Q4 2024 Earnings & Guidance

-

Here you will find information relating to the earnings results of stocks we hold, management commentary sourced from their conference calls including their guidance outlook for Q1/2025 and beyond, together with our thoughts. We start on the 29th with the mega caps.

-

After the closing bell tonight, the following Mega Caps will report their Q4 earnings and typically provide guidance for the following(Q1/2025 Q).

Meta. Expected Revenue $46.99B/EPS(GAAP) $6.76

Microsoft. Expected Revenue $68.81B. $3.10

Tesla will also report. And whilst we don't hold the stock, it is eagerly anticipated and its earnings/operations do ripple across the broader tech market.

I would expect Microsoft's business to be solid. They tend to come in in-line without many surprises. Meta should be strong, a lot more scope for upward revisions in earnings. It's business has been expanding and Zuckerburg has been masterful in flexing their AI leadership via Llama 3.3. Essentially this model has allowed the company to serve far better ads to customers and advertisers are willing to pay more for this. I think they could report earnings > $7

-

Tesla is the curious one in this line-up.

It feels like Elon has been corrupted by his own social media channel - recent posts appear to rant about anything and everywhere - plus many reports of people (& businesses) being put of Tesla because of his intrinsic association.

I don't doubt they will continue to sell cars, but feels like a correction in their trajectory.....& the Chinese are coming: our local Hyundai garage has turned to BYD....Thanks again for all the updates, Adam!

-

You can call it lefty nonsense if you want - your view is as valid as everyones - but maybe you haven't seen the many and varied reports on how Musk's behaviour is being perceived by others.

I wasn't trying to make this a political point, but a point that his behaviour IS having a negative impact.https://www.garagetalkonline.co.uk/ev-hub/the-musk-effect-a-third-of-brits-less-likely-to-buy-tesla-due-to-elon-musks-recent-behaviour as one example

https://www.businessinsider.com/europe-pension-sold-entire-585-million-stake-in-tesla-2025-1 as another.Plenty, plenty more.

Enjoy your first EV when you get there. -

Reports like where ? Liberal / leftist nonsese no doubt.

The Chinese certainly are coming, I for one will never buy one and when it becomes too dfficult to not have an EV I'll go straight to Tesla for my 1st.@PM3 said in Q4 2024 Earnings & Guidance:

Reports like where ? Liberal / leftist nonsese no doubt.

The Chinese certainly are coming, I for one will never buy one and when it becomes too dfficult to not have an EV I'll go straight to Tesla for my 1st.I presume you mean you'll never have an EV until there is no other choice.

I was of this mindset up until may be 6 to 8 weeks ago, adamant I wouldn't have an EV, too expensive, no range, too long to charge, too risky if it goes wrong (I'm a mechanic although more trucks than cars), I was adamant I was going to keep my trusty 2009 Tiguan diesel I'd owned since 2013 until it fell to pieces.

Sat on the drive now is a 2021 E-Niro 4+, just over three years old, 39,000 miles, purchased at half its original sales price, with 4 years warranty left on it. Range is 200 to 300 miles, it fantastic to drive, going out to a warm defrosted car every morning is shear bliss.

So what changed my mind? I realised how easy recharging is away from home, how quick it can be nowadays, and how cheap it is presuming you can charge at home (£1300 fuel bill down to less than £300 a year). There would only likely be less than half a dozen times a year I will need to charge away from home, basically on UK holidays.

The above was like a light bulb moment.

PS. Its highly unlikely I'd have a Tesla, to start with I don't like the man, secondly I don't like the lack of buttons or dashboard.

-

A huge Meta beat. Over $8 per share. Quite incredible a business thus large can grow earnings 50% yoy. Nice beat from msft. Details tomorrow

-

@PM3 said in Q4 2024 Earnings & Guidance:

Reports like where ? Liberal / leftist nonsese no doubt.

