Thoughts on short term market direction

-

Trumps taken a wrecking ball to the US economy, people trust him even less than they did before, so I think it will be some time before things recover, no matter how good the companies are trust in america has been eroded.

What's the point of doing a deal with him, when he'll change his mind the next day, next month or next year.

Markets need stability, not constantly changing direction with an unpredictable president.

-

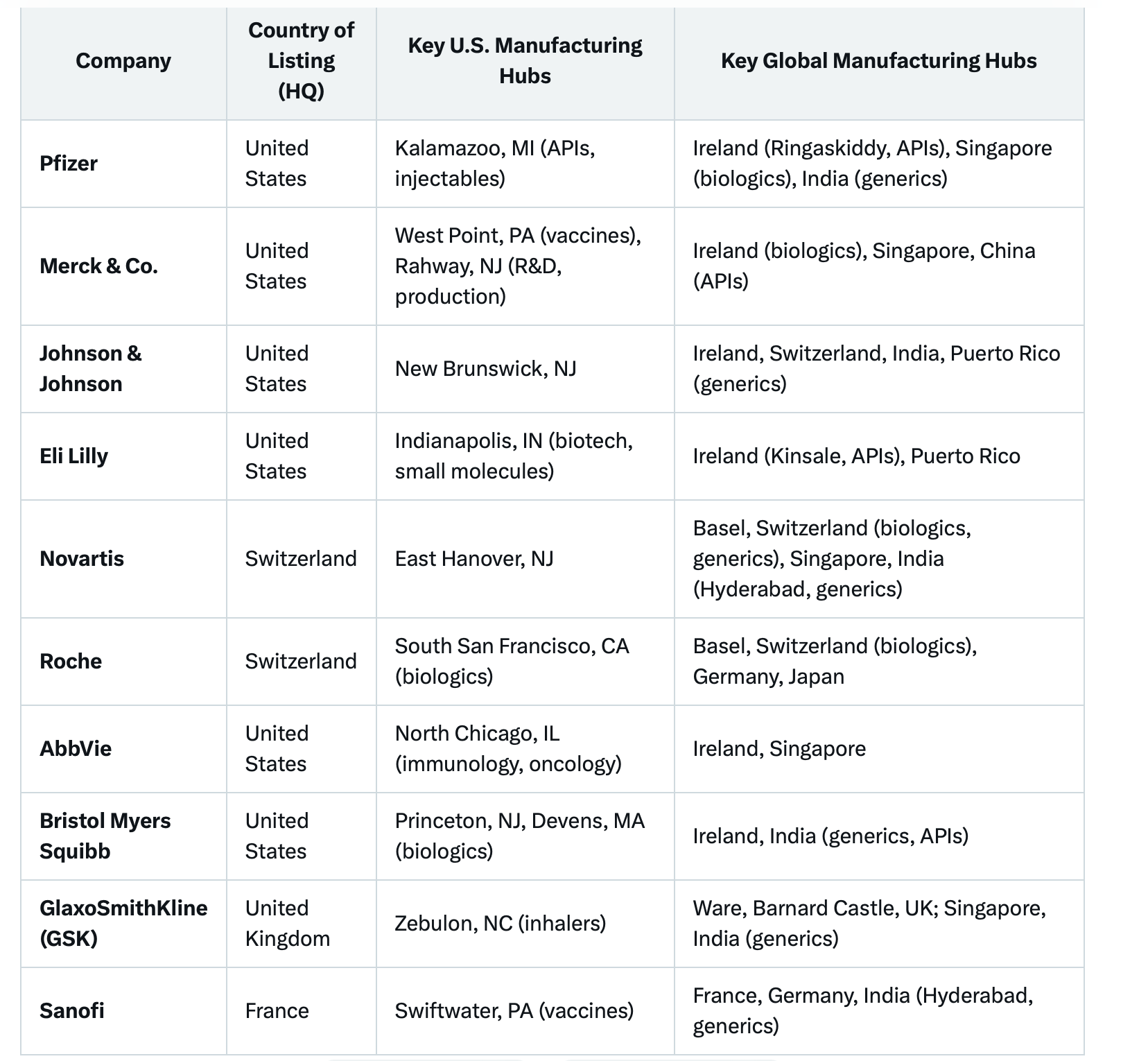

Our main Pharma holding is Vertex. They have majority manufacturing presence in Boston, Massachusetts, where they use a cutting-edge continuous manufacturing facility for cystic fibrosis drugs like Trikafta. Their golden goose.

Other companies:

-

Personal highlight but this morning it seems my Cobens stuff just climbed enough to surpass the previous ATH back on 20th Feb before the Nvidea wobble and SMCI fright and Trump doing his Trumpy Tariff things. I’ll still keep my head under the pillow for a while tho… just incase.. but that was nice to see.

