Nvidia News

-

China tells technology companies to stop buying all nvda ai chipsets

Hmm hopefully a buying opportunity and not a change of trend direction in the stock

Eta -

Looking likely that the buying opportunity was short lived. Algos bought the dipOnwards and upwards Rodney

-

China’s directive is an escalation but not an outright ban on NVIDIA chips. It’s a strategic move in the U.S.-China tech rivalry, with limited immediate impact on NVIDIA’s valuation due to its reduced reliance on China. The “ploy” theory is plausible but secondary to China’s broader goal of domestic chip dominance.

It will be resolved in time and im sure even more powerful chips will continue to be sold into China, legally and otherwise. China will fall further behind without Team Green. Fact.

The valuation of Nvidia has zero China component baked in.

-

Breaking-Nvidia invest $5B into intel and sign deal to co develop chips. Intel up 30%. NVDA up $5 :). the details are coming in.

-

here is the news article:

Interesting-I guess TSM are so constrained this makes perfect sense. It also rescued intel from almost certain misery. It also broadens Nvidia reach, into the PC market-more growth vectors and will have AMD worried for sure

And I just had a look at AMD and yes, the market is not liking it at all. Down 5%

And I just had a look at AMD and yes, the market is not liking it at all. Down 5%Nvidia (NASDAQ:NVDA) and Intel (NASDAQ:INTC) announced a major deal on Thursday to co-develop PC and data centre chips. Concurrently, Nvidia revealed it would take a $5B stake in Intel.Nvidia shares increased 2.2% in pre-market trading, while Intel’s jumped 32%. If Intel shares open at that level, it would be their highest in over a year.The partnership will utilise Nvidia’s NVLink, merging Nvidia’s artificial intelligence and accelerated computing expertise with Intel’s x86 architecture. Intel will produce Nvidia-custom x86 CPUs for data centres and supply x86 system-on-chips integrated into Nvidia’s RTX GPUs for the PC market.Additionally, Nvidia will invest $5B in Intel’s common stock at $23.28 per share, subject to standard closing conditions and regulatory approvals, the companies stated.

-

Nvidia continues to make moves.

NVDA has invested over $900M in a strategic deal with Enfabrica, a US-based AI hardware startup, securing key staff, including CEO Rochan Sankar, and licensing its cutting-edge networking technology. The transaction, finalised last week, involves cash and stock payments but is not a full acquisition.

Enfabrica’s Accelerated Compute Fabric (ACF) technology connects over 100,000 GPUs, enabling large-scale AI clusters to operate as a single system, reducing GPU idle time by up to 50% and slashing costs.

Nvidia aims to integrate this into its AI infrastructure, enhancing data centre efficiency for training large language models and supporting “AI factories” with partners like Microsoft. This strengthens Nvidia’s dominance in AI networking, giving it a competitive edge by optimising GPU-centric workloads. The deal, echoing Nvidia’s $7B Mellanox acquisition, avoids regulatory hurdles while bolstering its full-stack AI solutions for hyperscalers and enterprises.

-

More on the Intel deal.

Nvidia and Intel have unveiled a partnership to develop custom x86 CPUs for Nvidia’s AI infrastructure platforms, integrating Intel into Nvidia’s ecosystem.

This collaboration merges Nvidia’s AI and accelerated computing expertise with Intel’s CPUs, targeting a USD 50 billion opportunity in data centres and PCs. Nvidia’s GPU chiplets will enhance Intel’s offerings, bringing AI computing closer to users.

While Nvidia dominates AI-accelerated computing and GPUs, custom chip trends and competition are reshaping the semiconductor landscape. Supply chains are evolving dynamically, and the market is expanding and adapting!

This partnership is noteworthy in the context of advancing computing power and AI’s economic impact. Nvidia’s Jensen Huang emphasised, “Together, our companies will build custom Intel x86 CPUs for Nvidia’s AI infrastructure platforms, bringing x86 into Nvidia’s NVLink ecosystem.” Currently it is solely, Arm based.

