Nvidia News

-

As many will know from following the posts relating to chip production, the bottle neck is not in wafer production (WFE) nor lithography-producing the raw chips, but in the packaging. In simple terms 'packaging' (CoWoS) is a process of connecting many chips together in a compact/efficient way.

It is GPUs+wafer+substrate(silicon)+interconnects+3D stacking+power and thermal efficiency.

This process is very complex and time consuming. Incidentally KLAC (Tech holding) manufacturers the machines to manage the process and increase yield.

TSMC is the lead packager and last year they partnered with Amkor is increase output-TSMC can't keep up despite spending billions expanding their packaging capacity. More recently they also signed up ASE Technology Holdings and tis week Siliconware Precision Industries.

What is interesting is TSMC alone have massive capacity themselves(40k wafers per month Dec24 growing to 75k by dec 25) and this is growing by 3,000 wafers per month through 2025. Each wafer would yield 22-25 good Blackwell chips an Nvidia are taking around 50% of all new capacity and yet this still not enough. Some basic math suggests the monthly ramp in supply(from just TSMC) is 33K cumulative + we believe 12k wafers per month from the other two vendors(132k chips) all for one customer. That translates to > 5M chips in 2025. No one thinks they can produce 5M blackwell in 2025 however the evidence is building that they might. This does not include the expected 2M Hopper they are expected to produce also. Nor does it include their other divisions, gaming, visualisation automotive and enterprise (software).

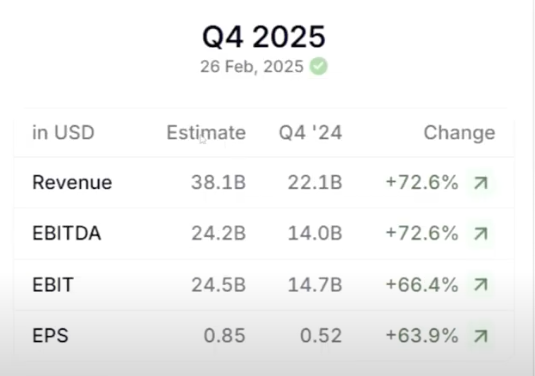

The Q4 earnings , due 26th Feb $38.1B and 80c/share is eagerly awaited

-

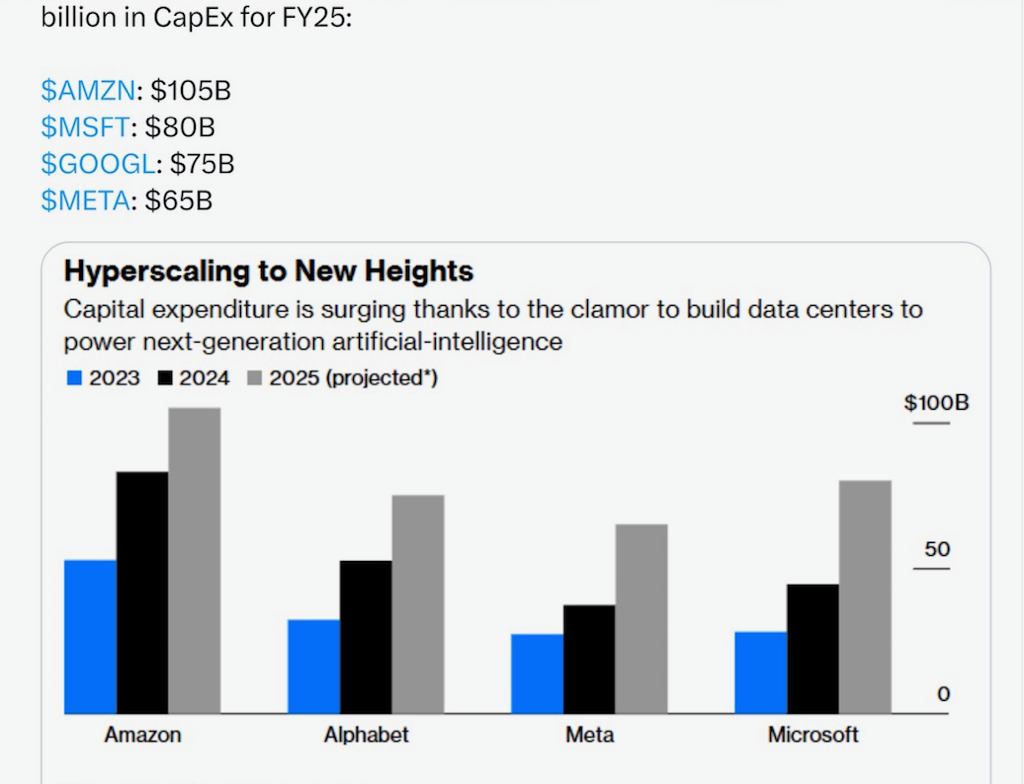

Latest 2025 capex-this is only the big 4 hyperscslers. There are many other second tier ‘spenders’. Xai, anthropic, coreweave, Orcl