-

Great to hear Jim,

The King is at 171.50 in PM. Big day brewing

-

@Adam-Kay said in Thoughts on short term market direction:

The King is at 171.50 in PM. Big day brewing

i have no idea what this means....

-

Think it's that the Nvidia share price was at 171.50 in pre-market.

-

Thanks Steve- Yes, PM means in pre-market trading. You have pre and post market trading for those that can't get enough. These are official, regulated markets albeit not on the respective official exchange. They are run by large broker dealers on the ATS-alternative trading system.

Main facilitators being:

Interactive Brokers

Charles Schwab

Fidelity Investments

E*TRADE (Morgan Stanley)

Webull

RobinhoodNB: Not to be confused with T212 or any other platform offering 24hr trading which is completely closed market where they offer you whatever price they think you will pay/sell at. In my opinion, to be avoided as the naive will not strike a good bargain!

-

Adam, do you ever feel that the drive for AI could potentially lead to a market crash?

It often feels like huge announcements are made (see yesterday at Windsor as an example) about the tens of billions of $/£ investments being made, but are there the products being made/sold/delivered to match that?Not wanting to be a doom-monger (I remain very much invested!), but it does kind of concern me a little….

-

Hi Mike,

These 'headline grabbing' numbers are spending over many years. For example the Open AI/ORCL deal, $300B over 5 years. The Stargate deal, the UAE deal. Once these projects get started, some allocate quickly and some stall. In many cases the physical infrastructure needs to be build. This could be the power source, the data centre itself or the compute hardware. I would think anyone announcing a new project today, would be waiting a long time for silicon. Case in point: Xai +800K GPU expansion of Colossus, which is being installed now. The chips were ordered a year ago and paid for at least 9 months ago.

We must be at a $trillion YTD in planned projects, but as we have discussed, companies like Nvidia, AMD, TSM can only supply so much compute, today(CoWoS-L/packaging constraint), why, because the tools of production take > 12 months to build. It's a fallacy- give me 1m chips more and TSM can magic them up. And TSM isn't going to 10X their production because who will pay for it. There is a demand supply imbalance of anywhere from 5-10X:1. CC Wei has said he is on a 50% CAGR trajectory. Very strong but planned growth trajectory over 5 years to 2030. What I am saying here is regardless of the 'spend' on AI Nvidia is locked in to a 50-60% growth rate pretty much over the next 5 years because they are inextricably linked to TSM capacity. I can live with that. Personally, that is what I think it will be-in that range.

In terms of valuation. If you look at the market you see hype for sure, some warranted, some not(imo). AI mania has caused almost everything in the space to appreciate materially. The Tesla effect if you will. Remember every kind of crypto imaginable, NFTs. Nothing but Tulips! Greed makes otherwise sane people do very silly things

I have no idea what the stock price of palantir will be next year but I can look at its valuation today, its past growth, and take a view. It's interesting, their 5 year avg growth rate is 31%. It's good but many companies can match that. Nvidia's number is 65%. So in my mind, here is a company with half the growth rate(historical) and if anyone says that 31% is going to accelerate, id say show me the evidence(there isn't any). Faith. Sorry I need more than that. So Palantir has a PEG of 8 vs Nvida < 1. Palantir also gives almost all its earnings to the directors of the company. As we have all seen, at least for a while anyway, stock prices can diverge from all reality-that is until reality bites. I personally think this stock is grossly overvalued-good luck to anyone holding it. They will need a bull market, perfect execution and to smash estimates every quarter like clock work.

Even if growth does accelerate-I see some 'experts' are saying their growth rate is actually 65%-double. OK so it's now only 4X more expensive than Nvidia. Why would I buy Palantir for $1 when I can buy Nvidia for 25c?.There is no margin of safety-none whatsoever. I would be buying 2030 earnings, which actually means the stock will flatline for the next 4-5 years as the business grows into its extreme valuation. I could be wrong, but as said the metrics are so off the charts it's just not worth taking the chance. And by that I mean what is the future upside. It might add another 50% but that would take its multiple to 400 and as we have seen there are alternatives with far better 'numbers'-this is what I mean about risk vs reward. It's literally gambling and we aren't in that business. I would bet if you asked the avg shareholder why they hold it, they would say 'to the moon' but could not articulate anything rational about their decision and the actual business fundamentals. In other words the-greater-fool-theory in play.

So to answer your question. No I am not worried about a crash. We don't hold anything with a materially stretched valuation. Multiples in the 70-200 range. Some of our holdings are probably fully priced. Oracle might be short term. It's not easy to value because of their $300B DC deal with OpenAI. Lots of moving parts and contingent elements. But that is the basis of the stock market(auction based). We are not traders so if I have an opinion a stock is over/under on any particular day, we would not act on that. However we did act on Colgate when for no good reason(a flight to safety?) the stock moved up materially to an ATH. Range bound for 5 years 70-80 then pops to $105 in a very short period. The investment committee took a big chunk of weight out of that one and it was absolutely the right thing to do. The stock fell back and is now back in its multi year range @ $81.