Both CEOs expressed optimism, focusing on innovation rather than politics or competitors, describing the collaboration as “historic.”The Verge reported that Nvidia and Intel will connect their architectures via Nvidia’s NVLink system, used in data centres to link GPUs. Huang noted, “Intel will build Nvidia-custom x86 CPUs for integration into our AI platforms, offering greater optionality for advancing AI workloads.” And clearly advance NVLink making it even more pervasive! It also heads off any potential expansion of the Asics market (Broadcom). Great move by Huang and Co

This fusion targets the USD 30 billion CPU data centre market, aiming to create rack-scale AI supercomputers.The partnership also extends to the PC market, leveraging the annual 150 million notebook market. Huang highlighted the innovative use of TSMC’s foundry for Nvidia’s GPU chiplets, combined with Intel’s CPUs through multi-technology packaging. This “mix and match” approach enables rapid innovation and complex system development

-

more news on allowing tier 1 silicon into China.......I think it's coming

David Sacks, White House AI & Crypto Czar, urged the U.S. to reassess its export control policies in light of China’s advancements in AI technology. In a post on X, Sacks highlighted Huawei’s launch of a new AI chip to compete with Nvidia and China’s directive to its companies to avoid purchasing certain Nvidia AI chips. He argued that China’s ability to produce its own chips shows it is not dependent on U.S. technology and aims to compete globally. Sacks warned that restrictive export controls could push countries towards China, risking America’s lead in the AI race. He noted Huawei’s strategy of clustering chips to compensate for weaker performance and criticised bureaucratic delays that benefit Huawei. Sacks advocated for allowing U.S. companies to sell technology abroad with security measures, particularly to allies, to maintain a competitive edge and prevent China from dominating the AI and semiconductor markets.

-

Breaking news

Nvidia just unleashed a massive $100 billion deal with OpenAI, announced 10 mins ago.

It’s not just a cash dump—think of it as a mega partnership where Nvidia’s pumping in up to $100 billion over time to power OpenAI’s huge AI setup, loaded with at least 10 gigawatts of Nvidia’s silicon.

Basically, OpenAI’s taking that money and pouring it right back into Nvidia’s GPUs, solidifying Nvidia’s grip on the AI compute game.Nvidia’s boss, Jensen Huang, called it “the next big leap,” hyping their decade-long collaboration vibe from the DGX days to ChatGPT blowing up. OpenAI’s Sam Altman is buzzing, saying, “It all starts with compute,” picturing this as the backbone for an AI-driven economy.

They’re talking proper game-changers—AI factories for next-gen models like GPT’s successors.

It’s a proper power move against AMD and big players like Google with their custom chips, while giving OpenAI a head start over Anthropic or xAI. Intel’s $5 billion deal looks like small fry next to this.

Batter up!

-

Details will emerge but yes Nvidia are buying a big piece of OpenAi

To build 10GW will require 7M Blackwell ultra equiv chips and cost $300 billion so one can only assume that the $100B is capital which will then be leveraged with debt. 7M chips is more than all life to date GPUs sold. it's 100k racks. Crazy

-

Nvidia's investment in OpenAI could be worth as much as $500B in revenue, BofA says, revising PT to $215. They read my post.

-

All time high on Nvidia today $187 as several analysts up their target to between $240-$250. Late to the realisation, again.

-

WiWynn, a major AI server original design manufacturer (ODM) partnered with NVIDIA, say they are grappling with an extraordinary surge in demand, with order visibility now stretching through 2027.

Despite operating facilities in Taiwan and a new U.S. plant set to nearly double production capacity by the end of this year, the company is still struggling to keep up. WiWynn is actively scouting new factory locations, with power supply capacity being a pivotal consideration. Key clients, including NVIDIA, OpenAI, Oracle, Google, and Meta, are aggressively scaling up investments in AI infrastructure, signalling that the AI arms race is intensifying. This robust demand underscores a vibrant and rapidly expanding AI server market.

