Busy couple of weeks on results front

-

It's a completely irrational view. Even if true and it's looking like it's completely false. Sam Altman says Deepseek has copied OpenAi 'technology' and that what they have done is 'easy' when you don't have to innovate and create new things.

Second if there is this new breakthrough(cheap) then it's good news because it means we will reach AGI even faster and all that compute can be used for inference rather than long periods of time and money in training.

On the basis the drop is unwarranted, yes it is an opportunity for those that like the space and see a long term future in it.

-

I would also say; there is no coincidence that Trump comes out promoting America first in the AI arms race and China just happens to rain on his parade. Secondly we know OpenAi has much more advanced models.

Third, what may happen is the next generation of chips will only be made in the US and never leave. TSMC will start production in their Arizona Fab this year. The Blackwell Ultra will be produced in this facility. It's also interesting when looking at DLC server racks. The big foreign player is Foxconn-they will produce these in Mexico but SMCI is the only American made supplier. Could they see favour with the 'buy american' policy. and what if tariffs are applied to Mexico goods? This could play out very nicely for American companies.

I envisage a scenario under Trump, that any friendly/partner country (west and some European), Australia etc wanting the next generation of chip, they can have it provided they set up shop in the US. When you think about the administrations policy, it would make a lot of sense to require all this business being State Side. Investment, jobs, security, tech advantage, all in America. The next season of Yellowstone might see the cattle moved on and a 10GW data centre in its place

-

Lots of Big Tech earnings this week. I am sure we will get plenty of CEO comments on this very topic.

Msft CEo Nadella commented 'Jevons Paradox' strikes against. Basically he is happy AI might become more efficient because it will simply lead to more consumption..'we just can't get enough of it' he said.

-

If anything, it may show that China are not as far behind as many think-the LLM is apparently very good but the suggestion it was trained on a handful of H800 chips is not plausible. If anything it will drive even more US investment.

-

Hi O,

Large daily moves are all part of the investment journey-no stock is immune. Some are warranted and permanent, others are not, being caused by a combination of sitting at peaks(the case) and a rumour or misinformation (the case). Even if this claim is true, would it change the built out. No it would not. As we have discussed numerous times, AI is little to do with LLM chatbots which are just stepping stones to reach AGI. That is the goal and the West will invest trillions to achieve it. Whether they succeed is up for debate. For now we get some clever productivity tools. One day we might get the theory for everything and a cure for all diseases.

China may or may not succeed but one thing is certain. Western allies will not be buying their discoveries any time soon, hence why the Mag 7 are building it. Meta's new Louisianna DC is already stood up, you can google photos. They aren't walking away because some Chinese startup made a clever chatbot. The only risk with Nvidia is whether a better accelerator comes to market (more efficient). It doesn't exist so we are happy investing in 'Team Green'

To reiterate, those that think the world is done buying GPUs simply don’t understand the purpose. It’s not to generate cat video’s. It’s to solve what is impossible today, tomorrow.

-

Adam, thanks. All understood, and I'm very happy to upvote your post (along with Dangermouse).

Holding one's nerve when faced with an interesting news day is all part of the fun of it I guess. And as Terry Smith said, "If you don't like what the screens are telling you then turn the screens off".

-

Well I logged on to the portal this morning expecting the figures to be dire, but they weren't. Down by a fat chunk less than I had expected. I thought that having a portfolio which is 1/3 in IMTech and 1/3 IMLifestyle (with a long end date) would have meant big exposure to NVDA but perhaps that isn't the case.

I also notice that all of the big losers of yesterday are back up significantly in after-hours trading. Will this all have blown over by this time next week?

-

Yes I noticed the same, was bracing for a big hit, just seems to be some of the gains from the last couple of weeks that have disappeared.

-

Yes I noticed the same, was bracing for a big hit, just seems to be some of the gains from the last couple of weeks that have disappeared.

@SteveRutter Precisely. I'm still up by 1.5% in this month on Cobens.

