Amazon News

-

Amazon EPS of $1.59 beats by $0.23, revenue of $155.7B beats by $580M

Another great quarter of 'Beat and Raise' from Amazon-as usual the focus its on AWS which showed 17% growth however, again management are repeating the same thing heard from other mega caps. Not enough AI. We have zero concerns about Amazons ability to continue to grow, driving double digit EPS growth.

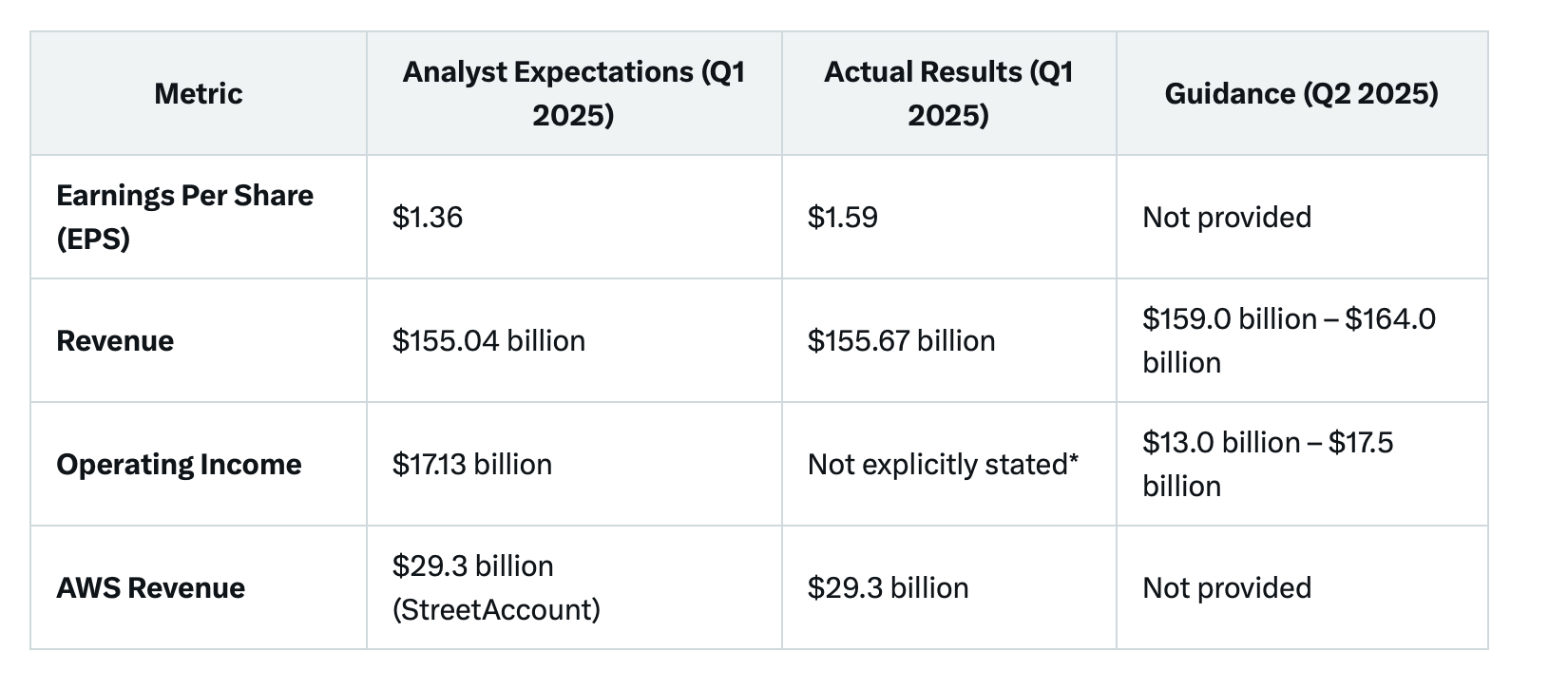

EPS and Revenue: Amazon exceeded analyst expectations for both EPS ($1.59 vs. $1.36) and revenue ($155.67 billion vs. $155.04 billion), driven by strong performance in AWS and advertising.

Operating Income: Specific Q1 2025 operating income was not detailed in the provided sources, but Q4 2024 reported $21.2 billion, up 61% year-over-year. Q2 2025 guidance ($13.0 billion – $17.5 billion) fell below analyst expectations of $17.82 billion, contributing to a stock dip of approximately 2–4% in after-hours trading.