The Chinese certainly are coming, I for one will never buy one and when it becomes too dfficult to not have an EV I'll go straight to Tesla for my 1st.I presume you mean you'll never have an EV until there is no other choice.

I was of this mindset up until may be 6 to 8 weeks ago, adamant I wouldn't have an EV, too expensive, no range, too long to charge, too risky if it goes wrong (I'm a mechanic although more trucks than cars), I was adamant I was going to keep my trusty 2009 Tiguan diesel I'd owned since 2013 until it fell to pieces.

Sat on the drive now is a 2021 E-Niro 4+, just over three years old, 39,000 miles, purchased at half its original sales price, with 4 years warranty left on it. Range is 200 to 300 miles, it fantastic to drive, going out to a warm defrosted car every morning is shear bliss.

So what changed my mind? I realised how easy recharging is away from home, how quick it can be nowadays, and how cheap it is presuming you can charge at home (£1300 fuel bill down to less than £300 a year). There would only likely be less than half a dozen times a year I will need to charge away from home, basically on UK holidays.

The above was like a light bulb moment.

PS. Its highly unlikely I'd have a Tesla, to start with I don't like the man, secondly I don't like the lack of buttons or dashboard.

@Ronski said in Q4 2024 Earnings & Guidance:

@PM3 said in Q4 2024 Earnings & Guidance:

Reports like where ? Liberal / leftist nonsese no doubt.

The Chinese certainly are coming, I for one will never buy one and when it becomes too dfficult to not have an EV I'll go straight to Tesla for my 1st.I presume you mean you'll never have an EV until there is no other choice.

I was of this mindset up until may be 6 to 8 weeks ago, adamant I wouldn't have an EV, too expensive, no range, too long to charge, too risky if it goes wrong (I'm a mechanic although more trucks than cars), I was adamant I was going to keep my trusty 2009 Tiguan diesel I'd owned since 2013 until it fell to pieces.

Sat on the drive now is a 2021 E-Niro 4+, just over three years old, 39,000 miles, purchased at half its original sales price, with 4 years warranty left on it. Range is 200 to 300 miles, it fantastic to drive, going out to a warm defrosted car every morning is shear bliss.

So what changed my mind? I realised how easy recharging is away from home, how quick it can be nowadays, and how cheap it is presuming you can charge at home (£1300 fuel bill down to less than £300 a year). There would only likely be less than half a dozen times a year I will need to charge away from home, basically on UK holidays.

The above was like a light bulb moment.

PS. Its highly unlikely I'd have a Tesla, to start with I don't like the man, secondly I don't like the lack of buttons or dashboard.

I'm only 50% luddite ( now I am retired ) I'll prob have one of those moments and change my mind. Happened to a good friend of mine who was firmly in the ICE or die camp with me.....after renting a couple of times for business journeys he rides in a new Polestar now , never say never .

-

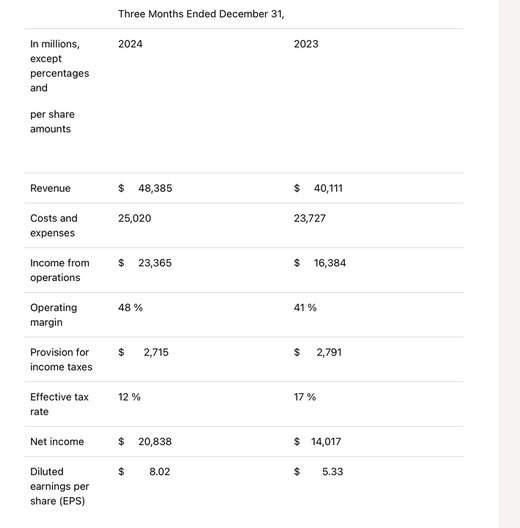

Meta

A exceptionally strong quarter from Meta. 700 bps increase in operating margin driven by leverage-21% top line growth cf modest ‘costs’ increases. 52 billion in free cash generation. Very impressive.

