Nvidia Q2 Earnings

-

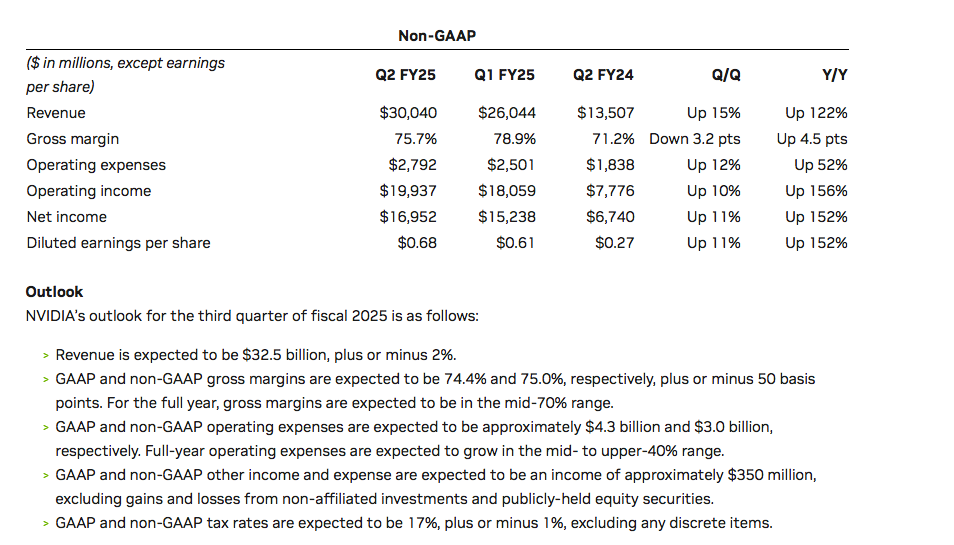

Nvidia reported record revenue and earnings

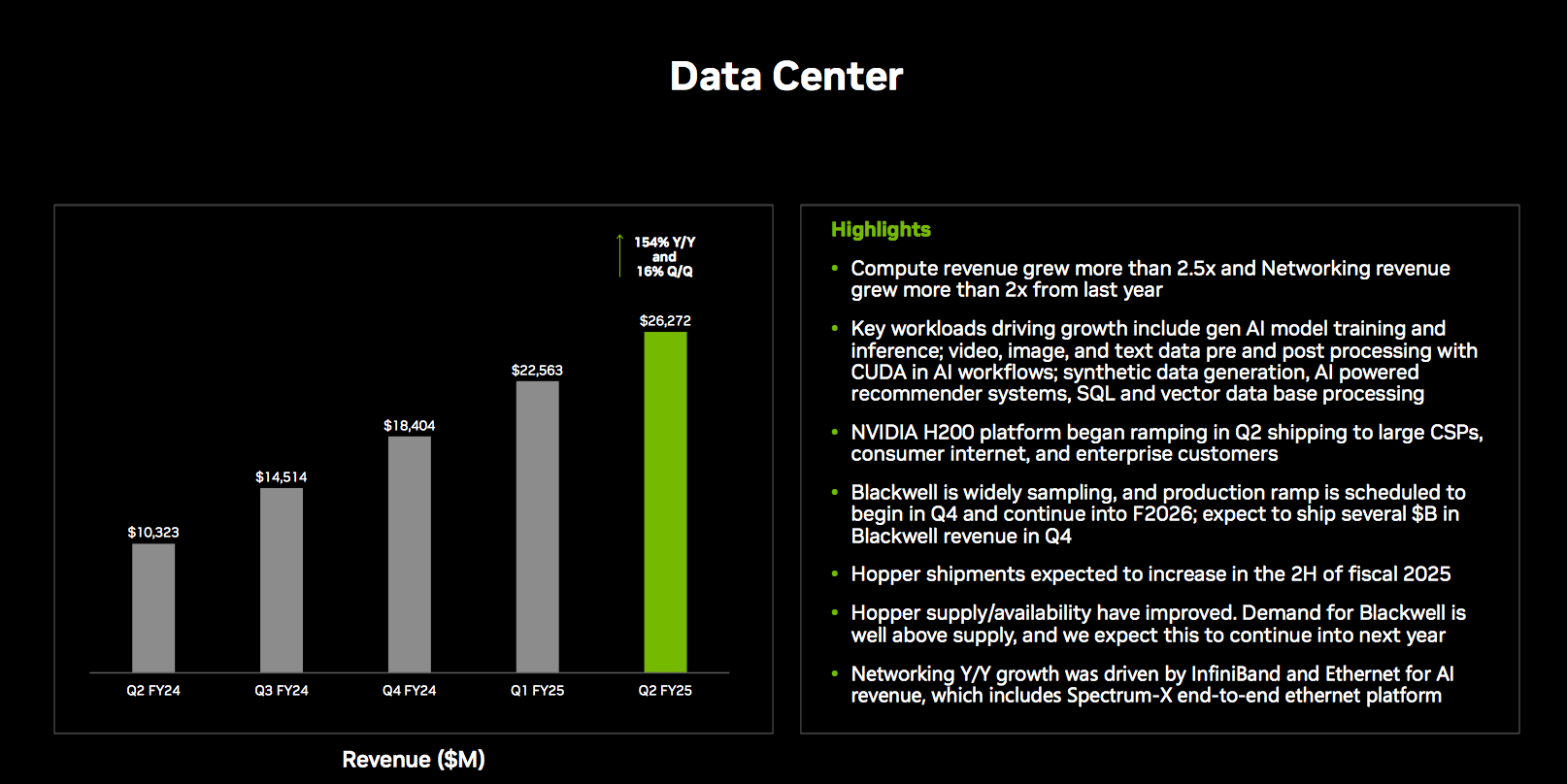

Nvidia reported record revenue and earnings for its fiscal 25 Q2, driven by data centre. Beating on both the top and bottom lines.

The rumoured delays in Blackwell were quashed by management. Citing the photomask as needing a small design only, and that has been successfully completed. A photomask is the master template which optically transfers the pattern onto the silicon wafer in order to fabricate the chip.

Blackwell is sampling today with ramping production in Q4. The company stated that several billion in revenue is expected in Q4. In the mean time Hopper capacity is growing quickly, whilst demand significantly exceeds the ability to supply.The guide for Q3 is $32.5B with gross margins in the mid 70’s range going forward. Typically the company beats on its guide so we would expect closer to $35B actual.

China sales of the H20 is pleasing with low single $billion during the quarter.

The real story will play out in the 2025 calendar year with Blackwell ramping quickly and Hopper still in very high demand, we would expect revenue growth to accelerate. Blackwell is believed to be sold out through 2025 and we would expect calendar 2025 revenues to exceed $200B with corresponding earnings being in the 115-120B range. For context MSFT earns circa $90B and Apple circa $100B.

-

What’s going on with this news article this evening?

Sky News said:

“China probe sees US tech giant lose more than $100bn ahead of Trump presidency

A Chinese competition investigation has knocked more than $100bn off the valuation of a US tech giant, as Beijing braces ahead of a second Trump presidency.

Nvidia, the world's largest chip maker, lost around 3% in early trading on Wall Street after China said the company was suspected of violating its anti-monopoly law.” -

China has been excluded from the AI revolution for at least 2 years. It’s only getting worse for them. Nvidia sell virtually nothing to them and are sold out for 2 years-seems illogical to sell the stock on China being upset.

It seems rather ironic that the biggest bad state actor, an enabler to Russia and Iran and North Korea, a champion of rights and upholder of ‘The Law’ is now crying foul.

In other news Nvidia will be sourcing its chips, State side starting in 2025.

-

The move by Chinese regulators came a week after the Biden administration expanded curbs on the sale of advanced U.S. technology to China.

What might they do-ban the chips they can’t buy?

China’s economy is faltering due to a an over reliance on property investment and with it, massive debt. More recently global trade tensions are beginning to pose a real threat. Consumer spending is falling. It sounds to me like a distraction-let’s pick on the biggest company in the world. Only issue with that plan, it won’t hurt the US.

