Meta News

-

Picked up the following-essentially, Llama foundational LLM progress is allowing these spin off projects. This is why companies invest in LLMs. A smarter machine can now train other machines!

Meta is investing heavily in humanoid robots and is forming a new team within the Reality Labs division to develop it, Bloomberg reported Friday, citing people familiar with the matter.

The new Reality Labs subdivision will be led by Marc Whitten, former CEO of GM's autonomous vehicle unit Cruise. Sources told Bloomberg that Whitten will be tasked with hiring around 100 engineers this year for the project.

Meta plans to work on the robot hardware, which will focus on household chores for now. Eventually, it hopes to make the underlying AI, sensors, and software for robots that will be made and sold by a range of companies, sources told Bloomberg.

The company is discussing plans with robotics companies, including Unitree Robotics and Figure AI Inc (an Nvidia investee) .Meta plans to compete with Tesla's Optimus robot.

“The core technologies we’ve already invested in and built across Reality Labs and AI are complementary to developing the advancements needed for robotics,” CTO Andrew Bosworth reportedly said.

“We believe that expanding our portfolio to invest in this field will only accrue value to Meta AI and our mixed and augmented reality programs,”

The software, sensors, and computing packages that are already being developed for the company's devices are the same technologies that are needed to power humanoids, and Meta will build some of its own hardware, use off-the-shelf components, and work with existing manufacturers as soon as it can, said the people with knowledge of the project. -

It's interesting that Meta is working with Figure AI, a company which Nvidia along with MSFT and Amazons's Bezos invested in last year. Again Nvidia is providing the chips to train the models and the robot-brain, Jetson Thor (JT), the most powerful platform for AI vision and autonomy every created. Pre trained with Isaac-sim(simulation) on a wide number of tasks, the machine is deployment ready-launching mid 2025. It can also support level 4 FSD in cars and trucks and has already been adopted by most car manufacturers.

Other companies developing robots are:

Boston Dynamics-parent Hyundai

Tesla Optimus bot

APL Robotics

PAL

BMW

Honda

Foxconn

MercedesJetson will be a significant new opportunity for the company in the years ahead.

The common denominator-Nvidia. It doesn't matter who makes the machines, they will win the dominant share of hardware and software solutions to make it work.

-

Meta has launched a standalone AI app for its Meta AI chatbot on 29 April 2025, to compete with OpenAI’s ChatGPT. The app, now available in the US and Canada, offers personalised responses by leveraging user data from Facebook and Instagram and includes a social "Discover" feed. Powered by Meta’s Llama 3.2 model, it supports natural conversations, image generation, and task assistance, aiming to reach over 1 billion users by year-end, as stated by CEO Mark Zuckerberg.

Meta is also exploring a paid subscription model for premium features, following competitors like OpenAI and Microsoft. With 700 million monthly active users already, India is its largest market. The move intensifies the AI chatbot race, with Meta positioning itself against ChatGPT, Google’s Gemini, and xAI’s Grok.