Staggering 325 billion

-

Nvidia has put a hold on Samsungs HBM memory qualification. In other words, sorry guys it's not good enough. Hynix and Micron confirm they are expanding to pick up the 115k wafers required-both firms have confirmed 'we are buying tools and building out ourfactories to meet the increased demand. The tools come from KLAC btw

-

Today TSMC announced plans to build a 3rd fab in Arizona, beginning around June this year, a year earlier than planned. Fab 1 is operational and Fab2 well under construction. Clearly demand is sky high. The company is also seriously considering a CoWoS packaging plant in the US-something is previously stated it would not do. Is this a tariff avoidance move?

-

Here’s the base line

-

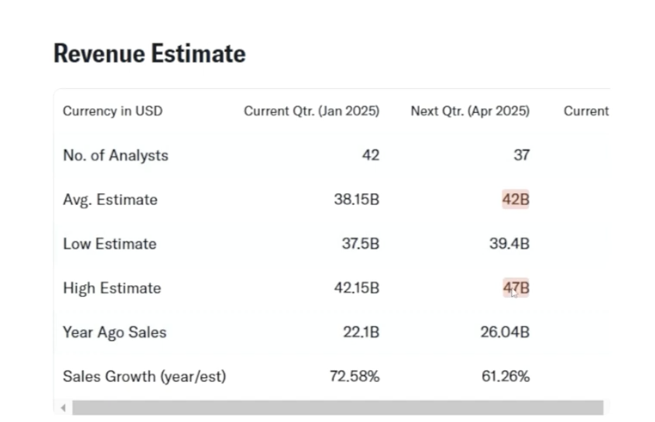

In order. Company own estimates $38.1. Analyst estimates range $37.5B to $42B(a big range). The Q1 guide is expected to be anywhere from $38.15B to $47B. A significant range, due to unknown `Blackwell capacity/yield.

My thoughts. Impossible to say with any accuracy due to a number of factors. Primarily Blackwell yield. When a brand new architecture is released even the company is providing a guesstimate in some areas. However, Nvidia rarely fail to exceed their own guidance. My personal opinions are that the guide for Q1 will exceed $42B (the average expectations). I would like to see $47B+ and they could achieve 50B but management usual guide low. One thing is certain, the growth will continue and the company is in the very early stages of a continued multi year revolution. Expect volatility.

-

Other areas of interest. H20 sales into China should be at record levels due to the concern over further chip restrictions. Id expect the Chinese to buy up as many s they can before possibly being 'cut-off'. A new generation of gaming cards was released in Q4 and were sold-out very quickly so there should be record segment revenues here.

Automotive is very close to much wider adoption of more advanced ADAS systems

-

And following on from the above, today, Reuters report 'significant' increases in H20 sales from Tencent, Alibaba and Byte Dance. From various sources Id estimate :

Q1 125,000

Q2, 187,500

Q3 281,250

Q4(this reporting Q) 421, 875It's estimated the H20 sells for $12k each, This would translate into revenue of just over $5B compared to $3.375B in the prior Q, an almost $2 QoQ increase. If true this is how you beat estimates!

-

Final pre announcement dart at the board.