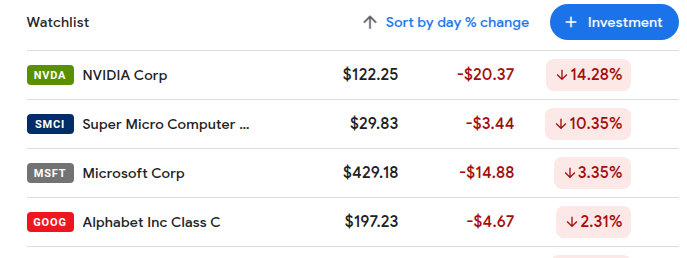

The press are screaming about a 17% drop in NVIDIA, but are saying nothing about the 98% growth in 12 mths or 20% growth in 6 mths. Recent buyers will have been stung, but that's the nature of investing. HOLD / BUY.

I bought NVDA on 11/12/2024 for $95, and it's now worth $87. I've just queued $240 more for when the market opens at 1430GMT.

Watch it crash!!

-

8 of the 13 holding in tech actually appreciated yesterday, some by 2-3% so it softened the blow. We will hear from Amazon, MSFT, Meta and KLAC this week. Nvidia will report on the 26th of February as their fiscal year end is 31 January. It's impossible to know precise timing with any new architecture release(the mass production/shipping) however if we take Q4(to be reported) together with the Q1 guide we will see exactly what they've been cooking. Historically they have been reporting 'their guide +$2B beat'. They guided $37.5B so the market will expect close to $40B. Their actually result all hinges on how much Blackwell they managed to ship and new launches are always iffy when you are reporting every 13 weeks. In saying all of that, chip industry experts expect 250k B series chips which is close to $10B.

Hopper is peaking or has peaked in the last couple of months so if they had a great Blackwell launch we expect very big numbers because now we have two high end chip architectures not one! But what i'm most excited about is the guide. The same industry pundits are estimating Blackwell supply in Q1 to be Q1+500k chips. At 50k a piece that is $25B additional revenue. I am not suggesting they'll guide $60B but clearly if output is anything like that suggested, they'll be growing a lot faster! The company itself has made no secret of the fact that they sold about 2.43M Hopper chips in 2024 and they expect to sell 4.2M Blackwell in 2025. The most they think TSMC can package(but they too are accelerating COWOS). What is surprising is the industry thinks they will also sell 2M hopper in 2025 as it's still in very high demand albeit slowly coming down.

My take on that is simple. In 2025 we could see Hopper revenue at 80% of 2024 plus twice 2024 revenue just from Blackwell. I say twice because the chips, when shipped, are 40% more expensive than Hopper. Not a bad deal when they are 10X faster

Very rough number for 2025, by quarter-I am expecting something like 50/60/70/80 (billion)

Today, analyst expectations for this full year ending jan 26 is $196B. In our opinion this is materially understated.

And just a recap on the targeted 4.2M Blackwell. A week ago Meta announced a 1.3M chip datacentre(half in 2025?, we don't know), Stargate will deploy 100B 'immediately(2025) so between them that is 40% minimum. MSFT are spending $80B, another 1M, Google? AWS, Xai, Coreweave?

-

Sorry to keep talking about the opposition here (I'm hoping it's not a bannable offence) but Fundsmith has jumped like a jumping thing today. And my experience is that rises in FS one day are often followed by a rise in the IM number the following morning.

-

I am more than happy to discuss Fundsmith-we don't compete with them because our point of difference is that clients have access to the people who directly influence the decisions surrounding their investments and operationally, where possible we do our best to meet their needs one on one, even if its a quick turn around to any comms.

When you say jumped 'today', I assume you are looking at the ETF? As you know they hold Meta, GOOG and MSFT, ball up today nicely. There is little similarity between FS and Tech/Lifestyle. And just stating a fact, both of our portfolio's had returned significantly greater returns over the last several years.

Real time Tech is up about 2.5%. But remember, fx is volatile at the moment and we take a cut off at 11.30 GMT. What you are seeing is live until UK market close(I assume) so when it opens again you will see a gap up or down from the previous evenings fx and US price changes. I don't know how their ETF is cut off.

-

I think Meta is responsible for a lot of their gains. I don't know how much they hold percentage wise but the stock is up 16% YTD! -for Jim that is 28 days

. BTW, they report tomorrow and as always, the market reaction is a big unknown. I do think they will report very good numbers-exceeding expectations. You don't comms $65B to capex unless your'e making a lot of money.