Fourth Quarter and Full Year 2024 Operational and Financial Highlights

• – The average daily users 3.35 billion in December 2024, reflecting a 5% increase year-on-year.

• Ad impressions – Ad impressions across our Family of Apps rose by 6% and 11% year-on-year for the fourth quarter and full year 2024, respectively.

• Average price per ad – The average price per ad increased by 14% and 10% year-on-year for the fourth quarter and full year 2024, respectively.

•. Revenue stood at $48.39 billion and $164.50 billion, marking year-on-year increases of 21% and 22% for the fourth quarter and full year 2024, respectively. On a constant currency basis, revenue would have risen by 21% and 23% year-on-year for the fourth quarter and full year 2024, respectively.

• Costs and expenses – Total costs and expenses amounted to $25.02 billion and $95.12 billion, reflecting increases of 5% and 8% year-on-year for the fourth quarter and full year 2024, respectively. Fourth-quarter costs and expenses were positively impacted by $1.55 billion due to a reduction in accrued losses for certain legal proceedings.

• Capital expenditures – Capital expenditures, including principal payments on finance leases, stood at $14.84 billion and $39.23 billion for the fourth quarter and full year 2024, respectively.

• Capital return programme – Share repurchases of our Class A common stock were nil and $29.75 billion, while total dividend and dividend equivalent payments were $1.27 billion and $5.07 billion for the fourth quarter and full year 2024, respectively.

• Cash, cash equivalents, and marketable securities – These totalled $77.81 billion as of 31 December 2024. Free cash flow was $13.15 billion and $52.10 billion for the fourth quarter and full year 2024, respectively.

• Long-term debt – Long-term debt stood at $28.83 billion as of 31 December 2024.

• Headcount – The total headcount was 74,067 as of 31 December 2024, representing a 10% year-on-year increase.

CFO Outlook Commentary

We anticipate total revenue for the first quarter of 2025 to range between $39.5 billion and $41.8 billion, reflecting 8-15% year-on-year growth, or 11-18% growth on a constant currency basis. Our guidance assumes that foreign exchange rates will create an approximate 3% headwind to year-on-year total revenue growth. This forecast also accounts for the leap day effect in the first quarter of 2024. While we are not providing a full-year revenue outlook for 2025, we believe our continued investment in our core business will enable us to sustain strong revenue growth throughout the year.

For full-year 2025, we expect total expenses to be in the range of $114-119 billion. The largest driver of expense growth will be infrastructure costs, due to increased operating expenses and depreciation. Employee compensation is expected to be the second-largest contributor, as we expand our technical workforce in key areas such as infrastructure, monetisation, Reality Labs, generative artificial intelligence (AI), and regulatory compliance.

We forecast full-year 2025 capital expenditures to be between $60-65 billion, primarily driven by increased investment in generative AI initiatives and our core business. The majority of capital expenditures will continue to be allocated to our core operations. -

MSFT to follow later this morning. happy to both results. Both companies are growing nicely and executing to their plans