-

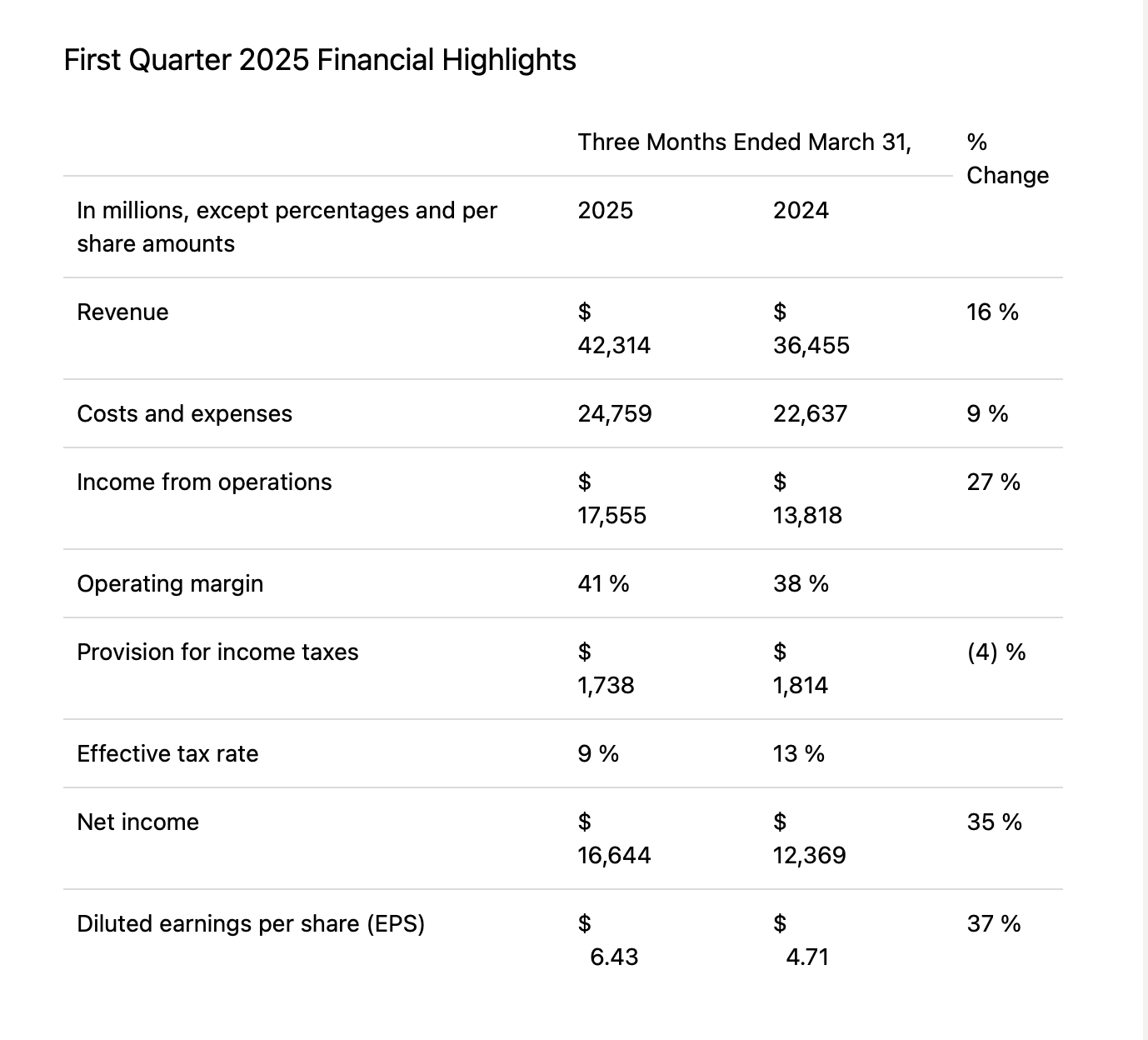

Meta Platforms GAAP EPS of $6.43 beats by $1.21, revenue of $42.31B beats by $950M

A big beat. Details tomorrow.

-

The Q2 guide is higher; $42.5-$45B

Meta expects its full-year capital expenditures at $64B-$72B, higher than previous expectations for $60B-$65B.

"This updated outlook reflects additional data centre investments to support our artificial intelligence efforts as well as an increase in the expected cost of infrastructure hardware.

Meta emphasised significant progress in AI, particularly with Meta AI and its Llama 4 model:

Meta AI Usage: Approaching 1 billion monthly active users, with 700 million reported earlier in the quarter.Llama 4: Powers the Meta AI assistant, launched as a standalone app on April 29, 2025, to compete with OpenAI’s ChatGPT and Google’s Gemini. It offers personalised responses and multimodal capabilities (text, images, video, audio).

