-

Hi Ducati,

By definition they are closer but precisely when that will be is unclear. What we do know:

- Their review has been in-progress, 7 weeks now.

- Management have previously said they do not expect to find anything material.

- The law requires them to disclose anything material when it is identified. It is speculation however one would assume, after 7 weeks they would be aware of anything material.

The question today is, what are the risks vs rewards.

The stock has already produced stellar returns (realised). We have actively managed the position, both in terms of realising profit and managing the carrying weight in light of the 10-k.

Here is a business in the front row position of a secular shift in related technology. They are the Nr1 supplier in DLC, a product made for Blackwell architecture. When we say risk/reward, the stock is depressed and their valuation very very low. The downside is they grow 100% in the next 12 months and if they don't expand margin, earn $2.5B, sitting at a multiple of 10. The upside is they grow a lot more and put these filing/perceived control issues behind them.

We feel given the realised position and our current holding, the risk/reward assessment puts us firmly in the wait and see category.

Regards

Adam

-

I should add they have a final red line to file being 27 Nov. Their quarterly earnings could be announced from Monday next week.

-

Thank you Adam ….really appreciate your info on these companies

-

Their value will be driven by gross margin and operating leverage. Revenue growth in the medium term is a given. Just under 15B to June 24. Wallstreet expected $24B to June 25 but we think it will be at least 35B. Access to Blackwell will determine that however it's only a matter of time before they start really firing. Will they generate $50B in a fiscal year, soon. We think so. Will margins return to 14-17% range. We think they can so the first sign of this will be this quarters earnings-management said they'd improve-in my mind this is key in the process to rebuilding the foundations.

-

Hi Adam, I notice there's a loss/recovery case growing against SMCI. I would expect if material this may also be having an impact on recent valuations? - see below.

Super Micro Computer, Inc. Investors: Please contact the Portnoy Law Firm to recover your losses. October 29, 2024 Deadline to file Lead Plaintiff Motion

LOS ANGELES, Oct. 23, 2024 (GLOBE NEWSWIRE) -- The Portnoy Law Firm advises Super Micro Computer, Inc. ("Super Micro" or the "Company") (NASDAQ: SMCI) investors of a class action representing investors that bought securities between February 2, 2021 and August 28, 2024, inclusive (the "Class Period"). Super Micro investors have until October 29, 2024 to file a lead plaintiff motion. -

Ambulance chasing lawyers-it's nothing new. They will have a very hard time proving their case.

-

The only thing holding the stock price down is the 10-k filing. I would expect them to file by mid November. It is worth noting that they can not file their Q1 10-Q until they file their 10-k.

-

The only thing holding the stock price down is the 10-k filing. I would expect them to file by mid November. It is worth noting that they can not file their Q1 10-Q until they file their 10-k.

-

See other thread content

dingg

wrote about 2 hours ago

last edited by dingg

#1

Auditor has resigned.Looking like the rumours were true, damn

A Online

Adam Kay

GLOBAL MODERATOR

wrote 22 minutes ago

last edited by Adam Kay

#2

The auditor, EY has resigned. But this appears to me to be more about a stand off between them and the Board. EY have found nothing after a very long review. As was discussed some time ago I pondered, will they try and re-audit ‘years’ of accounts. The 10-k needs filing. They can’t file if EY want to keep looking back.If you read the 8-k it is clear, nothing has been found which would require the AR to be restated.

In any event I can confirm that the IC materially reduced our Smci holding (many weeks ago)to where is is no longer a significant holding. We did this to protect from such an event.

A Online

Adam Kay

GLOBAL MODERATOR

wrote 18 minutes ago

last edited by

#3

Any further posts please refer to original Smci threadA

Adam Kay

moved this topic from General Chat

about a minute ago

A Online -

Smci announced Q1 ‘business update’ date, Nov 5th.

FYI, they can’t report q1 formal results until the 10-k is filed for y/end hence the terminology. I can imagine that caused some friction with EY. -

I can't comment on that, G.

We hold the stock as you know.

We hold a lot less than we did

The business continues to grow very rapidly. Something like 100% per annum and whilst that is unsustainable it is reasonable to assume 50% CAGR for 5 years.

Accusations have been made regarding aggressive sales tactics and disclosures. The company denies this.

A deep review has been ongoing for 6 weeks now. Both by EY and a 3rd party forensics firm Cooley LLP who are globally, top tier.

As of today, nothing has been found which would require any financial statements to be re-stated'. The company assert this and EY do not dispute this. So why won't EY sign the accounts...... there are several reasons why they won't. One being, they want to keep going back further yet the company wants to move forward, i.e an impasse.There is no getting away from the fact that over the past few months it has become clear that the CEO calls the shots and corporate governance regs put in place a Board and various independent committees to guard against any undue influence. It doesn't have to be toxic just the impression of influence is enough to cause issues with regulators. After all the company is in public hands.

We took the decision to materially limit our exposure to the company, having already realised a significant profit. We make this decision because we have to err on the side of being conservatism.

It is unpleasant seeing the price drop on what is speculation, which is what markets do so no surprises there. However we do not believe that this represents a permanent impairment to the business.

-

And some perspective. In total PHT is down 1.5% today. As of last nights close it was +6.5% MTD Oct and +42.5% YTD.

-

I'll be providing a detailed update on this holding later today after I write it up. The company held it's Q1 'Business Update' last night which went on until past 11pm. The net take away is positive-with the CEO hinting that he may resign, which is great news imo.