-

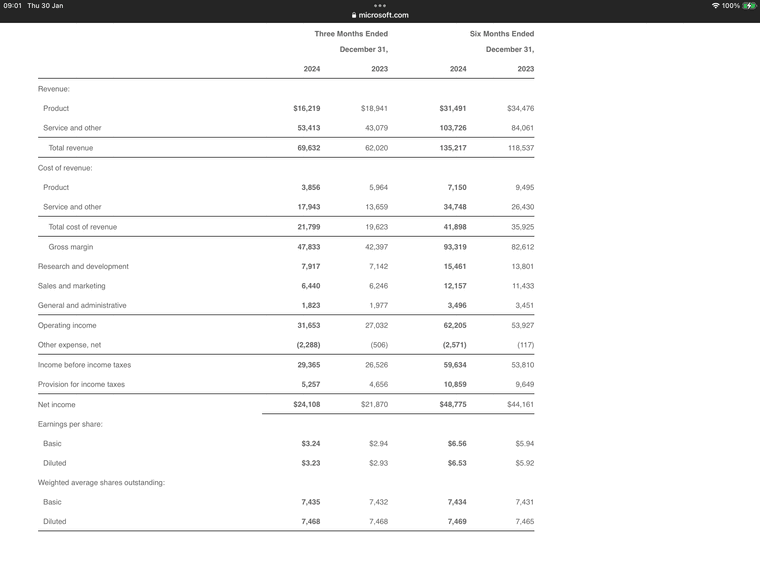

Microsoft turned in a 17% increase in operating profit, handily beating estimates in the top and bottom lines. Azure revenue increased 21% with next quarter guide to be in the range +30-31%. Ai revenue increased 175% yoy. You can see the impact of FX(17% constant ccy to 10% in usd).

Microsoft Corp. today announced the following results for the quarter ended December 31, 2024, as compared to the corresponding period of last fiscal year:

· Revenue was $69.6 billion and increased 12%· Operating income was $31.7 billion and increased 17% (up 16% in constant currency)

· Net income was $24.1 billion and increased 10%

· Diluted earnings per share was $3.23 and increased 10%

“We are innovating across our tech stack and helping customers unlock the full ROI of AI to capture the massive opportunity ahead," said Satya Nadella, chairman and chief executive officer of Microsoft. “Already, our AI business has surpassed an annual revenue run rate of $13 billion, up 175% year-over-year.”

“This quarter Microsoft Cloud revenue was $40.9 billion, up 21% year-over-year,” said Amy Hood, executive vice president and chief financial officer of Microsoft. ”We remain committed to balancing operational discipline with continued investments in our cloud and AI infrastructure.”

-

Meta is up in Pre market to $693, an all time high. The reason is didn't pop more is because it's been on a tear lately, +15% YTD and almost 50% in the last 6 months so Mr market expected a very good result. Either way a very impressive, circa $21 billion quarter. This is 'Apple money'. In fact GOOG,MSFT, META and AAPL all generate similar earnings in the 20-25B per Q range so it's interesting to look at their disparate valuations, and why we may favour (weight)one over the other. Meta clearly has the wind at its back and is growing at a higher rate than both Msft and Apple, for now. I would expect Google to report similarly impressive numbers and on a relative basis it is the 'cheapest' of the Mag 7. But as always we need to balance growth with operation risk (regulatory risk, disruption and competition) and this is where the market will ascribe a valuation not just purely looking at the numbers. Microsoft for example has a much broader income base and I would think, more sticky (like Apple) whereas Meta could face competition from the likes of TikTok (it does). And all of these considerations drive the multiple afforded by investors. No surprise both Apple and MSFT trade at higher multiples. Simply because their earnings are more certain.

-

MSFT is off slightly in pre market by approx 3%-the usual 'we expect more'. In particular, more than 31% Azure growth. When you look under the hood at cashflow they actually did far better than the GAAP(accounting) numbers portray. Depreciation is up 900M (all that capex) and they incurred an unrealised (book and non cash)) loss of $1B on derivative transactions. This will be hedging which swings around quarter to quarter.

-

Adam,

Excellent stuff, as usual. Thanks.

This may have been explained elsewhere in which case then apologies. However if MSFT is reporting a nice fat jump in profits and yet the share price has dropped then where are these extra profits going? I presume that they are being paid out as share dividends and hence to the shareholders, i.e IM.

Do the share dividends get paid into the accounts of the individual IM account holders? Do they sit as cash or do they get used to buy more shares?

Or am I way off beam somewhere?

Thanks again for the distilled analysis and patient explanations.

-

Hi O,

Dividends get paid in cash where one holds individual shares(the acc yes), 4X per year. The company may or may not increase it. It has nothing to do with the share price changing as the same total Nr of shares are held somewhere. All that changed with the share price is the dividend yield will move Eg: $3 per share at $450 or $3 per share at $400, 0.66% vs 0.75% yield.