AI Infrastructure Investment: Meta raised its 2025 capital expenditure forecast to $64-$72 billion, up from $60-$65 billion, to support AI-driven initiatives, including data centers and hardware.

AI-Driven Ad Growth: AI tools enhanced advertising performance, attracting marketers despite tariff-related economic uncertainty.

Leadership Comments: CEO Mark Zuckerberg highlighted AI progress, stating, “We’re making good progress on AI glasses and Meta AI, which now has almost 1 billion monthly actives,” and noted AI as a key driver for future growth.

Meta’s earnings call underscored AI as a cornerstone of its strategy, with tangible user growth and infrastructure investments signaling confidence in long-term returns

-

Management Perspective

Chief Executive Mark Zuckerberg outlined five key prospects fuelled by AI investments: enhanced advertising, immersive experiences, business messaging, advancements in Meta AI, and AI-powered devices. He highlighted a 5% rise in ad conversions driven by an updated recommendation model for Reels and a 30% surge in advertisers adopting AI creative tools. The company reported significant growth in Threads, now surpassing 350 million monthly active users, and underscored AI’s role in boosting Facebook engagement by 7% and Instagram by 6%.Zuckerberg noted progress with Meta AI, which has nearly one billion active users, with plans to prioritise scaling and deepening user interaction before monetisation. Sales of new AI-enabled Ray-Ban glasses tripled year-on-year. Finance Director Susan Li reported total revenue of $42.3 billion, a 16% year-on-year increase, with operating profit of $17.6 billion and a 41% operating margin. Free cash flow reached $10.3 billion, and the company repurchased $13.4 billion in shares.

Outlook

Meta projects Q2 2025 revenue of $42.5 billion to $45.5 billion, supported by a 1% currency tailwind. Full-year 2025 expenditure is forecast to range from $113 billion to $118 billion, reduced from previous guidance. Capital expenditure guidance for 2025 has risen to $64 billion to $72 billion, largely due to data centre investments and elevated infrastructure costs. The company expects tax rates for 2025 to be between 12% and 15%.Financial Performance

Q1 revenue totalled $42.3 billion, with advertising revenue contributing $41.4 billion, up 16% year-on-year. Strong performance was noted in North America and Rest of World regions. The Family of Apps generated $41.9 billion in revenue, while Reality Labs revenue fell 6% to $412 million due to lower Meta Quest sales. Total operating costs rose by 9%, driven by increased infrastructure and compensation expenses, though general and administrative costs dropped by 34%. The company closed Q1 with $70.2 billion in cash and marketable securities. The average price per advert increased by 10%, with advert impressions growing by 5%.Q&A Session

Brian Nowak, Morgan Stanley: Enquired about progress with AI models like Llama 4 and Meta AI usage trends. Zuckerberg explained that Llama 4 is optimised for low latency and tailored interactions.Eric Sheridan, Goldman Sachs: Asked about the standalone Meta AI app. Zuckerberg emphasised its role in securing U.S. leadership and standing out through personalisation.

Justin Post, Bank of America: Questioned Q2 guidance amid e-commerce trends and rising CapEx. Li confirmed the guidance reflects solid revenue trends and highlighted increased infrastructure investments.

Analysts raised concerns about CapEx intensity and recruitment. Management reaffirmed its focus on AI infrastructure and technical talent to support strategic priorities.Sentiment Analysis

Analysts voiced concerns about high CapEx and the timeline for AI monetisation but recognised strong engagement and revenue growth. Management expressed confidence in AI-driven growth opportunities, with Zuckerberg highlighting AI’s transformative potential and stressing efficient investments. Compared to the prior quarter, discussions maintained a consistent focus on AI and infrastructure, with an optimistic outlook for long-term growth.Quarter-on-Quarter Comparison

Revenue guidance for Q2 2025 rose from Q1’s $39.5 billion–$41.8 billion range. Expenditure guidance was lowered compared to the previous quarter, reflecting refined projections. CapEx outlook for 2025 increased from $60 billion–$65 billion due to accelerated data centre investments. Continued emphasis on AI advancements, with Threads and Meta AI showing notable user growth compared to the prior quarter.Final Takeaway

