Earnings 29th October for previous Quarter

-

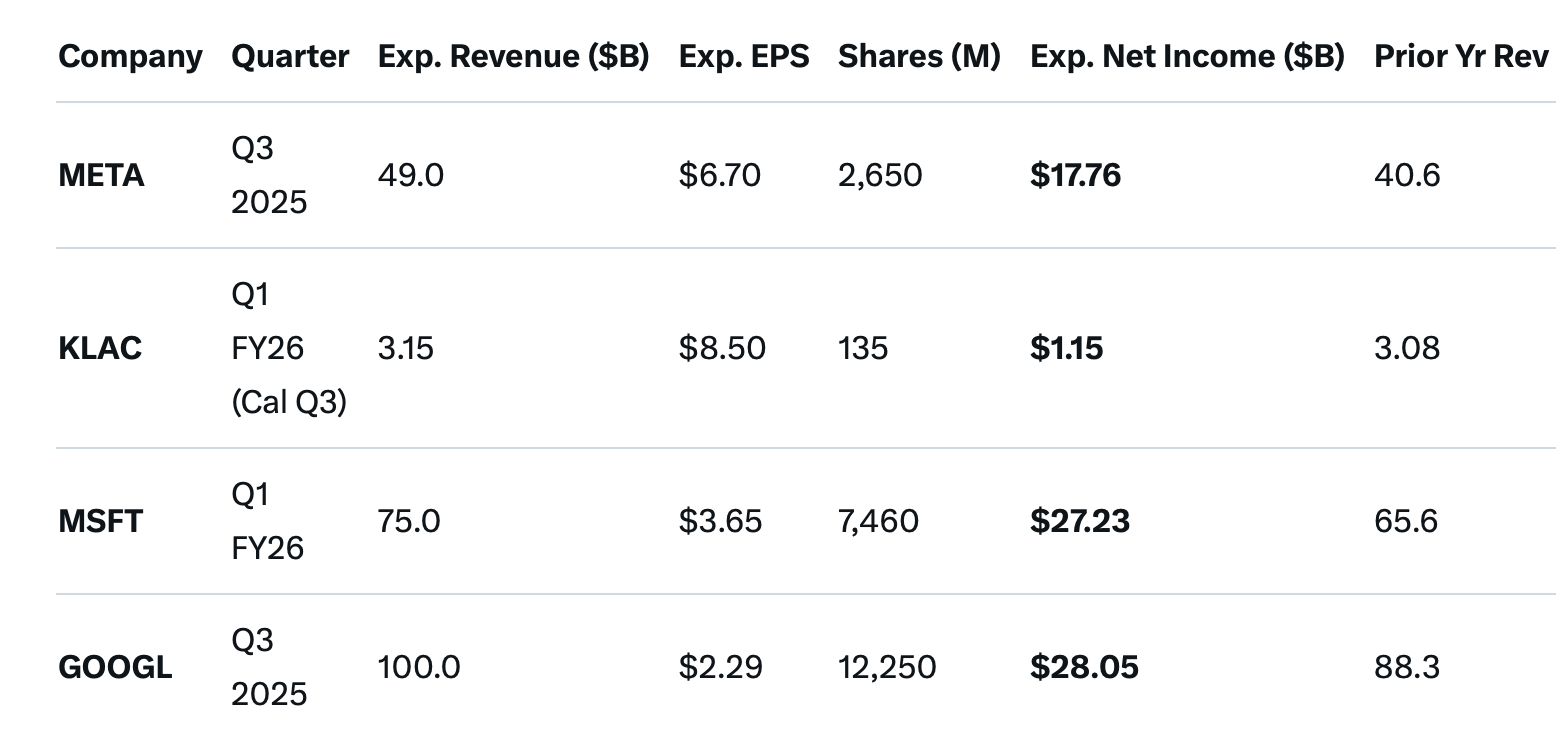

First off the rank are the following

GOOG, $100 billion in revenue in 13 weeks. A reminder that this organisation is a lot more than search! Today, backed on the previous year it is the most profitable company in the world, yet is value at circa 20% less than Microsoft and Apple.

I would expect all 4 names to beat and raise-as to market reaction, no body knows, however the businesses are very healthy with solid growth justifying their valuations. No loss making or 200x multiples here!

-

everyone smashed it and guided higher-more details tomorrow.

-

Microsoft had another big outage with Front Door (their gateway into basically everything that is also used by customers to host their own platforms), so any services relying on that went down for a few hours last night. Under 3 weeks since it last happened, so that might go some way towards their price change.

-

And yet, after hours:

META is down 7.78%

KLAC is down 1.56%

MSFT is down 3.82%GOOG is the only one up after hours, and then by 6.42%

One day I'll understand stock markets. That day isn't today.

@2BToo If you Google "why do stocks fall on good news" you will get some idea.

From what I can make out...

It's not how the company is performing, it is how the company is performing against expectations.

Expect 5%, achieve 7.5%, stock value goes up.

Expect 15%, achieve 10%, stock value goes down.

-

It's a bit more nuanced than that, G. And glad you did something nice with your gains, that's what it's all about, benefiting through investment.

People will always take profit into new highs, we've discussed the psychology

What are 'expectations'? You could say even higher than what was delivered so is it the first point or the second?

For example MSFT X, I posted those numbers(official market expectations) and they comfortably beat, all the reporting entities did. However different reactions. You might also have noticed after hours RED/GREEN/RED(same company) and then at the open big Green. Derivatives in play again.

You will often hear the cliche 'it's priced in'. I'm not a fan of the catchphrase. It's largely nonsense. The PH resident IFA will say 'you don't have an edge against the pro' just word-salad. You don't need an edge, just don't chase meme stocks, chase quality and have some patience.That is why we simply stay the course. A drop yesterday and looks like(given 300+ futures) gains today.