-

I’ll update tomorrow. However, KLA didn’t disappoint, exceeding on all metrics. The stick us up 5%.

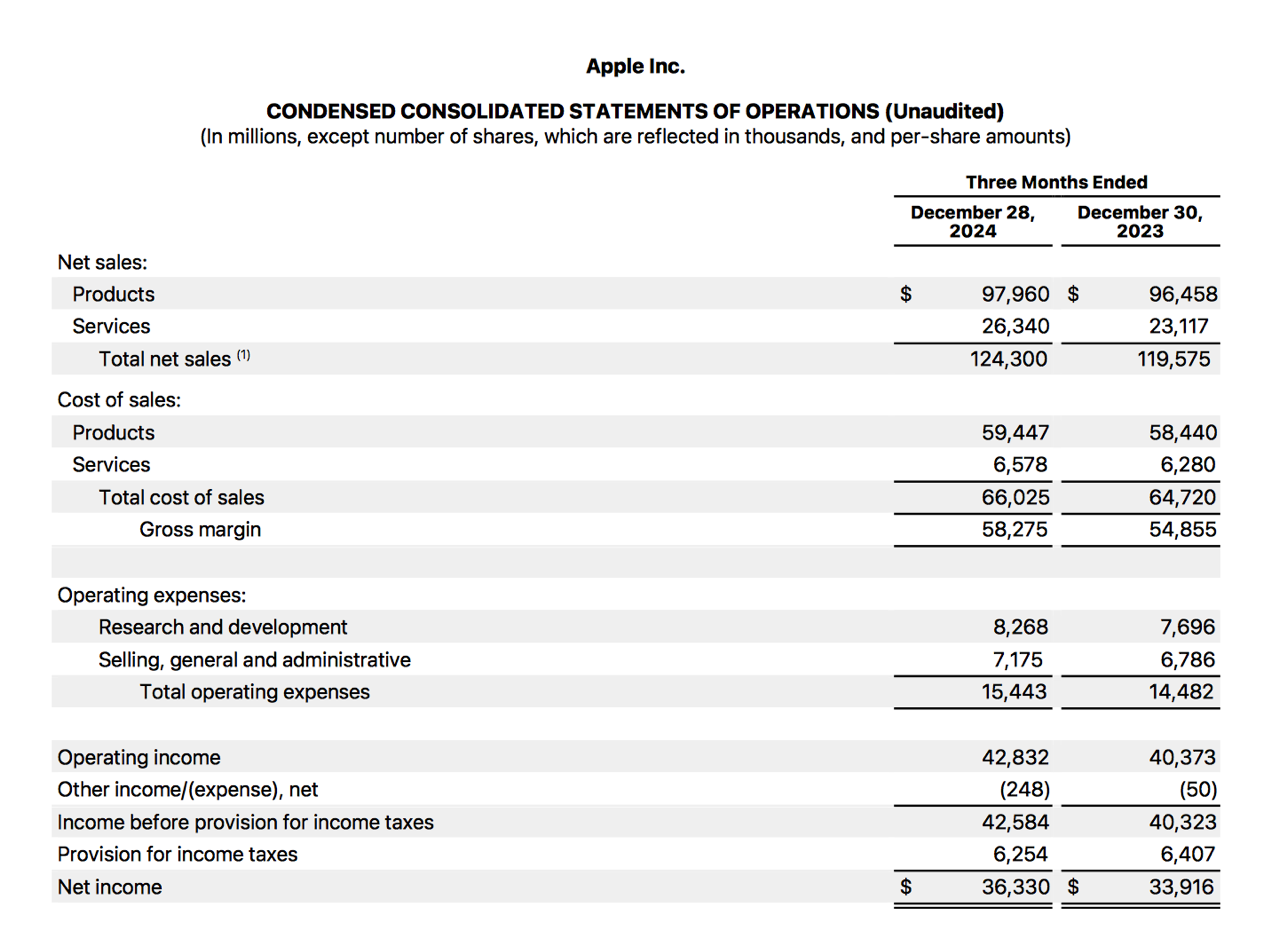

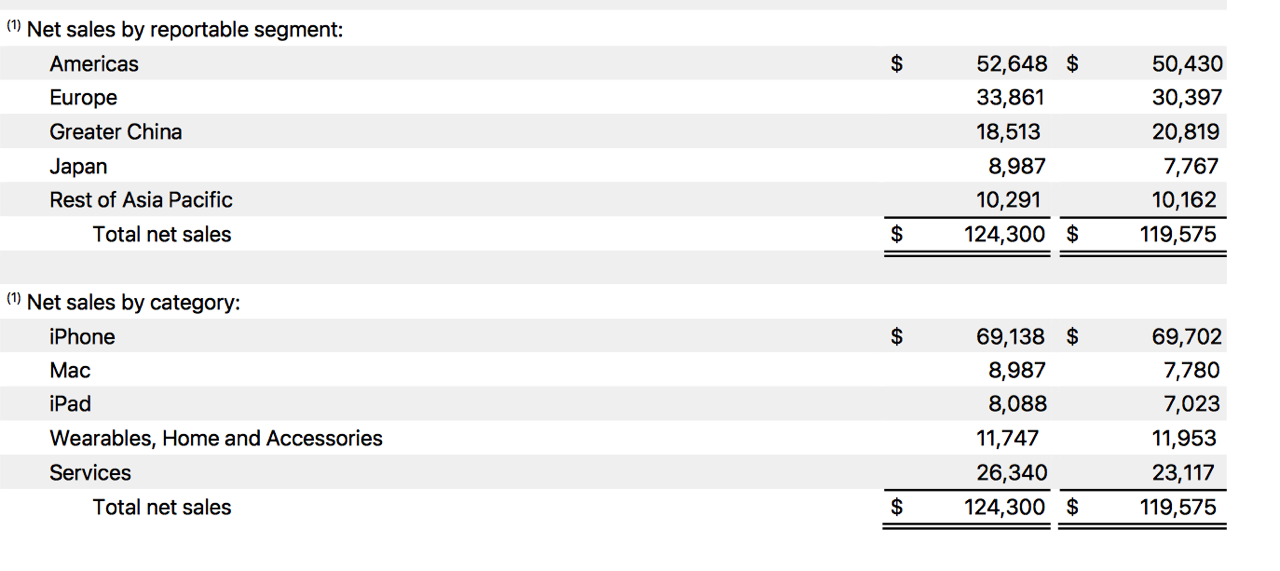

Apple beat despite weakness in China. Those that followed the Apple thesis ‘back in the day’ will remember, we said ‘services’ is their golden goose. The 2 billion users buying apps, iCloud, tv, news, warranty. It was predicted to be a huge cash cow. It is. Services grew 3 billion yoy and had a 90% gross margin.Apples moat is OS/IOS installed base. Whilst I think it will be challenging to launch a needle moving hardware product. I do think when AI matures they will monetise various tools all through their store channels .

Apple is a core, SWAN, sleep well at night, stock. -

Apple GAAP EPS of $2.40 beats by $0.06, revenue of $124.3B beats by $270M

-

-

It's clear to see how Apple 'made up' for poor China sales. Services! Services have a 90% margin. For ever $1 in sales, 90 cents drops to the bottom line-you may recall this was the reason we invested, originally. $36B net income is huge. It is of course their biggest quarter and it is a lot bigger than the other three (Q's).

The company gross profit on all hardware was 38.5B. The gross profit on services was $20B and if we look a bit deeper they made gross profit on phones of about $27.6B. Services is a major contributor-we still think one day it will exceed GP on hardware.

Apples strength is in monetising the 1.3B customers and 2B phones. We firmly believe that when co-pilots/AI agents get better, and they will, Apple is in a prime spot to monetise this new segment.