Meta Platforms delivered a robust Q1 2025 with $42.3 billion in revenue and strong growth across its AI-driven initiatives. The company increased its CapEx outlook to support AI and data infrastructure while reducing full-year expenditure guidance. With confident projections for Q2 2025 revenue and growing user engagement in apps like Threads and Meta AI, Meta is positioning itself for sustained growth despite regulatory challenges. -

Meta will pour vast sums into AI and I believe will reap super normal returns. post from X below

-

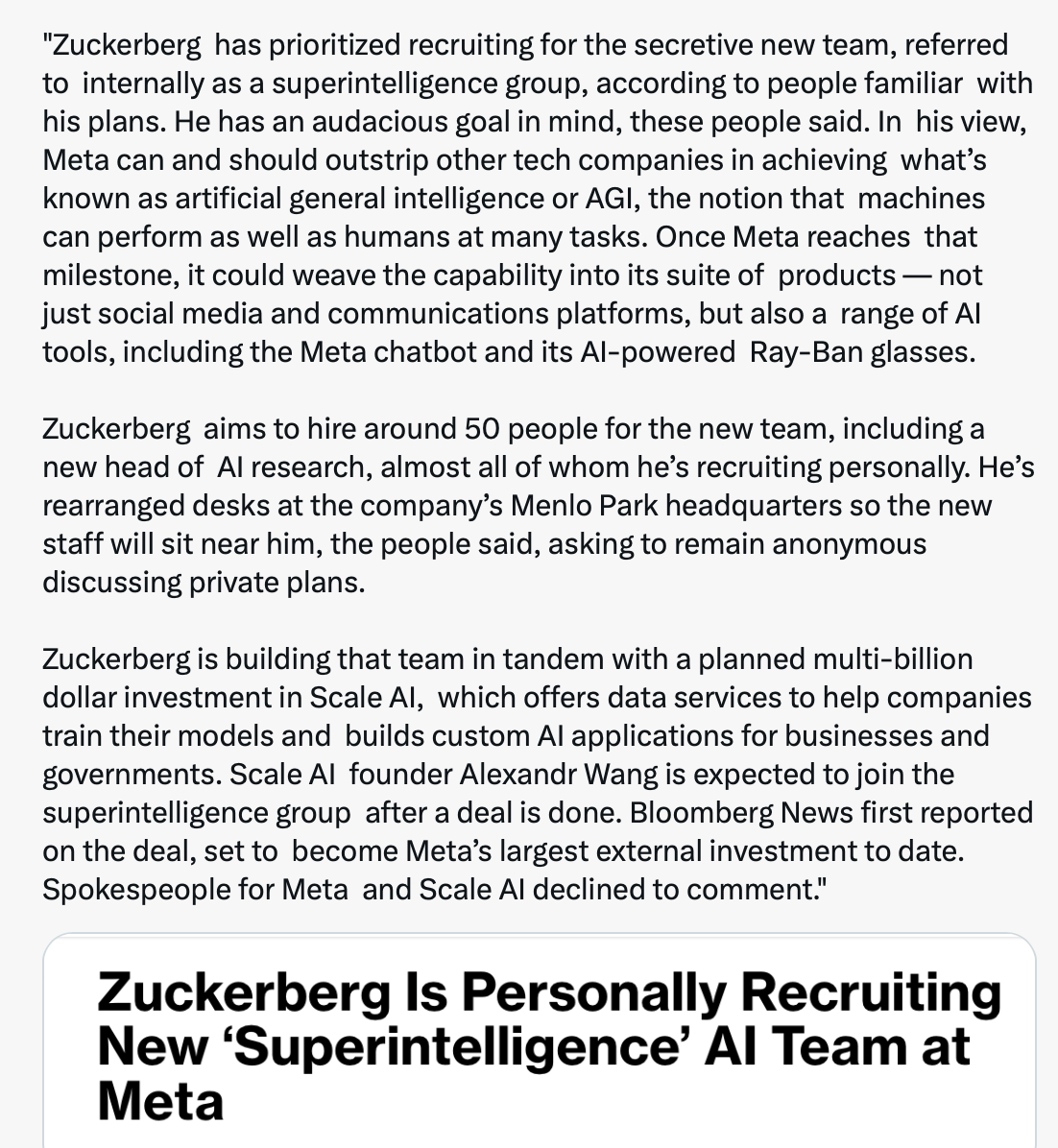

Meta Acquires 49% Stake in Scale AI

Meta has purchased a 49% stake in Scale AI, a US-based firm specialising in data labelling and AI model evaluation, for $14.8 billion. Scale AI supports major clients like OpenAI, Microsoft, and the US Department of Defence, helping them refine AI systems with high-quality data.Meta aims to leverage Scale’s expertise to enhance its AI models, particularly Llama, and establish a new “superintelligence” lab led by Scale’s CEO, Alexandr Wang. The deal, valuing Scale at $28 billion, strengthens Meta’s position in the AI race and expands its reach into defence and enterprise markets.

-

Sounds good and great to hear that they're also moving in this direction. I am curious on how the valuation works as to my (simple) mind purchasing 49% at $14.8bn creates a company valuation of $30.2 bn not $28bn?

As always thanks for the insight Adam.

-

Hi SZ,

The deal structures like discounted share sales, non-cash payments, strategic terms. The final valuation of Scale AI, based on Meta’s acquisition of a 49% stake for $14.8 billion, vs $28 billion for the whole. I think just because the 'valuation' is X doesn't meant you pro rata that value for a given percentage, given this is a very big deal comprising a very long list of add ons. The CEO is now working at Meta so maybe there is a massive sign on incorporated in the deal.

When Xai raises its next $20B they have already stated 'at a valuation between 120-200 billion'. Does that make sense-no, not really