In conclusion, one shouldn't take a view 'when is the next crash'. Why would the broader market crash as opposed to be choppy- the US economy is ok. I wouldn't say great but it's doing well enough. But more specifically look at big techs earnings. It's at a record and healthy and they have had many quarters of growth with continued higher guides. GOOG still trades below a 22-23 multiple and its growth is still very strong, for example.

There are pockets of extreme valuation for sure-best leave that to Cathy Wood

-

An interesting short video on AI & the risks of “circular transactions”.

https://youtube.com/shorts/NFao97yTNPc

Sorkin is an American journo who is a financial columnist for the NYT.I should probably stop watching things so closely….the Santa Rally does appear to have started very early this year 🫣

-

That's a nicely tailored jacket he's wearing.

His initial thoughts about it being a bubble but also something that's rapidly becoming something foundational are my view as well. And if you're in the game for the long term then this is unlikely to be a problem; there'll be bumps in the road but time will make them less significant.

One thing that's occurred to me is that things seem to be going VERY fast. Remember the thumping that Nvidia took when that Chinese company claimed they could do similar AI at 20% of the cost, but it turned out they had used someone else's LLM? That seems eons ago, but was only earlier on this year.

-

Yup…a very nice jacket

Things ARE going fast….one of the things we used to speak about (5 years ago, when I was paid employment!) was that if people thought things had changed quickly in the previous 5+ years, hold on to your hat - everything tech is massively accelerating.

Part of the reason I don’t envisage another “hard crash” ahead, but a series of bumps and dips and new all time highs sliding in too….but he does make a good point about circular money….Microsoft pouring a bit more into OpenAI mentioned on another thread. Funny money, as my old mum would have called it

-

Recent speed is simply a function of the market being asleep at the wheel for some time in regards to big names like GOOG and NVDA. The stock market can often serve up opportunities. When there is fear the unlikely becomes likely. It's been that way 'forever'. The price is rarely a true reflection of real worth on any one day or week

Not only had they distilled OpenAIs work they also used 10k of the most powerful GPUs(claiming they did it with a ZX81 and few solar panels). The irony being even if what they claimed was true it just made AI more accessible.

At the end of the day Nvidia is the greatest company in existence with an iron grip on many industries and sectors.Not only do they dominate they create new industries. In my opinion they are still just getting warmed up. The naysayers can shout at the clouds all they want ;).

Volatility will remain a constant.

-

Morning O,

Days like yesterday are much more common. Kicked off by a lacklustre Palantir earnings. They were good in isolation but not anything spectacular and when you are priced into the stratosphere you need a lot more. 115X revenue! That's all I can say.

Coupled with Big Shorts Michael Burry stating he has loaded up on Puts (a way of shorting) Nvidia and Palantir. Good luck with that, he's shorted Nvidia before and got bruised.

So in summary what has happened? Not a lot really. And with Nvidia earnings on the 19th(?) I doubt it will stray too much in the interim.

-

it's a slight delay as rebalancing in progress.

-

Volatility indeed. It's looking sticky out there today; is this the start of the much-talked-about 'correction'?

@2BToo I've just moved my PHT profits into a safer (I hope) place, and done the same with NVDA and TSLA shares. I'm willing to lose the capital, as that's always the deal with betting on shares, but I don't see the point of losing the profit as well.

If the good times keep on rolling, I've just lost out on compounding. If it's bad times a-coming, I won't lose as much before the growth starts again.

-

I can see the logic in that. However the compounding is where the big gains are made ('eighth wonder of the world', according Bertie Einstein.) There are occasional VERY good days which produce big gains on some shares, and missing out on those days would dent performance quite significantly.

Some time ago I concluded that I would stay invested through the bad times, mainly because I am almost certainly not clever enough to do anything else that would produce better results.

-

We all have different ideas, driven by a number of factors:

Years to retirement

short term vs long term cash needs

volatility appetite

Total invested assets

The usual psychological effectsSir Alex isn't saying 'do this'. His decision is based on a number of factors which in all likelihood don't apply to 'you'.

Put it this way, when a portfolio gains 8% in a month and the following month adds another 12% , exceeding prior highs by some margin, odds are it will have a pullback. In isolation that is no reason to sell it. See the factors above. If one is trying to simply time the market and nothing else, that imo should be a habit to lose because human nature being what it is -being on the right side of that decision once will only persuade you to do it again and you will get caught out, imo :).

Also discussed before, never take a 'what would you do' poll. The person you are asking has no idea due to the above and the market moves irrationally most days, as shown from the Micron example earlier.