scale cloud contracts, particularly for AI workloads. Cloud RPO alone grew nearly 500% YoY in Q1 FY2026, indicating a shift toward long-term, high-value commitments.

Oracle’s strategic focus on AI infrastructure and its ability to provide cost-effective, high-performance cloud solutions **have positioned it as a preferred provider for AI-driven workloads, as noted by CEO Safra Catz: “**Oracle has become the preferred destination for AI workloads.”

-

When we decided to buy Oracle we took the view that their expertise in database management would cement them in the AI ecosystem-we were right!

Leadership in Database Management: Oracle’s unparalleled expertise in database management, particularly for big data, remains a cornerstone of its success. CEO Safra Catz and CTO Larry Ellison emphasised the company’s vectorised database capabilities, which are critical for AI workloads and handling large, sensitive datasets. Cloud database services generated $2.8 billion in annualised revenue, up 32% year-over-year, underscoring Oracle’s dominance in this space.

Security and Data Sovereignty: Large corporate customers prioritise security and control over their critical data, opting not to migrate to competing clouds like AWS, Azure, or GCP due to privacy and compliance concerns. Ellison highlighted Oracle’s ability to provide secure, private AI solutions, ensuring data remains within customer-controlled environments. This is a key differentiator, as Oracle’s cloud infrastructure (OCI) is designed to support secure, enterprise-grade data management.

Multi-Cloud Strategy: Oracle’s integration of OCI regions within competing clouds (AWS, Azure, GCP) saw multi-cloud database revenue soar by 1,529% in Q1. This allows customers to leverage Oracle’s superior database technology without moving sensitive data, reinforcing trust and driving adoption.AI Workload Advantage: Oracle’s database leadership is pivotal for AI training and inferencing, where secure, high-performance data handling is essential. Partnerships with AI leaders like OpenAI, xAI, Meta, NVIDIA, and AMD reflect Oracle’s role as the “go-to place for AI workloads,” with remaining performance obligations (RPO) hitting $455 billion, up 359% year-over-year.

-

worth a watch-Ellison explaining the F1 AI race. And you have to hand it to him-still working all hours and driven at 81 years young coupled with being the wealthiest man on the planet

-

yes it is. Having signed +300B ish new contracts. And the CFO said:

we expect Oracle Cloud Infrastructure revenue to grow 77% to $18 billion this fiscal year—and then increase to $32 billion, $73 billion, $114 billion, and $144 billion over the subsequent four years."

-

further comments...Oracle $ORCL CEO Safra Catz: "Over the next few months, we expect to sign-up several additional multi-billion-dollar customers and RPO is likely to exceed half-a-trillion dollars."

If this was the Daily Mail it would also say 'Catz made $108,282,333 in total compensation last year.

-all Oracle numbers are big!

-all Oracle numbers are big! -

Oracle is on the move again(up) based on rumours it will run the US operations of Tik-Tok. According to DT (Trump) 'a deal has been done'. The parties to said deal have yet to comment.

-

Oracle is raising $50B for data centre expansion, but not only for OpenAI.

"Oracle said we should expect that this money will go toward data centres for TikTok, AMD, Elon Musk's xAI and Nvidia..."

Recent comments from Jensen Haung about limiting its investment in OpenAI. This isn't a slow down. Rather, recalling the prior $100B announcement I recall Altman announced a deal with AMD(within days) which was clearly a slap in the face and dirty trick imo. My take away from the latest pushback is Jensens way of flexing their dominant position (we have all the money and the chips so play nice). From the Wanderers 'don't X with the

WongsHuangs'It would appear Nvidia is cosying up to XAi