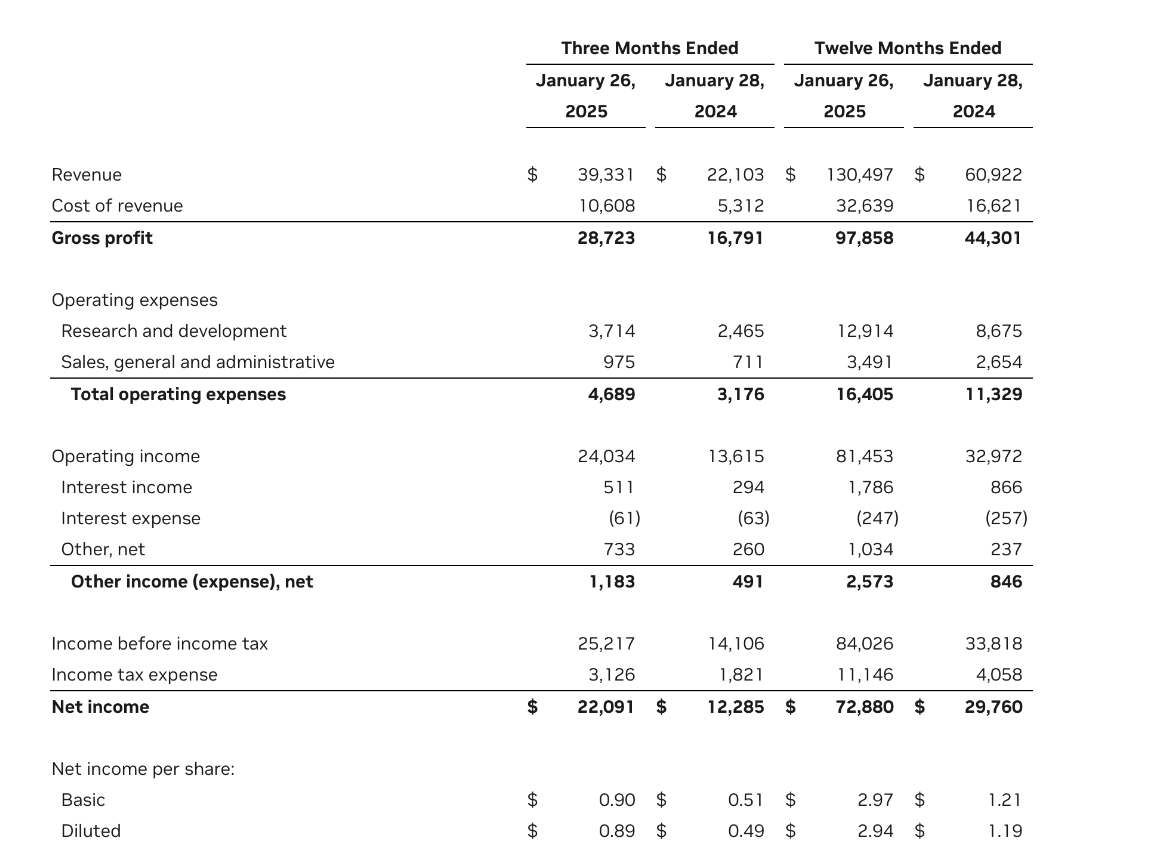

The market expects $21.2B net income or 85c/share

I think this is too low. I think they will deliver closer to $25B net income or $1/share.The revenue number expected is $38.15B and analysts highest expectation is $42.15B. They have the ability to deliver anywhere from $42 to $49b. The guide I'm looking for is Q4+$4B min.

The big unknowns being:

Was Hopper in Q4 just as strong as Q3

Did Blackwell ramp enough to ship 250k chips

Was there a record in H20 sales to China

Record gaming-i think so

Automotive/Omniverse should also be records.Nvidia management are always very conservative-they don't throw big guides out there. They prefer to guide low and beat. This period is the inflection point for their architecture plus the US tariffs/chip restrictions are creating a lot of noise. Just remember, every chip they make is spoken for by western customers. And I don't think restrictions work anyway. If a state wants the tech they will buy it.

I'll write up the details for the morning and i might post a quick update at 10pm depending on how we go

-

about 9.20-30 GMT.

-

@exIM said in Nvidia News:

