Q4 2024 Earnings & Guidance

-

From the top table, Google earned > $100B net income for the 2024 year. A staggering amount of money with free cashflow of $72.8B.

Google search grew double digits including Youtube. Google cloud, noted in the third table is now generating a profit and grew 30%. The majority of Google clouds customers are:

eBay, PayPal, Intel, Verizon, Deloitte, Chevron Corporation, Bloomberg plus most startups. Although they are a distant third in cloud behind Azure and AWS.

Other bets continues to make losses, it always has, however it is the incubator of segments like Quantum, robotics and tech used by Waymo which is painting critical mass and is leading self drive. I would expect at some point, Waymo to be spun out as a separate entity, unlocking its true value.

The Capex of $75B is outsized but not unexpected I suppose when you hear MSFT is spending $80B and Meta $65B.

Clearly an AI arms race is underway where the ones who achieve results able to be commercialised will sell and embed themselves in customers businesses and end users. It's also interesting how the market is not rewarding the obvious winners yet ,despite the clear and unequivocal evidence that estimates are way too low! Possibly by as much as 70-80%. We will discuss this more over the next couple of weeks as we get closer to Team Greens earnings. -

Hi Ex, I did bracket the 0.17% miss. It's irrelevant

what's 100m when you generate almost 100B. The slight negative reaction is due to the huge capex spending. I think Google management know a bit more about their industry than the average investor.

what's 100m when you generate almost 100B. The slight negative reaction is due to the huge capex spending. I think Google management know a bit more about their industry than the average investor.What we should be thinking about now is, who will be tasked with building out this data centre infrastructure. Three names we hold will be beneficiaries. And don't forget, however big spending is in 2025, TSMC have committed to producing at least 50% more chips in 2026 and 50% more again in 2027 and today an AI servers cost is circa 10% HBM memory-Micron estimate the TAM to be $100B annually by 2030 which implies $1T total spend. Annual spending! If anyone suggested even 5 years ago that a company could generate $1T in a fiscal year you'd be ridiculed, but it now seems plausible. Exciting times ahead

-

AMD also reported last night. What a damp squib that was. Last year AMD stock peaked at $227, a ridiculous sum for a very average business. Today it will open at $108. It was obvious AMD had an inferior product.

A quick recap on the headlines their CEO created last year:

'AMD is coming for Nvidia's crown'

'AMD the AI powerhouse battling for dominance'AMD is an also-ran low profit business which has been trying to compete with Cuda for a decade-and failed. They've spent 10's of billions buying loss making start ups and produced a few chip concepts which are not even close to competitive. Why have they failed to take share from Nvidia. Simple. Having a fast chip means very little when you don't have a software stack or the ability to network them due to bandwidth constraints. And this is precisely why so many don't understand how accelerated computing works. It's not about fast chips. It's about fast systems.

We said in the early days that once you embed into the DC you won't get it out. First to market, first to secure design wins =long term success.

And AMD come to market late and with a cheaper solution. Does anyone think the customer wants 'cheaper'? It's cheaper for a reason, it's inferior and has no competitive software to run it on.

AMD reported full year non gaap earnings of $3.30. GAAP earnings were a measly $1 so with a share price of $100 which was $227 the PE is well above Nvidia. Why the disparity of $3.30 to $1. The enormous amortisation of the goodwill they purchased buying businesses with no assets, just IP-IP which has failed to make a return.