AWS Revenue: AWS grew 17% year-over-year to $29.3 billion, meeting expectations but marking the third consecutive quarter of revenue misses relative to consensus estimates. Casey did mention the constraints re chips but said this will be alleviated in H2 which bodes well for other names we hold

Guidance Context: Q2 2025 revenue guidance ($159.0 billion – $164.0 billion) represents 7–11% growth but is below analyst expectations of $160.9 billion. Operating income guidance was notably lighter than the $17.82 billion expected, with factors like stock-based compensation increases and Project Kuiper launch costs cited. Amazon also noted potential impacts from tariffs, trade policies, and a $2.1 billion foreign exchange headwind.

AI and CapEx: Amazon reiterated significant AI investment, with Q1 2025 capital expenditure aligned with the Q4 2024 rate of $26.3 billion with Casey saying they expect this spending tempo to be consistent over the year, projecting over $100 billion for 2025, primarily for AWS AI infrastructure

-

-

-

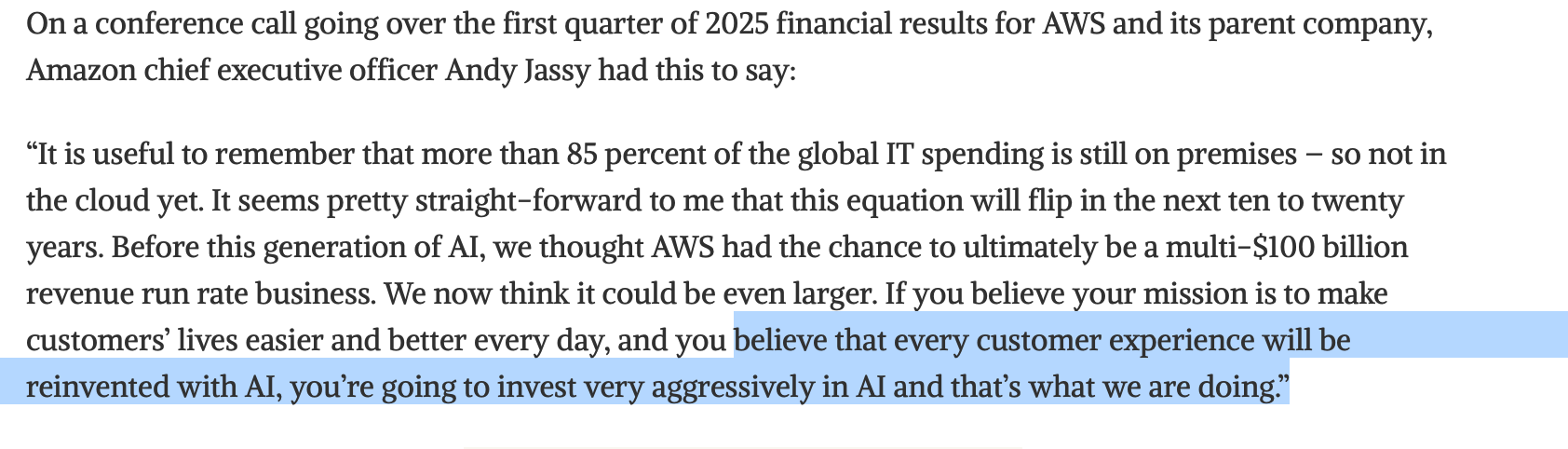

Coming from a previous background in IT-related businesses, I'm astonished at the 85% figure - shows what a massive potential market there is, because lots of companies, and lots of providers, are pushing a move away from the (some would say "old") on prem model.

-

Yesterday, Amazon CEO Andy Jassy issued a memo to employees, describing generative AI as a “once in a lifetime creation” that “will change everything.”

He predicted billions of AI agents will revolutionise industries, including Amazon, by automating tasks like research, coding, and web searches, declaring, “Make no mistake, it’s coming fast.” Jassy highlighted Amazon’s progress.

He cautioned that AI’s rise will likely reduce Amazon’s corporate workforce in coming years, as routine tasks require fewer people, while new, AI-driven roles emerge. Jassy urged employees to embrace AI, upskill through training, and adapt to remain relevant, positioning those who do as key contributors to Amazon’s future.

He likened AI’s impact to the internet’s emergence, emphasising its potential to redefine efficiency and productivity. By freeing staff from mundane tasks, AI agents will enable a focus on strategic, customer-centric innovation, ensuring Amazon stays competitive in a rapidly evolving landscape.

Very soon I suspect companies will start spending far less on human capital and increase spending on digital capital.

-

From JP Morgan: AMZN has grown its Advertising Services revenue from ~$13B in 2019 to ~$56B in 2024, implying a +39% CAGR. The success of Amazon’s Advertising Services business highlights key advantages AMZN & retailers have over GOOGL & META.

According to WSJ, AMZN has deployed more than one million robots in facilities, which is the most it has ever had and near the count of human workers at the facilities.