. BTW, they report tomorrow and as always, the market reaction is a big unknown. I do think they will report very good numbers-exceeding expectations. You don't comms $65B to capex unless your'e making a lot of money. -

I think Meta is responsible for a lot of their gains. I don't know how much they hold percentage wise but the stock is up 16% YTD! -for Jim that is 28 days

. BTW, they report tomorrow and as always, the market reaction is a big unknown. I do think they will report very good numbers-exceeding expectations. You don't comms $65B to capex unless your'e making a lot of money.

. BTW, they report tomorrow and as always, the market reaction is a big unknown. I do think they will report very good numbers-exceeding expectations. You don't comms $65B to capex unless your'e making a lot of money.@Adam-Kay said in Busy couple of weeks on results front:

the stock is up 16% YTD! -for Jim that is 28 days

-

I am more than happy to discuss Fundsmith-we don't compete with them because our point of difference is that clients have access to the people who directly influence the decisions surrounding their investments and operationally, where possible we do our best to meet their needs one on one, even if its a quick turn around to any comms.

When you say jumped 'today', I assume you are looking at the ETF? As you know they hold Meta, GOOG and MSFT, ball up today nicely. There is little similarity between FS and Tech/Lifestyle. And just stating a fact, both of our portfolio's had returned significantly greater returns over the last several years.

Real time Tech is up about 2.5%. But remember, fx is volatile at the moment and we take a cut off at 11.30 GMT. What you are seeing is live until UK market close(I assume) so when it opens again you will see a gap up or down from the previous evenings fx and US price changes. I don't know how their ETF is cut off.

@Adam-Kay said in Busy couple of weeks on results front:

I am more than happy to discuss Fundsmith-we don't compete with them because our point of difference is that clients have access to the people who directly influence the decisions surrounding their investments and operationally, where possible we do our best to meet their needs one on one, even if its a quick turn around to any comms.

When you say jumped 'today', I assume you are looking at the ETF? As you know they hold Meta, GOOG and MSFT, ball up today nicely. There is little similarity between FS and Tech/Lifestyle. And just stating a fact, both of our portfolio's had returned significantly greater returns over the last several years.

Real time Tech is up about 2.5%. But remember, fx is volatile at the moment and we take a cut off at 11.30 GMT. What you are seeing is live until UK market close(I assume) so when it opens again you will see a gap up or down from the previous evenings fx and US price changes. I don't know how their ETF is cut off.

Thanks Adam. I don't know what an ETF is but the Fundsmith fund I mention is the bread-and-butter one which is available as an ISA or a GIA. They have a cut-off at 12.0pm every day which I think is when they take their values, and they publish them on their website at 2.30pm.

Yes, IMTech and PHE have both out-paced FS over the last 10 years (and comfortably over the last 3). There's a reason I've been shuffling funds from one to the other!

That's an interesting comment about META. I noticed that you added META to IMTech a few months back.

-

Hi O,

Yes FS owned meta a while before we did. An insight into the process. We didn’t like it up to 6 months before we bought it, maybe a bit longer-would need to check my notes. Big change with Apple privacy opt in. A big deal back 2-3 years. I know the stock so well I don’t even need to check. It lost maybe 40% of its value. Meta fundamentally changed maybe 2 years ago but for us it was too expensive at the time. We loved the company fundamentals but it was too expensive. It was $560 going into q3 24 and they blew away earnings but said ‘we are investing 30b in ai’ the stock tanked to 450. Ok

We jumped in. The take away is, a good investor must be willing to change their mind-avoid bias. ‘It’s a dog-always a dog’. Avoid that mind-set. Be patient. This market will serve investors great opportunities regularly. Case in point ‘today’.

Last rule us never time the market-however we did time that acquisition to pefection

-

Deepseek has been accused of distillation of Open AI models. This is a process where they train their model(the student) on the Teacher model(Open AI). So it's nothing more than mimicking open AI-not very clever at all! Big surprise, China start-up is lying. And it looks like the US will ban the App.

It also struck me as odd that Deepseek is run by a hedge fund. I wonder whether they profited from the flash-crash in some US stocks.

-

Further update, Microsoft has implemented a formal investigation into Deepseeks unauthorised use of Open AI data. The US government has banned employees and anyone in the Navy from downloading the App.

As DT would say, Deepseek is 'fake news'.