-

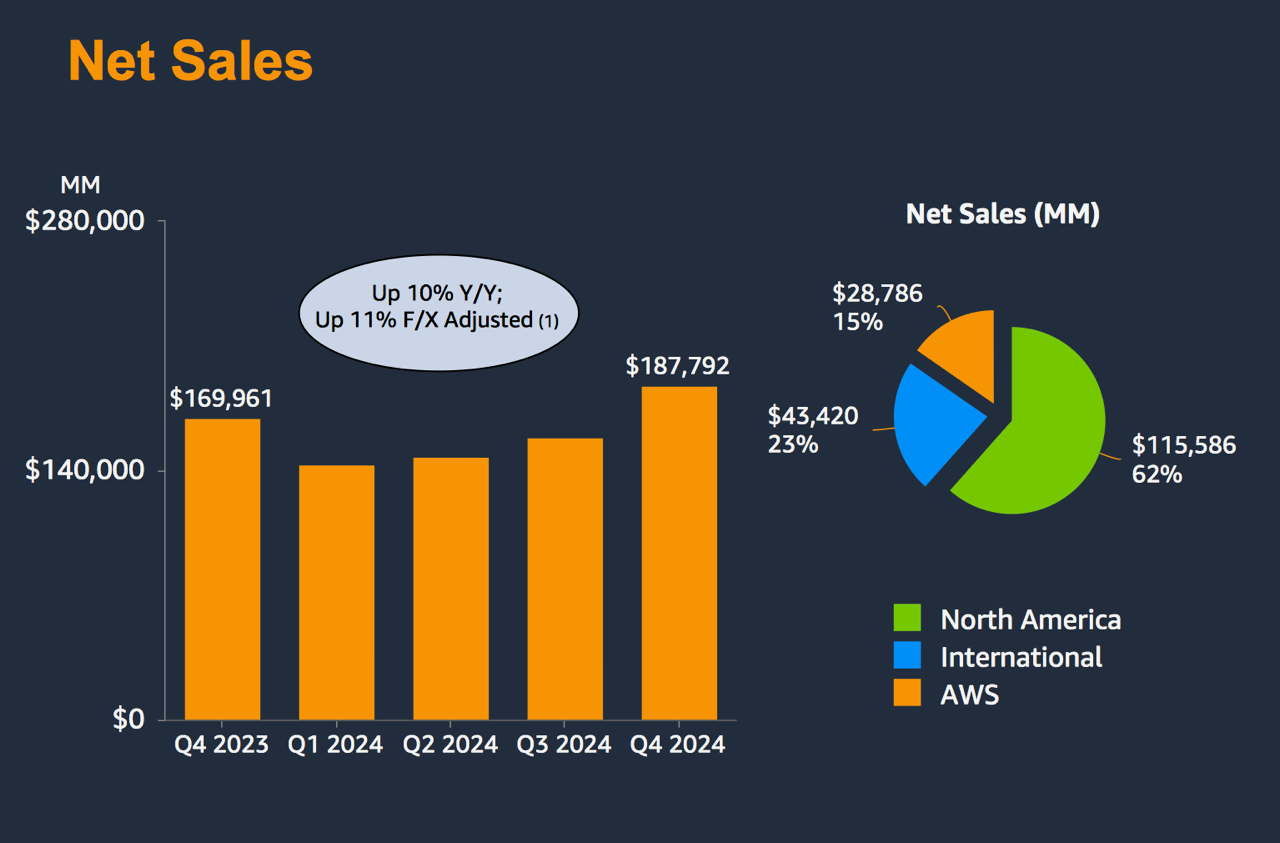

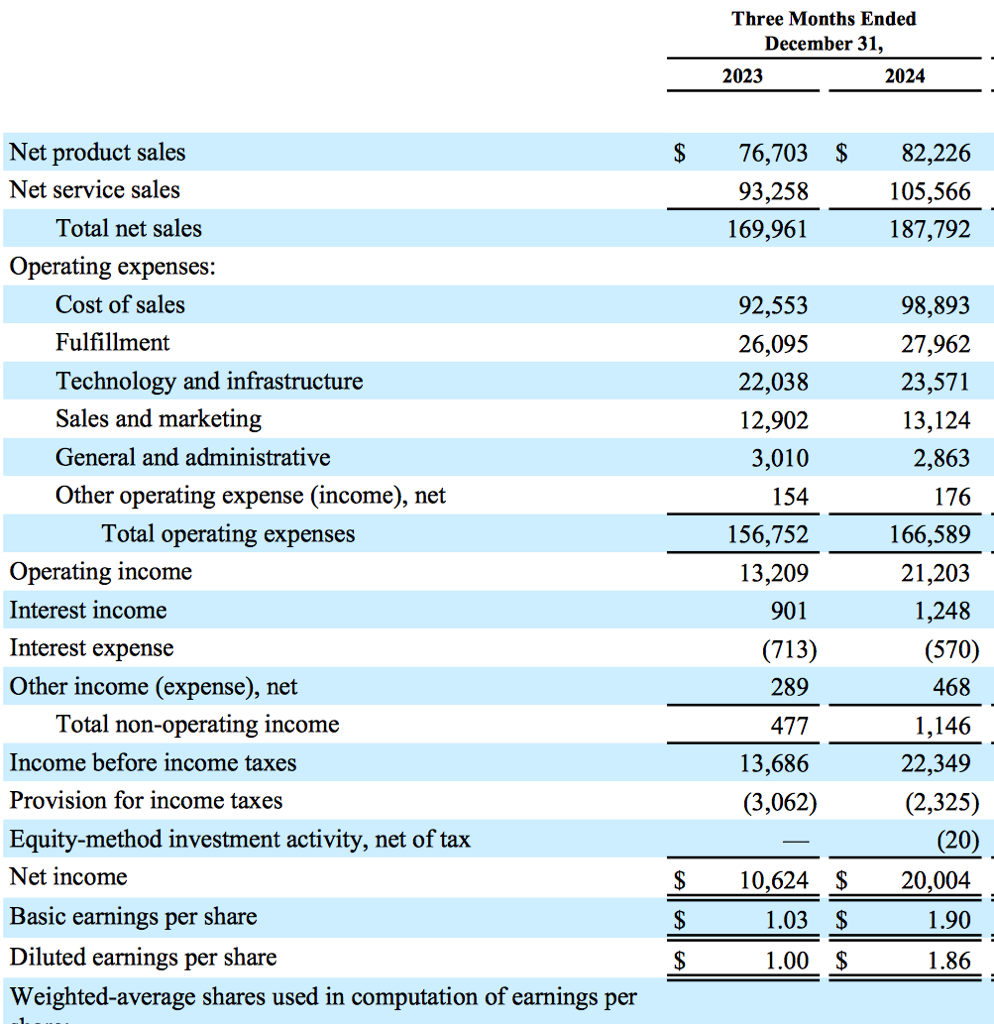

Amazon came in with a strong result. Revenue $187.8B/EPS $1.86. Beating by $560M and $0.38.