-

Meta begins monetising news on WhatsApp, backed by vast user base

Meta has started monetising news content on WhatsApp by allowing publishers to earn revenue through in-app advertising, paid subscriptions, and premium content via WhatsApp Channels. This move marks a shift in WhatsApp’s traditionally ad-free model and positions it to compete more directly with platforms like Telegram for news distribution.

The decision is underpinned by Meta’s immense global reach. As of the fourth quarter of 2024, Meta reported 3.35 billion daily active users across its core platforms—Facebook, Instagram, WhatsApp, Messenger, and the growing Threads app. This vast user base has helped drive profitability, with Meta’s average revenue per user reaching $49.63 in 2024, up from $44.60 the previous year.

Meta’s dominance in the digital space provides a strong foundation for this latest monetisation push on WhatsApp.

-

The crazy world of AI. What's crazy is he 'failed', allegedly

-

Meta have their wallet out hoovering up the AI elite. Crazy numbers.

Meta Platforms has offered exceptionally large compensation packages to key hires for its new “superintelligence” division, including a deal worth over $200 million for Ruoming Pang, a former distinguished engineer at Apple, Bloomberg reported, citing people familiar with the matter.

-

Nice job ..if you can get it

-

Nice job ..if you can get it

@Ducati996R said in Meta News:

Nice job ..if you can get it

I studied AI as part of a degree back in the early 2000s. It was pretty rudimentary stuff then and I've not kept up with it since, but still...

I'd be happy to take on a role at a salary as low as $5m/yr and if it doesn't work out after a few months, there'd be no hard feelings if I was let go.

I should probably let them know I'm available since they haven't been in touch yet...

-

A,

I'll put a good word in with Mark when we meet

-

I’m sure I mentioned that Wendy deals directly with Mark and also The Donald.. but has never been on a private jet or island with either of them!!

-

it's marvellous, Jim