Numbers are good

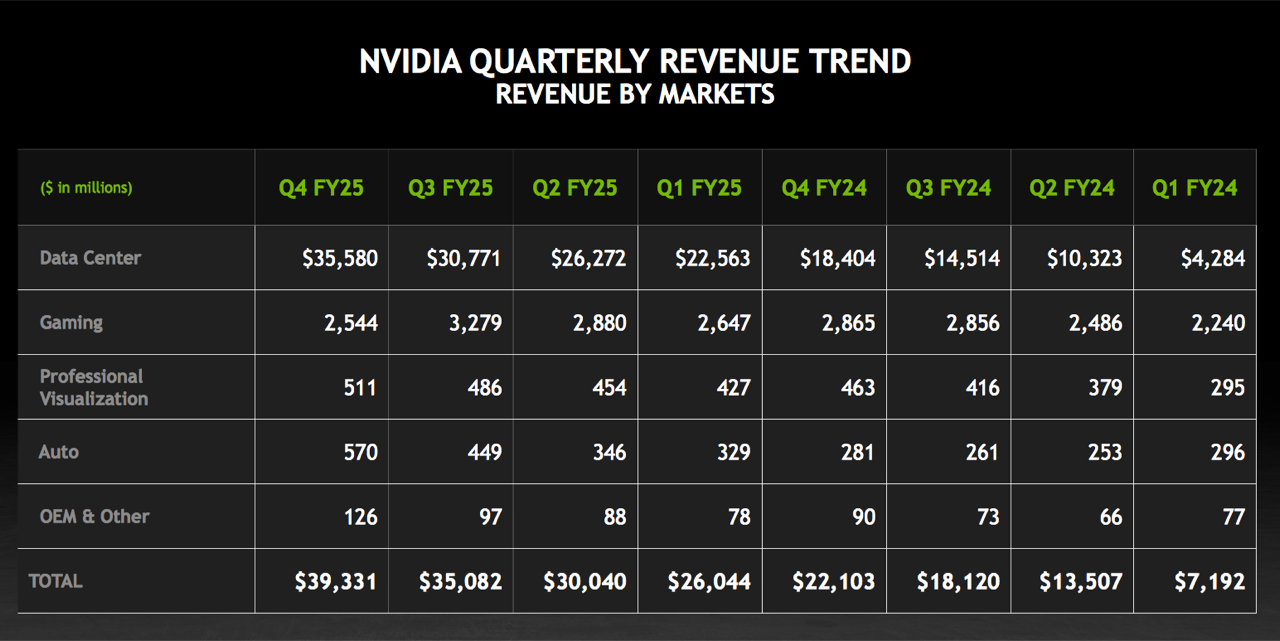

My reading of these things is always wooly but it seems that they delivered $39.3bn in Q4 and guide of $43bn for Q1 next year. This is against a guide of $37.5bn for Q4 just gone (i.e up by $1.8bn) and Q1 next year is in line with Adam's hoped-for Q4+$4Bn.

The detail is more than my IQ can cope with but it looks like exIM's comment is correct!

(Interestingly, the other big NVIDIA piece in the news today concerns faults in their GPU chips, with a small %age of them not being up to snuff. I assume that this is such a tiny detail in the vastness of NVIDIA as to be immaterial).

-

-

$39.3 actual with a $43B guide. It's a solid result. China revenue was relatively unchanged from previous quarters. Well, it's the same on a %age basis which is 'more' but it just goes to show, you can't believe anything you read (Reuters). And gaming was sold out leading me to think they'd ship a record number of cards when in fact they didn't have enough supply.

On 2BT comment above 'big news of faults'- that’s minor fault relating to gaming cards, impacting < 1% of cards. Now fixed. The CEO spoke about previous Blackwell GPU issues last night-they had some issues last year with the mask and yield. That has been resolved and in his words 'it's full steam ahead'. He acknowledged that the previous issues has put them 2 months behind. Does this matter? To some it does but with reporting every 13 weeks does it matter. No it doesn't-you can clearly see the likes of SMCI guide flat due to that delay and many other vendors in this ecosystem has similar stalled guides.

Blackwell shipments in the 4th Q were $11 Billion which is surprising. I had assumed Hopper would stick at its peak for at least another Q or so but clearly, customers want Blackwell. This would account for only +4B Q o Q. The good news is Q1 will see a substantial increase in supply. If accurate the industry expects +500K chips in Q1 which translates to around +$20B so I want to point out, when they guide +$4B yet their potential supply is 5X more than this it becomes difficult to zone in on an accurate result! I do not think Hopper will fall away that quickly so there is material scope for upward revisions.

The company confirmed they are starting to ship Spectrum-X networking with NVL-72 servers, which in their words 'represents a major growth vector'.

Stargate will use this configuration and Cisco systems will integrate Spectrum-X into their entire portfolio which is a big deal due to Cisco, previously relying solely on ethernetBlackwell Ultra is on target for deployment in H2/2025 and Vera Rubin thereafter. At GTC in March (17th-21) the CEO will present what architectures come next. Presently the Rubin next chip is internally referred to as 'X'

-

The Blackwell Ultra (B300) is scheduled for H2 production, so Q3 and Q4. Jensen stated 'the GB300' transition will be much smoother than the Hopper to Blackwell-we have learned a lot. It will just slot in. What he is tell us here is the ramp will be much faster. By mid 2025 TSMC will have at least 20k wafers CoWos-L packaging solely for Nvidia which yield 16 chips per waker or 320,000 per month(1 M/Q?). More chips and a higher average selling price.