-

If you think about US/China relations-trade wise. Things have been quite bad for a while and will almost certainly get worse before it gets better. It is worth remembering that the tensions escalated in 2018 under the first Trump administration. The route cause being, unfair trade practices and theft of US IP. Without getting 'into it', it's no secret that China does what is best for China. Here are some factual abuses which can not be allowed to go unchecked:

- State-sponsored hacking used to acquire trade secrets

- High levels of counterfeit goods

- Forced transfer of IP from foreign companies operating in China

- State Owned business subsidies(and export subsidies) which allow a significant advantage on the world stage

- Weak labour and environmental standards including slave labour

- Mislabelling to bypass tariffs. Anyone read about the tomato scandal

- Belt and Road initiative which creates debt dependency for other smaller countries

- South China Sea aggression and Taiwan. Supporting Iran and Russia

In summary, the US policies have been in place for 6 years and clearly for good reason. The businesses we invest in are doing just fine despite the tensions. Could Apple sell less product or Tesla less cars if tensions escalate further. Quite possibly. Will this lead to a permanent impairment. Highly unlikely. I would suggest that Nvidia is the least likely to be impacted due to global demand and their constrained supply chain.

As we have said before, the US market is by far the biggest and historically, where the biggest opportunities are. The biggest concern for China is actually domestic unrest. If growth slows, unemployment will rise which may pressure the CCP to change policy. Whatever the outcome, the goal is containment not decoupling.

-

Interesting post Adam, thanks as always.

Trump's very aggressive stance on China when he was POTUS 2016-2020 was a clever position to take, and a very good reason why a lot of people will welcome him back in 2025 with open arms. The threat that China poses to the rest of the world is hard to under-state, and initiatives to curb their power and growth are a good thing. However I notice that I've just strayed WAY off-topic, so let's talk about something else!

-

You aren't wrong O! How can the West compete when, for example, we have min wages/conditions, limits on fossil fuel use and regulations which others may even sign up to but simple ignore them. It's not a level playing field.

We could go on however this is a great job for DT to get stuck into

And fishing vessels that catch more fibre optic cables than fish

And fishing vessels that catch more fibre optic cables than fish