So, they invest heavily a year ago to 2X output and now this is no where enough. Visibility through 2027 is impressive. BTW analysts currently have 2027 as flat for NVDA-sure it is

We said if before, POWER is the new constraint. Not just in the DC but also the factory that makes the servers-why, because these systems must be tested so hooking up a 'system' of X racks needs substantial juice

-

Wowsa

BREAKING: Nvidia, $NVDA, now represents 5.04% of the MSCI All Country World Index.

The MSCI ACWI Index captures ~85% of global equity markets, including large and mid-cap stocks.

Nvidia's weight now significantly surpasses Japan's 4.78% share, the world’s 3rd-largest stock market.

By comparison, China, the UK, and Canada account for 3.33%, 3.23%, and 2.92%, respectively.

Nvidia’s contribution to the index is now larger than France and Germany combined.https://x.com/KobeissiLetter/status/1975391629906485511#

A bit frothy, perhaps?

-

Someone on X making a statement (27k tweets(busy busy)) and calling it 'breaking news'. as though they are Reuters or similar.Someone who bashes 'equity' 24/7 but likes Gold. It's a very insightful observation ;). It's just envy they missed out. Remember, we paid $25.

It's about as useful as Pistonheads Mr Whippy 'Nvidia? They make gaming GPU, right' and another gem ' Nvidia at $40-LOL this will end well'. He was right-it did.

If Nvidia is the most profitable company in the world(fact) then why should it not also have the highest valuation? A valuation that is relatively, lower than KO, Starbucks, Unilever, CL and 1/10th the value of Palantir?

In other breaking news Nvidia now exceeds the combined GDP of all the world’s coffee shops.

-

United States Approves Billions in Nvidia AI Chip Exports to UAE

The United States has authorised billions of dollars’ worth of Nvidia AI chip exports to the United Arab Emirates (UAE), marking a major milestone in the implementation of a high-profile bilateral artificial intelligence agreement, according to a Bloomberg report.

In return, the UAE has pledged to match chip imports with an equivalent level of investment in the United States, as part of a broader plan to invest $1.4 trillion over the next decade. The Commerce Department’s Bureau of Industry and Security recently issued the export licences under a deal reached in May, which could become a template for future U.S. AI diplomacy.

Although specific investment projects have yet to be disclosed, these are the first approved Nvidia AI chip exports to the Gulf nation since former President Donald Trump took office, signalling progress on a deal that has been controversial in Washington.

The agreement centres on a five-gigawatt data centre in Abu Dhabi, where OpenAI is a key partner. The broader arrangement allows for up to 500,000 advanced AI chips each year, with 20% earmarked for G42, an Abu Dhabi-based AI firm working closely with OpenAI. However, the initial batch of export licences excludes G42, and future approvals will depend on the pace and substance of Emirati investments in the U.S.

Some U.S. officials have expressed unease about building critical infrastructure abroad—particularly in a nation maintaining strong business ties with China. The UAE, which has made artificial intelligence a national priority, had been pushing for swift approval amid mounting frustration over regulatory delays.While the Biden administration had previously imposed strict controls on AI chip exports to countries like the UAE due to national security concerns, the Trump administration appears to be relaxing those restrictions. Officials say the goal is to counter China’s technological influence by ensuring that American companies dominate key AI infrastructure across the Middle East.

This development is a significant win for Nvidia. After months of export uncertainty and tightening U.S. chip restrictions, the approval opens a valuable market in the Gulf region, potentially worth billions in new sales.

The UAE’s commitment to match chip imports with U.S. investment also strengthens Nvidia’s strategic positioning within American foreign policy objectives—effectively tying commercial opportunity to diplomatic influence.

If the UAE follows through with its pledged investments and infrastructure rollout, capital should begin to flow relatively soon. The export licences have already been granted, meaning Nvidia can start fulfilling orders and recognising revenue once shipments commence.