Q1 CoWoS-L capacity max 15k wafers (168k chips/M)

Q2 20K (224k/M)

Q3 30K (336K/M)

Q4 expected ending 2025 45K wafers

Nvidia have secured 70% of total capacity. This suggest 500K/month or 1.5M/Q

I absolutely expect revenue to accelerate through the year.The bottle neck is with the packaging (CoWoS-L) which is new, (Hopper was 'S'). The net yield per wafer is 16 chips

-

One just needs to be patient. Real time we are back to where we are early Feb. Nothing is plummeting. SMCI will be volatile and is trading on massive short interest currently-all that derivative action needs to unwind. When we added to the holdings we paid $28. It's $47. We bought a great business which is at the very bottom on its cycle. Revenue and margins can only rise materially from here.

I try to avoid making statements of fact when there is doubt. Nvidia delivered a good result. Look above. Q1 2024 $7B quarterly revenue and that was in scope for all prior recent quarters. Look at it today. The new chip needs CWS-L packaging. There isn't enough but it's coming very quickly. Jensen Huang said they have 350 different vendors making all the required parts. He must orchestrate that.

TSMC must build new factories and buy new equipment-you can't magic that up 'hey C.C Wei, ship me another million chips next month, cheers'. It doesn't work like that. TSMC would say give me your plan, give me $2B and i will start building-luckily that process started 2 years ago.

What I can assure you all is that the CWS-L packaging is critical, it started 12 months ago. Today TSMC can process 20k silicon wafers per month. That is it. Demand is at least 100k per month today. 1 wafer yields 16 Blackwell chips (B100/B200/B300-soon). The process is completely different to Hopper hence why there was a lot of noise around the start.

We are at 20k give or take/month today and from what I understand that capacity (new capacity) is increasing by 20% per month with a target of 75k/month by Dec 2025 and 140k by end of 2026-this may change obviously. Therefore it's academic how much product can be supplied. But anyone who bothers to look, can see, that the capacity will grow very quickly. FYI there are two other vendors helping with CWS-L, actually 3. Amkor, ASE, Samsung-they too have been given help by Nvidia to get going!Nvidia isn't slowing, it's not out of first gear. But you will see some real 'financial genius' say look they did 120% last year and now it's 90%-that's bad. Just idiots. You can't grow at 100%+ every year, it's simple maths. Architecture transitions will mean ebbs and flows. It's a very small operating window(every quarter). 350 suppliers. Just one chink and you miss?

The chips, once you factor in the CPU/HBM/DPU/Stectrum X etc etc are not 30k. I look at it differently-one chip is useless without the other parts so i add them (parts) all up. 1 chip is 50-60k so their 11B is something in the order of 220-250k chips which is what various experts thought they could produce. There are a few flavours, right. We don't know exactly what the price points are but 50-60k is about right and when they say '11b blackwell' it's a system of many parts not 1 chip' so this is how i look at it.

Quick math recap. 250k/16 =15,625.

20k wafer capacity and as noted Nvidia get 70% of the output-why? Because they put the moneyup.TSMC always services all comers-good business but Nvidia get the lions share. So 20k @70% x 16 chips = 224,000 chips. pretty close! This is how it works pretty much.And next month they get 20% more. Speculating, in the next 3 months Feb through April, Q1) 20k X (1+r)^n we get 24/28.8/34.56 or 87,360 wafers x 16 chips (@70%) = 978k chips.

Now, that is a lot! Morgan Stanley think they'll receive '500k more' than Q1 so 750k but even still, that is $35B+. And clearly TSMC might make some progress or might fall behind in the CWS-L ramp. If anything they will exceed, they are too good to fall behind. And without getting too excited. By year end we are talking over 2M chips in the quarter-that is $100B+. Hopper is still selling but slowing. Plus other segments(auto/vision/gaming).

The year following is 2X again-not wishful thinking the investment ground has been laid and the demand is there.

Every year the experts have been 50% behind what the company has managed to produce. In fact for the year end they delivered(whilst constrained) 131B and estimates 6 months ago were 97B.

What I am suggesting is a guide of $43B in Q1 is nothing compared to the very likely scenario that they are pushing 100B for the same quarter next year(12 months away) and anyone bothering to listen to the CFO will know that margins are rising throughout the year(back to 75+).

Nvidia is a once in a generation business and i'll add that they partner with the best. SMCI are a core partner who we understand will consume somewhere in the order of 25% of total chip output. That is gigantic.

-

And through the year you will see not just more supply but transitions to B300 which is much more powerful and much more expensive. The GB300 'chip' is a 3KW chip. 3000 watts and a large rack holds 72 of them. Anyway, what i want to say is ASP is also going up. This is where the revenue grows even faster. But given q4 was 11b and as per above we are looking at 35b just Blackwell, it’s going to be explosive imo.