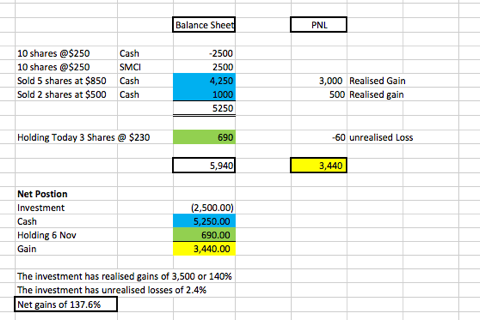

As a starter, I wanted to set out our investment position and illustrate with real numbers just how good an investment SMCI was. Today we are up 137.6%. In fact if you valued our holding at zero the gain would be 110%. To be clear, if the stock got wiped out, we would still be up 110% in cash. By any measure it was a great investment, in less than 11 months.

More to come on last nights update

-

What are the issues facing SMCI and in particular, why are they having problems with their 10-k and EY resigning. We believe this is a governance and independence issue. Not a false reporting issue.

The CEO, Charles Liang has other family business interests, namely Ablecom and Compuware which manufacture power supply and server chassis products. SMCI(SM) have large commercial purchase agreements with these entities. In accounting terms these are called Related Party Transactions.

An audit in the US has a primary objective; to determine whether the financial statements are presented fairly in conformity with GAAP (generally accepted accounting principles), in ‘all material respects. This is equivalent to the UK IFRS standard ‘true and fair view’.

Related party transactions are a significant area where the concept of a "true and fair view" — or fair presentation in U.S. terms — is critically relevant. These transactions can easily misrepresent an entity’s financial position if not disclosed and accounted for accurately. In U.S. audits, the treatment of related party transactions is designed to ensure transparency and fairness, aiming to prevent misleading financial statements. Imagine if a non arms length supplier charged a price which was not a market price or received special treatment. The company could manipulate margin! It is important to note, both the company and the auditor assert that this is not the case. We think this about the optics of the relationship and coupled with loose controls making EY’s position untenable.

Here’s how related party transactions are approached within the U.S. framework to ensure a "fair presentation in all material respects:

Auditors must evaluate whether these transactions might impact the "fair presentation" of the financial statements, as undisclosed or misrepresented related party transactions could mislead users and compromise the financial statements’ credibility.

Materiality and Professional Scepticism

- Materiality is crucial in assessing related party transactions, as even a small, undisclosed transaction can significantly mislead financial statement users, especially if it conceals potential conflicts of interest or transactions that don’t reflect market conditions.

- Auditors are expected to apply professional scepticism and investigate whether these transactions are genuine and necessary for the business or simply to distort financial performance or position.

Audit Procedures Specific to Related Party Transactions

- Auditors perform specific procedures for related party transactions, such as reviewing board minutes, identifying key management and their relationships, and checking for any significant unusual transactions that could indicate misrepresentation.

- In cases where the transactions are not disclosed or appear non-standard, auditors must obtain sufficient evidence to ensure these are accurately accounted for, either by modifying their audit opinion or requiring further disclosure.

These steps ensure that financial statements reflect "fair presentation," giving users a reliable view of the entity’s financial health.

Mitigation

The above poses significant challenges for an auditor however these can be mitigated if the Board and Audit Committee are clearly independent from both the contract negotiations and payment thereof, including things like competitive tenders. In other words, the Board acts freely, without interference/input or its appearance from the related party. In this case Charles Liang. And it is our opinion that the auditors can not discharge their obligations in this matter. It is our opinion that Liang's influence is pervasive.

What Next?

I think Liang will resign along with the CFO and the Board will be restructured. I think this will be a condition of any new Audit engagement. And whilst regaining compliance is critical, I believe they will do so. The company is highly profitable and growing rapidly. It is critical in the accelerated compute sector and it offers unique solutions which can not be replicated elsewhere within any reasonable time frame (years). The reason for this is simple. SM possess DLC rack scale capacity, built up over the last 3 years. This capacity is absent elsewhere. Further, their specific custom solution is quite unique and they have demonstrated that large US customers demand locally built solutions. Eg Xai Colossus cluster being built in just 122 days.

Q1 Business Update.

- Circa $6B revenue. A record.

- Circa 75c/share based on 640M shares or $480M net income. A record.

- Cash on hand exceeds bank and convertible debt by 600M.

- $5B inventory on hand.

All very positive

Guidance for next quarter is flat. It would have been nice to see some growth however put in context, with the overhang of the non compliance and severe scrutiny, management themselves stated that they are being ultra conservative. We believe this to be the case. Now is not the time to make bold promises-they need to change. They need to start delivering and on that it was very positive to see gross margin increase significantly, from 11.3 to 13.3%. A key metric which derives earnings growth.

Valuation

The company is now valued at $12B. Even assuming zero growth they are on a $2B earnings run rate which corresponds with a PE of 6. It’s this low for a reason but still detached from the business fundamentals. If Liang was ‘cooking the books’ it’s reasonable to assume he would have offloaded a lot of stock when the price was high. He owns 15% of the company. $8B paper net worth would be mighty tempting? He didn’t.

Blackwell is a DLC story and even if the company units shipped was flat, the selling prices being 60% higher would drive further growth.

Rumours of Nvidia reducing GPU supply are just that and in our opinion, false. Jensen Huang is a life long close ally of Liang and as said, SMCI are a critical partner. Liang stated unequivocally that to this day they remain on excellent terms with Nvidia and whilst matters are no doubt strained, we believe good business will prevail.

)

)