In short, this is a big deal both politically and commercially. It signals a renewed U.S. willingness to project AI leadership through private-sector partnerships, while giving Nvidia a powerful foothold in one of the world’s fastest-growing technology regions. -

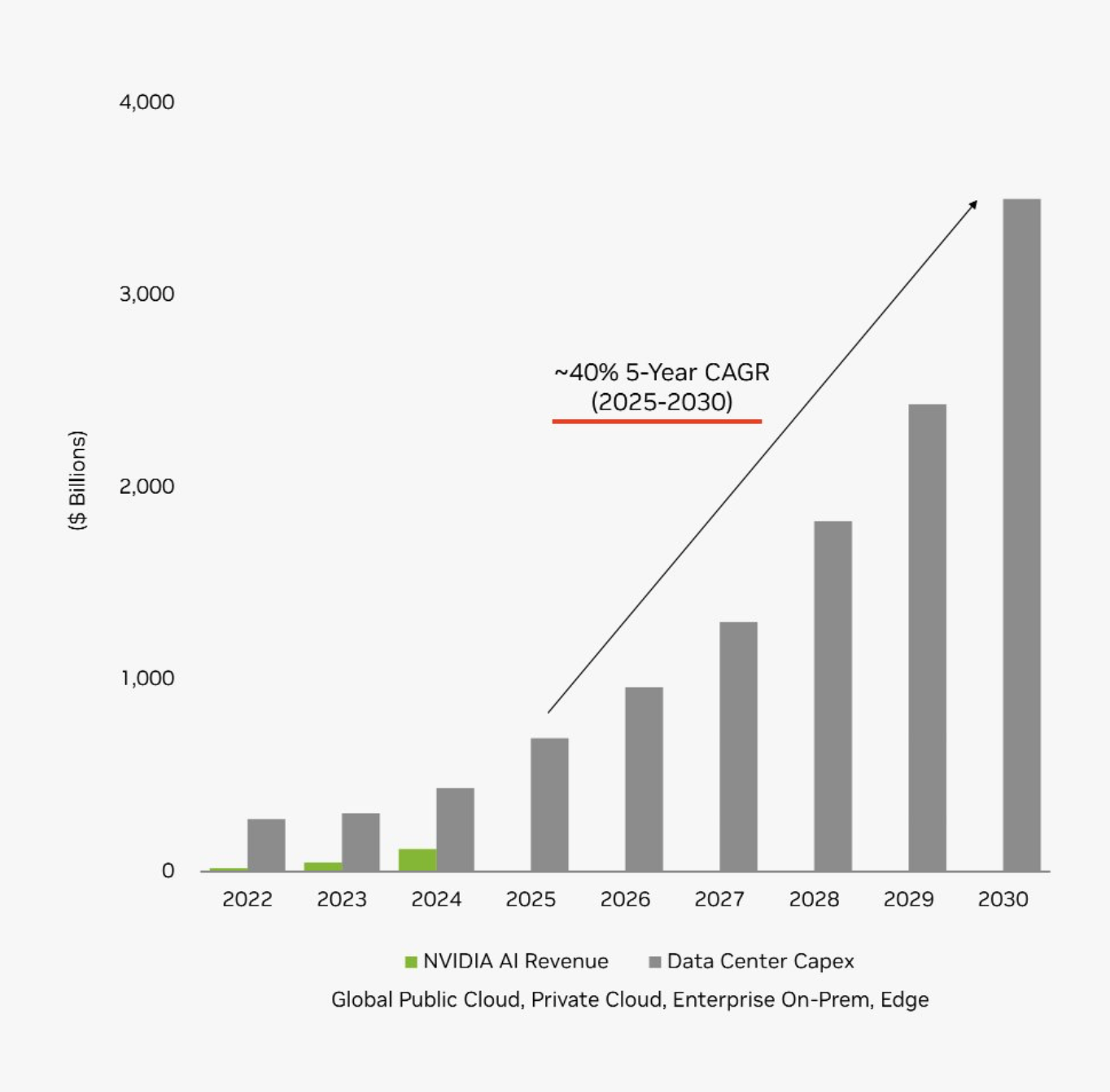

Internal(NVDA) slide on Capex....and driven by

A $50 Trillion industry. Interesting, given where we are now!