Operating Income increased by 61% to $21.2B due to expanding prime membership and tight cost control across fulfilment.

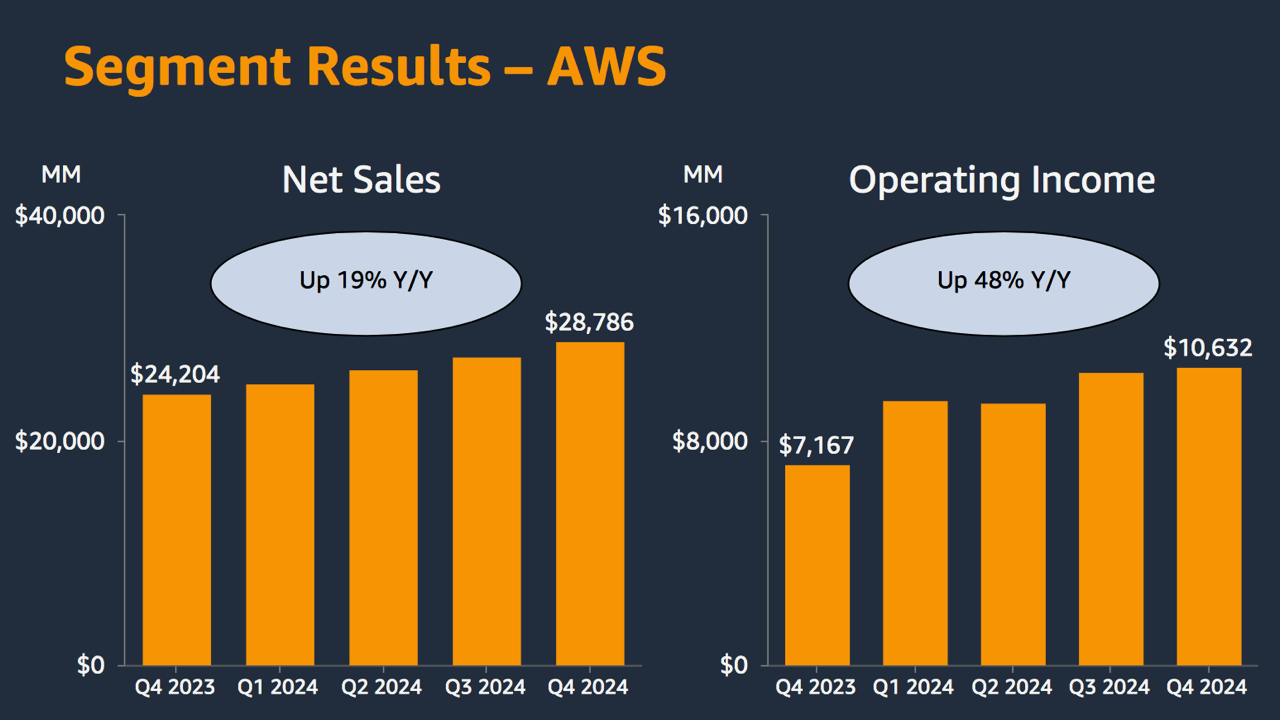

AWS has achieved a $115B annual run rate-impressive.Amazon makes all of its money, largely AWS and a 9% North America 'amazon stuff' margin plus $17.3M in advertising revenue. This is where vendors pay amazon for product placement. Internationally their margin is a small 3%

Capex, mainly on DC will be $75B-a very large number. Beneficiaries will be Broadcom/Nvidia and the server builders

The stock fell 3% after hours which is typical of a stock which is up 9% YTD, at an all time high, 50% since August 2024 and trades at quit a high multiple of 30+

Global annual sales are now $650B -close to $2B/day. Imagine processing all of that and the logistics involved . Amazon now manage > 600 million sq feet of warehousing. To put that into perspective, the Tesla giga factory in Nevada is 5.3M sq feet. 113 Giga factories

-

-

The easiest way to look at 'value'

Amazon earned $20,004M in the final Q4 and approx $60B of the full year 2024 ending 31 Dec. Clearly Q4 is their biggest quarter(Xmas). With 10-15% expected growth and further leverage due to cost control one could assume 2025 earnings in the 65-70B range. Now compare this to Meta/AApl/GOOG/MSFT which are all at the 90-110B range in annual earnings. Then compare their respective market caps, growth rates and brand power.

Amzn MCap is 2.5T

Meta $1.8T

GOOG $2.35TBoth Meta and GOOG earn significantly more money-does this mean that Amazon is over valued. No, it means Meta is relatively cheaper-quite a bit cheaper.

-

Over 50% of the value of the company is AWS-maybe 65%

AWS generates approx 28.7b and earns 10.5(quarter)

Azure generates about 24.5b(less than AWS) but also earns 10.5b

Similar money makers similar growth.

Msft earns significantly more money overall-circa 50%+ more.